Region:Middle East

Author(s):Shubham

Product Code:KRAA8827

Pages:91

Published On:November 2025

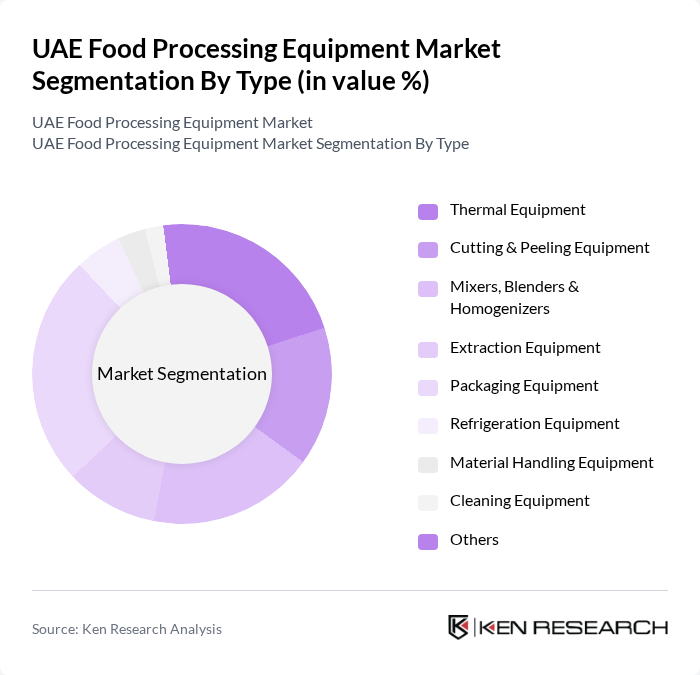

By Type:The market is segmented into Thermal Equipment, Cutting & Peeling Equipment, Mixers, Blenders & Homogenizers, Extraction Equipment, Packaging Equipment, Refrigeration Equipment, Material Handling Equipment, Cleaning Equipment, and Others. These categories reflect the diverse processing needs of the UAE food industry, with thermal and packaging equipment holding the largest shares due to their widespread use in meat, seafood, bakery, and beverage processing. Automation and energy efficiency are increasingly prioritized across all equipment types .

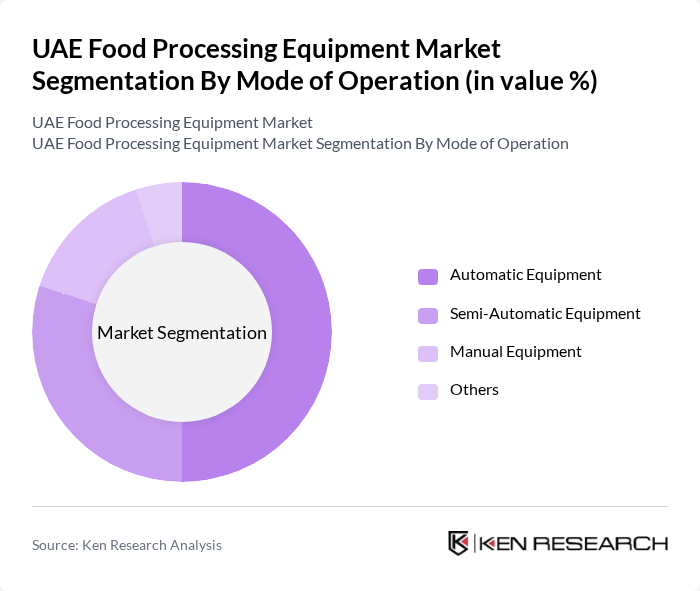

By Mode of Operation:The market is segmented by mode of operation into Automatic Equipment, Semi-Automatic Equipment, Manual Equipment, and Others. The shift towards automation is prominent, with automatic equipment accounting for the largest share, driven by its ability to improve efficiency, reduce labor costs, and enhance food safety. Semi-automatic and manual equipment remain relevant in niche applications and smaller-scale operations .

The UAE Food Processing Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ghurair Foods, Emirates Food Industries, Agthia Group, Al Ain Dairy, National Food Products Company, Almarai, Al-Bahar (Caterpillar Dealer), Atcoworld, Al Futtaim Engineering, Al Halabi Refrigeration & Kitchen Equipment, Al Razana Kitchen Equipment, Middleby Corporation, Marel, GEA Group, SPX FLOW contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE food processing equipment market appears promising, driven by technological innovations and government support. As the demand for processed foods continues to rise, manufacturers are likely to invest in smart and automated solutions to enhance efficiency. Additionally, the focus on sustainability will drive the adoption of energy-efficient equipment, aligning with global trends. The integration of IoT technologies will further revolutionize food processing, ensuring better quality control and operational efficiency in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermal Equipment Cutting & Peeling Equipment Mixers, Blenders & Homogenizers Extraction Equipment Packaging Equipment Refrigeration Equipment Material Handling Equipment Cleaning Equipment Others |

| By Mode of Operation | Automatic Equipment Semi-Automatic Equipment Manual Equipment Others |

| By Application | Bakery & Confectionery Processing Meat & Seafood Processing Dairy Processing Beverage Processing Others |

| By End-User | Food & Beverage Manufacturers Hotels & Restaurants Retail Chains Food Service Providers Government Institutions Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Technology | Automated Equipment Semi-Automated Equipment Manual Equipment Others |

| By Policy Support | Subsidies for Equipment Purchase Tax Incentives for Local Manufacturing Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Equipment Manufacturers | 100 | Product Managers, Sales Directors |

| Food and Beverage Producers | 90 | Operations Managers, Plant Supervisors |

| Distributors of Food Processing Equipment | 60 | Supply Chain Managers, Business Development Executives |

| Regulatory Bodies and Industry Associations | 50 | Policy Makers, Industry Analysts |

| Research Institutions and Academia | 40 | Research Scholars, Professors in Food Technology |

The UAE Food Processing Equipment Market is valued at approximately USD 1.1 billion, driven by increasing demand for processed foods, advancements in processing technologies, and a growing food and beverage sector.