Region:Middle East

Author(s):Shubham

Product Code:KRAD3684

Pages:85

Published On:November 2025

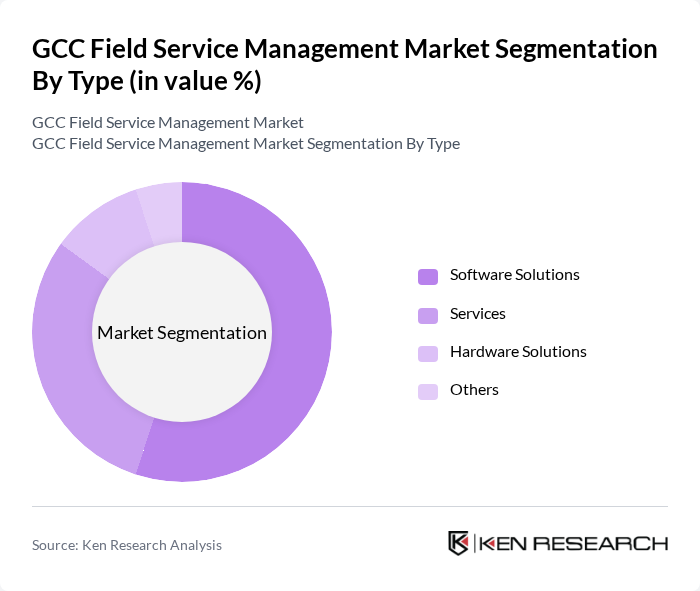

By Type:

The segmentation by type includes Software Solutions, Services, Hardware Solutions, and Others. Among these, Software Solutions dominate the market due to the increasing demand for comprehensive management tools that facilitate scheduling, dispatch, and customer management. The trend towards automation and real-time data access has led to a surge in the adoption of software solutions, particularly in sectors like telecommunications and utilities. Services, including integration and support, also play a crucial role, as businesses seek expert assistance in implementing these technologies effectively.

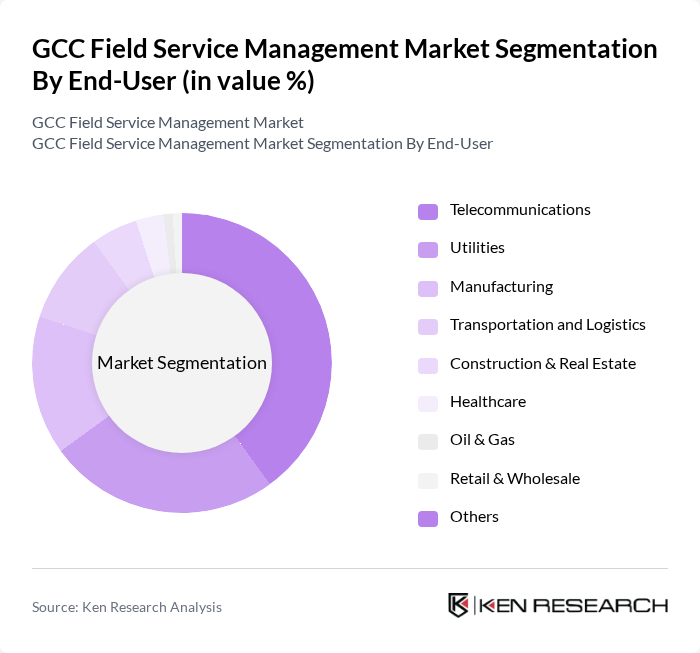

By End-User:

This segmentation includes Telecommunications, Utilities, Manufacturing, Transportation and Logistics, Construction & Real Estate, Healthcare, Oil & Gas, Retail & Wholesale, and Others. The Telecommunications sector leads the market, driven by the need for efficient service management in a highly competitive environment. The rapid expansion of telecom networks and the increasing complexity of service delivery have necessitated advanced field service management solutions. Utilities and Healthcare also represent significant end-users, as they require reliable systems to manage their field operations effectively.

The GCC Field Service Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, ServiceTitan, Salesforce, Inc., IFS AB, ClickSoftware Technologies (an SAP company), FieldAware, Trimble Inc., Astea International Inc. (part of IFS), Zuper, Jobber, Freshworks Inc. (Freshdesk), mHelpDesk, ServiceMax (a PTC company), Telenor Group, Etisalat Group, STC (Saudi Telecom Company), Ooredoo Group, Zain Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC field service management market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt cloud-based solutions, the market is expected to witness enhanced operational efficiency and scalability. Furthermore, the emphasis on real-time data analytics will enable organizations to make informed decisions, improving service delivery. The growing focus on sustainability practices will also shape the market, as businesses seek to align with environmental regulations and consumer preferences for eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions (e.g., Scheduling, Dispatch, Route Optimization, Customer Management, Work Order Management, Inventory Management, Service Contract Management, Reporting & Analytics) Services (Integration & Implementation, Training & Support, Consulting) Hardware Solutions (Mobile Devices, Rugged Tablets, IoT Sensors) Others |

| By End-User | Telecommunications Utilities (Electricity, Water, Gas) Manufacturing Transportation and Logistics Construction & Real Estate Healthcare Oil & Gas Retail & Wholesale Others |

| By Industry Vertical | Telecom Energy & Utilities Manufacturing Healthcare BFSI Construction & Real Estate Transportation & Logistics Retail & Wholesale Oil & Gas Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Service Type | Field Service Software Field Service Management Consulting Field Service Training Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Field Services | 100 | Field Service Managers, Operations Directors |

| Healthcare Equipment Maintenance | 80 | Biomedical Engineers, Facility Managers |

| Utility Service Management | 90 | Service Delivery Managers, Compliance Officers |

| Manufacturing Equipment Servicing | 70 | Production Managers, Maintenance Supervisors |

| Logistics and Supply Chain Services | 85 | Logistics Coordinators, Supply Chain Analysts |

The GCC Field Service Management Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital transformation initiatives across various sectors, enhancing operational efficiency and customer satisfaction.