Region:Global

Author(s):Shubham

Product Code:KRAA2727

Pages:94

Published On:August 2025

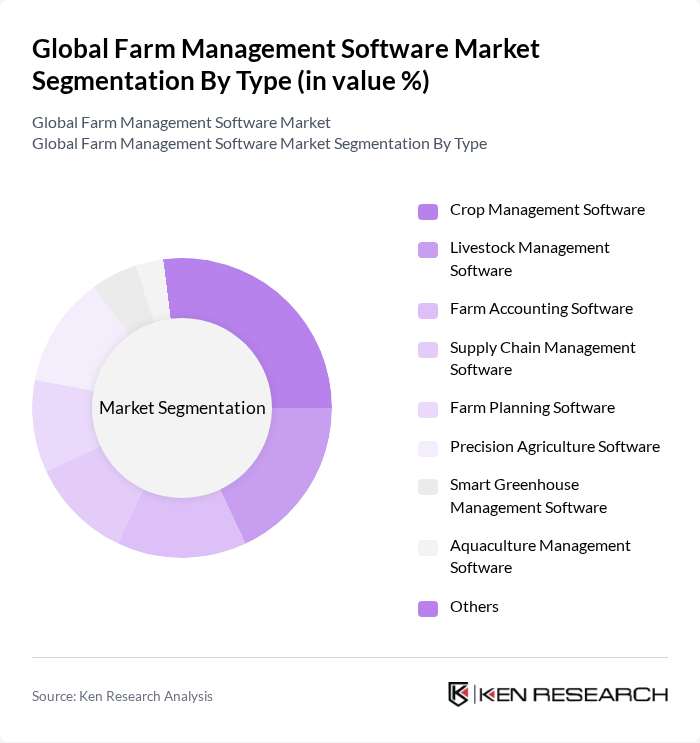

By Type:The market is segmented into various types of software solutions that cater to different aspects of farm management. The subsegments include Crop Management Software, Livestock Management Software, Farm Accounting Software, Supply Chain Management Software, Farm Planning Software, Precision Agriculture Software, Smart Greenhouse Management Software, Aquaculture Management Software, and Others. Each of these subsegments plays a crucial role in enhancing operational efficiency and productivity in farming .

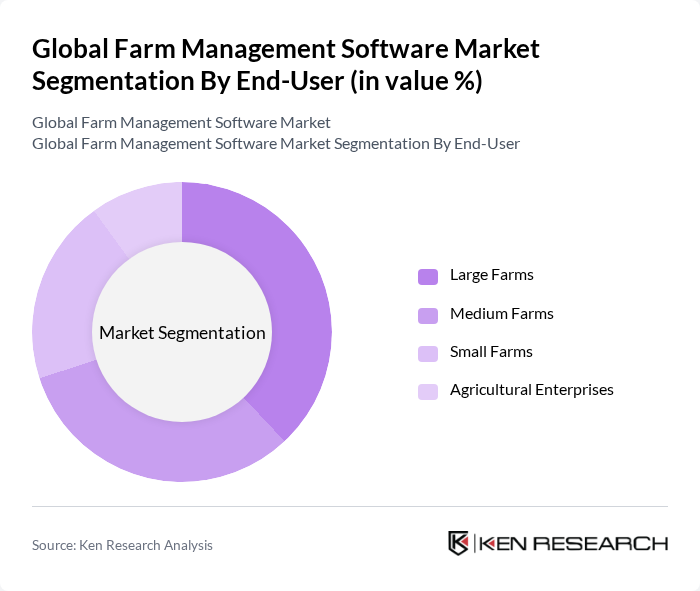

By End-User:The end-user segmentation includes Large Farms, Medium Farms, Small Farms, and Agricultural Enterprises. Each category has distinct needs and requirements for farm management software, with larger farms typically adopting more advanced solutions due to their scale and complexity. The demand from agricultural enterprises is also significant, as they seek comprehensive solutions to manage multiple farming operations efficiently .

The Global Farm Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trimble Inc., Ag Leader Technology, Raven Industries, Inc., Farmers Edge Inc., BASF SE (xarvio™ Digital Farming Solutions), Deere & Company (John Deere Operations Center), The Climate Corporation (Bayer Crop Science), Granular (Corteva Agriscience), AgJunction Inc., Topcon Agriculture, Proagrica (RELX Group), AgriWebb, Cropio (Syngenta Group), Taranis, Conservis contribute to innovation, geographic expansion, and service delivery in this space .

The future of the farm management software market is poised for significant growth, driven by technological advancements and increasing awareness of sustainable practices. As farmers seek to enhance productivity and reduce environmental impact, the integration of AI and IoT technologies will become more prevalent. Additionally, the expansion of mobile applications will facilitate access to farm management tools, particularly in emerging markets, enabling smallholder farmers to benefit from digital solutions and improve their operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Crop Management Software Livestock Management Software Farm Accounting Software Supply Chain Management Software Farm Planning Software Precision Agriculture Software Smart Greenhouse Management Software Aquaculture Management Software Others |

| By End-User | Large Farms Medium Farms Small Farms Agricultural Enterprises |

| By Application | Precision Farming Precision Livestock Precision Forestry Precision Aquaculture Dairy Management Farm Production Planning (Pre, During, Post) |

| By Deployment Model | On-Premise Cloud-Based Web-Based |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Free/Ad-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Management Software Users | 100 | Farm Managers, Agronomists |

| Livestock Management Solutions | 60 | Livestock Farmers, Veterinary Technicians |

| Precision Agriculture Technology | 50 | Agricultural Technologists, Data Analysts |

| Farm Financial Management Software | 40 | Farm Accountants, Financial Advisors |

| Supply Chain Management in Agriculture | 50 | Supply Chain Managers, Logistics Coordinators |

The Global Farm Management Software Market is valued at approximately USD 3.2 billion, reflecting a significant growth trend driven by technological advancements in agriculture and the increasing need for efficient farm management practices.