Region:Global

Author(s):Rebecca

Product Code:KRAD1471

Pages:88

Published On:November 2025

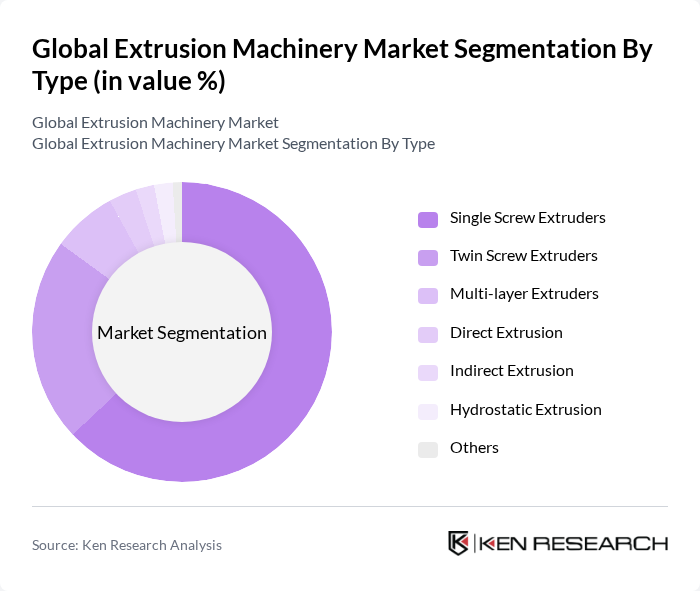

By Type:The extrusion machinery market is segmented into Single Screw Extruders, Twin Screw Extruders, Multi-layer Extruders, Direct Extrusion, Indirect Extrusion, Hydrostatic Extrusion, and Others. Each type serves distinct applications and industries, offering specific advantages in efficiency, product quality, and versatility. Single Screw Extruders are widely used for their simplicity and cost-effectiveness, especially in mass production of plastic products. Twin Screw Extruders are preferred for high mixing and compounding capabilities, suitable for complex formulations and advanced material processing.

The Single Screw Extruders segment is currently dominating the market due to their operational simplicity, cost-effectiveness, and versatility in processing a wide range of materials. They are extensively used in the production of plastic products, which remain in high demand across packaging, construction, and automotive sectors. Twin Screw Extruders are gaining traction for applications requiring intensive mixing and compounding, particularly in advanced material processing and specialty plastics. The preference for Single Screw Extruders is driven by their ease of operation and maintenance, making them a popular choice among manufacturers.

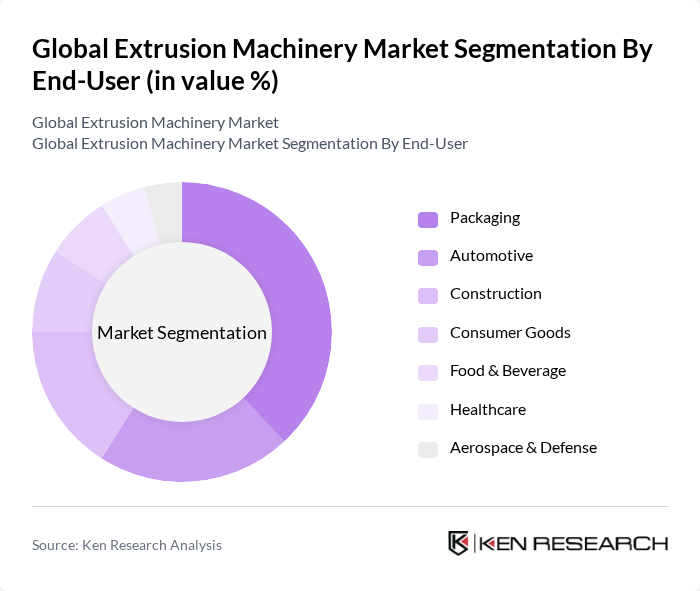

By End-User:The market is segmented by end-user industries, including Packaging, Automotive, Construction, Consumer Goods, Food & Beverage, Healthcare, Aerospace & Defense, and Others. Each sector has unique requirements for extrusion machinery, shaping demand dynamics. The Packaging segment leads due to the ongoing demand for flexible, durable, and sustainable packaging solutions, driven by e-commerce growth and consumer goods expansion. Automotive follows, propelled by the need for lightweight materials to improve fuel efficiency and performance. Construction remains a key segment, with extrusion machinery supporting infrastructure development and advanced building materials.

The Packaging segment leads the market due to the increasing demand for flexible and durable packaging solutions across industries. The rise in e-commerce and consumer goods has further fueled this demand, as companies seek efficient and sustainable packaging options. The Automotive sector follows closely, driven by the need for lightweight materials that enhance fuel efficiency and performance. Sustainability initiatives and environmental regulations are also influencing growth in the Packaging and Automotive segments.

The Global Extrusion Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as KraussMaffei Group, Milacron Holdings Corp., Reifenhäuser GmbH & Co. KG Maschinenfabrik, Battenfeld-Cincinnati Group, Davis-Standard LLC, Coperion GmbH, NFM Welding Engineers, Inc., The Japan Steel Works, Ltd., Bausano & Figli S.p.A., SML Maschinengesellschaft mbH, HPM Corporation, Graham Engineering Corporation, Erema Engineering Recycling Maschinen und Anlagen Ges.m.b.H., Clextral SAS, Kautex Maschinenbau GmbH, AMUT S.p.A., WENGER MANUFACTURING, INC., Extrusion Technik USA, Inc., BC Extrusion Holding GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the extrusion machinery market appears promising, driven by technological advancements and increasing demand for sustainable solutions. As industries adopt Industry 4.0 practices, the integration of automation and IoT technologies will enhance operational efficiency and product customization. Furthermore, the growing emphasis on eco-friendly processes will likely lead to innovations in machinery design, enabling manufacturers to meet stringent environmental regulations while capitalizing on emerging market opportunities in developing regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Screw Extruders Twin Screw Extruders Multi-layer Extruders Direct Extrusion Indirect Extrusion Hydrostatic Extrusion Others |

| By End-User | Packaging Automotive Construction Consumer Goods Food & Beverage Healthcare Aerospace & Defense Others |

| By Material | Plastics (Thermoplastics, Thermosetting Plastics) Metals (Aluminum, Steel, Others) Rubber Composites Others |

| By Application | Film and Sheet Extrusion Pipe and Profile Extrusion Coating and Laminating Wire & Cable Extrusion Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Conventional Extrusion Advanced Extrusion Technologies (Automation, Smart Manufacturing, IoT-enabled) Others |

| By Investment Source | Private Investments Public Funding Joint Ventures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Machinery | 100 | Production Managers, Quality Assurance Managers |

| Automotive Components Extrusion | 80 | Engineering Managers, Supply Chain Managers |

| Construction Material Extrusion | 70 | Project Managers, Procurement Specialists |

| Consumer Goods Manufacturing | 90 | Operations Managers, Product Development Managers |

| Medical Device Production | 60 | Regulatory Affairs Managers, Manufacturing Engineers |

The Global Extrusion Machinery Market is valued at approximately USD 9.2 billion, reflecting a robust growth trajectory driven by increasing demand across various industries, including packaging, automotive, and construction.