Region:Global

Author(s):Shubham

Product Code:KRAB0748

Pages:83

Published On:August 2025

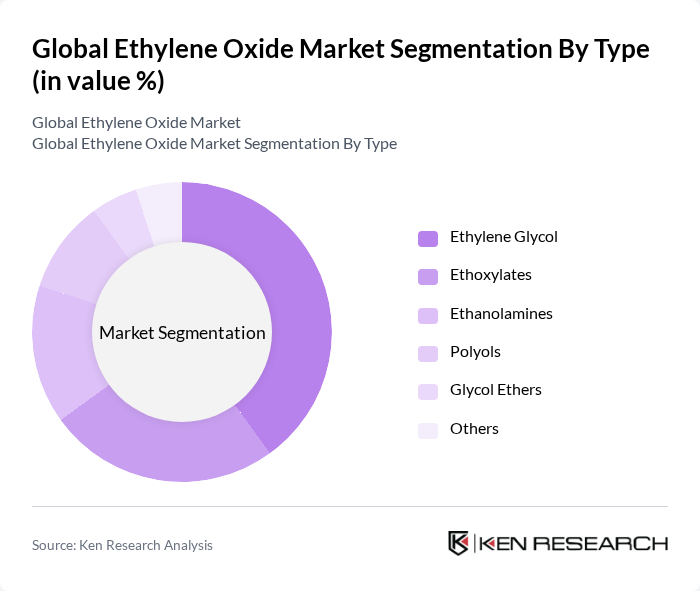

By Type:The market is segmented into Ethylene Glycol, Ethoxylates, Ethanolamines, Polyols, Glycol Ethers, and Others.Ethylene Glycolis the leading sub-segment due to its extensive use in antifreeze and coolant applications, as well as polyester fiber and PET resin production.Ethoxylatesare increasingly used in surfactant formulations for detergents and personal care products. The demand forEthanolaminesis rising, particularly in agricultural chemicals and gas treatment applications .

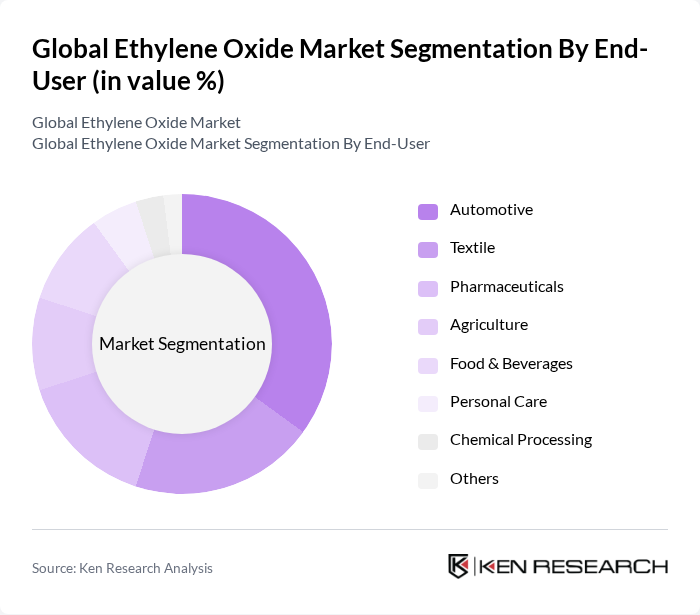

By End-User:The end-user segmentation includes Automotive, Textile, Pharmaceuticals, Agriculture, Food & Beverages, Personal Care, Chemical Processing, and Others. TheAutomotivesector is the largest consumer of ethylene oxide derivatives, primarily for antifreeze and coolant applications, as well as brake fluids and other automotive chemicals. TheTextileindustry is a major consumer, utilizing ethylene oxide in polyester fiber production and fabric treatments. ThePharmaceuticalsandFood & Beveragessectors rely on ethylene oxide for sterilization and packaging applications .

The Global Ethylene Oxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, LyondellBasell Industries N.V., Shell Chemicals, Huntsman Corporation, Eastman Chemical Company, SABIC, INEOS Group, Oxiteno S.A., Reliance Industries Limited, Formosa Plastics Corporation, Mitsubishi Chemical Corporation, Chevron Phillips Chemical Company LLC, Tosoh Corporation, TPC Group Inc., Sinopec (China Petroleum & Chemical Corporation), SABIC (Saudi Basic Industries Corporation), Sasol Limited, Clariant AG, Indorama Ventures Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ethylene oxide market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in production technologies, such as catalytic processes, are expected to enhance efficiency and reduce environmental impact. Additionally, the increasing focus on bio-based chemicals presents opportunities for growth, as companies seek to align with consumer preferences for sustainable products. The market is likely to witness a surge in demand for specialty chemicals, further diversifying applications and driving revenue.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethylene Glycol Ethoxylates Ethanolamines Polyols Glycol Ethers Others |

| By End-User | Automotive Textile Pharmaceuticals Agriculture Food & Beverages Personal Care Chemical Processing Others |

| By Application | Antifreeze Surfactants Solvents Sterilization (Medical Devices) Resins & Fibers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, France, UK, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, GCC, Rest of MEA) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing |

| By Product Form | Liquid Gas Solid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Control Analysts |

| Textile Industry Usage | 70 | Production Supervisors, Chemical Buyers |

| Household Products Sector | 60 | Product Development Managers, Marketing Directors |

| Agricultural Chemicals | 50 | Procurement Managers, Regulatory Affairs Specialists |

| Industrial Applications | 80 | Operations Managers, Supply Chain Coordinators |

The Global Ethylene Oxide Market is valued at approximately USD 36.5 billion, driven by increasing demand for ethylene glycol in various industries, including automotive and textiles, as well as the production of consumer goods utilizing ethylene oxide derivatives.