Region:Asia

Author(s):Shubham

Product Code:KRAD3602

Pages:96

Published On:November 2025

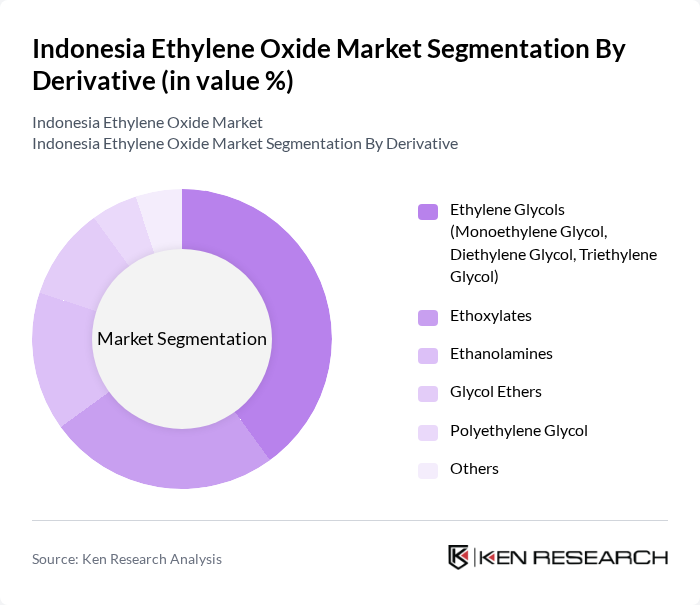

By Derivative:The derivatives of ethylene oxide are pivotal in shaping market dynamics. The primary derivatives include Ethylene Glycols (Monoethylene Glycol, Diethylene Glycol, Triethylene Glycol), Ethoxylates, Ethanolamines, Glycol Ethers, Polyethylene Glycol, and Others. Ethylene Glycols remain the most dominant segment, largely due to their extensive use in antifreeze formulations and as a precursor in polyester fiber production. The automotive sector’s demand for antifreeze and coolant products continues to be a major driver for ethylene glycol consumption .

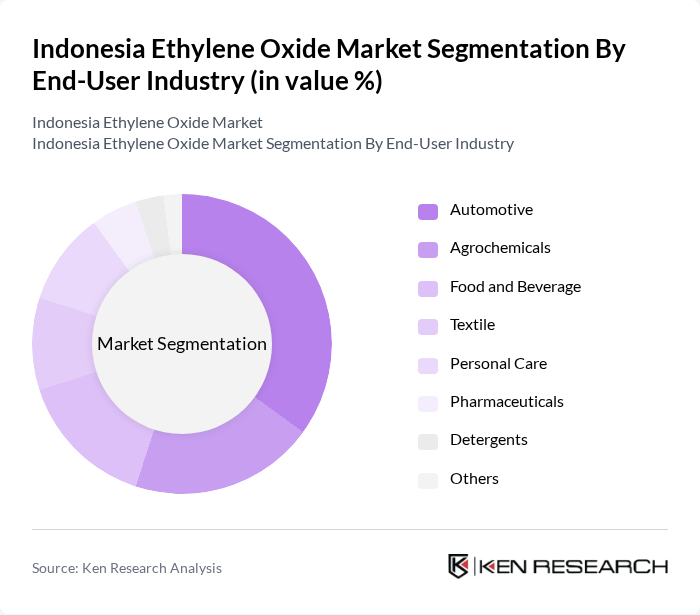

By End-User Industry:The end-user industries for ethylene oxide derivatives encompass Automotive, Agrochemicals, Food and Beverage, Textile, Personal Care, Pharmaceuticals, Detergents, and Others. The automotive sector is the leading end-user, propelled by rising vehicle production and sustained demand for antifreeze and coolant products. The pharmaceutical industry is also expanding, driven by increased requirements for sterilization and medical device applications, which utilize ethylene oxide for its effectiveness in microbial control .

The Indonesia Ethylene Oxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Chandra Asri Petrochemical Tbk, PT. Pupuk Kalimantan Timur (Pupuk Kaltim), PT. Indorama Synthetics Tbk, PT. Lotte Chemical Titan Tbk, PT. Asahimas Chemical, PT. Pertamina (Persero), PT. Trans Pacific Petrochemical Indotama, PT. Polytama Propindo, PT. TPIA (Chandra Asri Group), PT. Kaltim Methanol Industri, PT. Pupuk Sriwidjaja Palembang, PT. Pupuk Indonesia (Persero), PT. Bumi Resources Tbk, PT. Medco Energi Internasional Tbk, PT. Surya Semesta Internusa Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia ethylene oxide market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As companies increasingly adopt eco-friendly production methods, the demand for bio-based ethylene oxide is expected to rise. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and reduce costs. With the government promoting local manufacturing and innovation, the market is likely to witness robust growth, positioning Indonesia as a key player in the regional ethylene oxide landscape.

| Segment | Sub-Segments |

|---|---|

| By Derivative | Ethylene Glycols (Monoethylene Glycol, Diethylene Glycol, Triethylene Glycol) Ethoxylates Ethanolamines Glycol Ethers Polyethylene Glycol Others |

| By End-User Industry | Automotive Agrochemicals Food and Beverage Textile Personal Care Pharmaceuticals Detergents Others |

| By Application | Antifreeze and Coolants Surfactants Industrial Chemicals Sterilization (Medical Devices) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Java Sumatra Kalimantan Sulawesi |

| By Production Process | Catalytic Oxidation Non-Catalytic Processes Others |

| By Policy Support | Subsidies for Ethylene Production Tax Incentives for Manufacturers Regulatory Support for Sustainable Practices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 60 | Production Managers, Quality Assurance Officers |

| Textile Industry Usage | 50 | Textile Engineers, Supply Chain Managers |

| Food Processing Sector | 40 | Food Safety Managers, Operations Directors |

| Household Products | 40 | Product Development Managers, Marketing Executives |

| Industrial Applications | 50 | Procurement Managers, Chemical Engineers |

The Indonesia Ethylene Oxide Market is valued at approximately USD 1.5 billion, reflecting a robust demand driven by its applications in antifreeze, surfactants, and industrial chemicals, particularly in the automotive and pharmaceutical sectors.