Region:Global

Author(s):Dev

Product Code:KRAA1659

Pages:91

Published On:August 2025

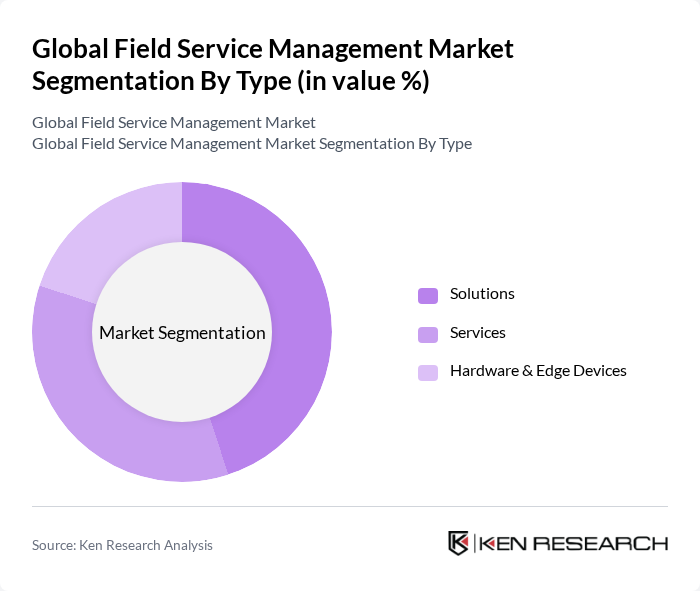

By Type:

The market is segmented into three main types: Solutions, Services, and Hardware & Edge Devices. The Solutions segment, which includes Work Order Management, Scheduling & Dispatch, Mobile FSM, Inventory/Parts, and Asset Management, continues to dominate as organizations prioritize workflow digitization, real-time mobility, dispatch optimization, and analytics to improve first-time fix rates and reduce operating costs. Mobile and cloud-native solutions that integrate AI/ML and IoT telemetry for predictive maintenance and intelligent routing are seeing elevated demand .

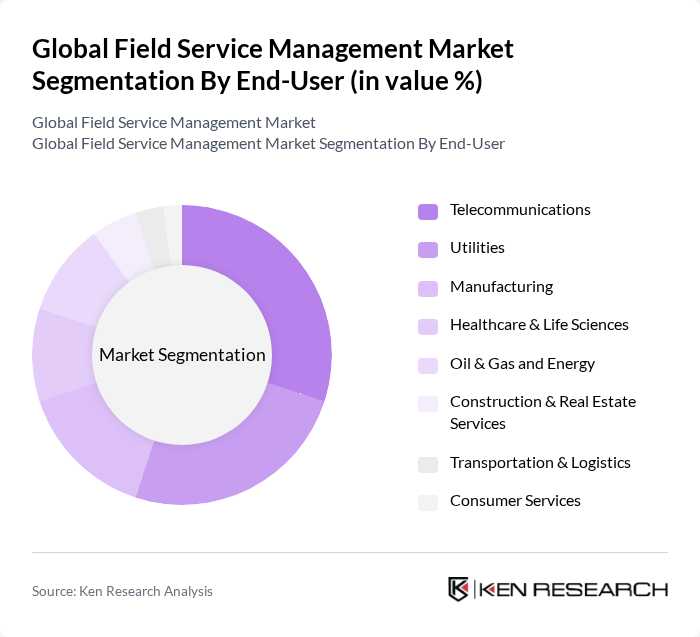

By End-User:

The end-user segmentation includes Telecommunications, Utilities, Manufacturing, Healthcare & Life Sciences, Oil & Gas and Energy, Construction & Real Estate Services, Transportation & Logistics, and Consumer Services. Telecommunications remains a leading adopter due to the ongoing expansion of fiber and 5G rollouts, complex multi-vendor service delivery, and the need for precise scheduling, SLA compliance, and workforce orchestration at scale. Utilities also show strong uptake tied to grid modernization and smart metering programs that require robust field execution .

The Global Field Service Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as ServiceTitan, Salesforce (Field Service), Microsoft (Dynamics 365 Field Service), SAP (SAP Field Service Management), Oracle (Oracle Field Service, formerly TOA), IFS (IFS Field Service Management), ServiceMax (a PTC business), Trimble (Trimble PULSE), OverIT (SPACE1, Next-Gen FSM), Zinier, KloudGin, Jobber, FieldAware, Praxedo, TrackTik (Mobile Workforce Management) contribute to innovation, geographic expansion, and service delivery in this space .

The future of field service management is poised for transformative growth, driven by technological advancements and evolving customer expectations. As organizations increasingly adopt cloud-based solutions, the flexibility and scalability of these platforms will enhance operational efficiency. Furthermore, the integration of AI and machine learning will enable predictive analytics, allowing companies to anticipate service needs and optimize resource allocation. This evolution will likely lead to improved service quality and customer satisfaction, positioning businesses for competitive advantage in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Solutions (Work Order Management, Scheduling & Dispatch, Mobile FSM, Inventory/Parts, Asset Management) Services (Implementation & Integration, Consulting, Training & Support, Managed Services) Hardware & Edge Devices (Rugged Mobile Devices, IoT Sensors, Wearables/AR) |

| By End-User | Telecommunications Utilities (Electric, Water, Gas) Manufacturing Healthcare & Life Sciences Oil & Gas and Energy Construction & Real Estate Services Transportation & Logistics Consumer Services (Home Services, HVAC, Plumbing) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Field Operations & Technician Management Customer & Contract Management Workforce & Capacity Planning Inventory, Parts & Asset Lifecycle Management Billing, Invoicing & Quoting Analytics, AI & Predictive Maintenance |

| By Deployment Model | On-Premises Cloud-Based |

| By Sales Channel | Direct (Vendor Sales) Indirect (Resellers, System Integrators, MSPs) |

| By Pricing Model | Subscription (Per-User/Per-Technician, Tiered) Perpetual License Usage-Based/Pay-Per-Work Order |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Field Service Management | 100 | Healthcare Administrators, Service Coordinators |

| Telecommunications Service Delivery | 80 | Network Operations Managers, Customer Support Leads |

| Manufacturing Equipment Maintenance | 90 | Maintenance Managers, Production Supervisors |

| Utilities Field Operations | 70 | Field Service Technicians, Operations Managers |

| Retail Service Management | 60 | Store Managers, Customer Experience Directors |

The Global Field Service Management Market is valued at approximately USD 4.5 billion, driven by the demand for operational efficiency and advanced technologies like AI and IoT, which enhance customer experience and reduce operational costs.