Region:Global

Author(s):Shubham

Product Code:KRAA2683

Pages:98

Published On:August 2025

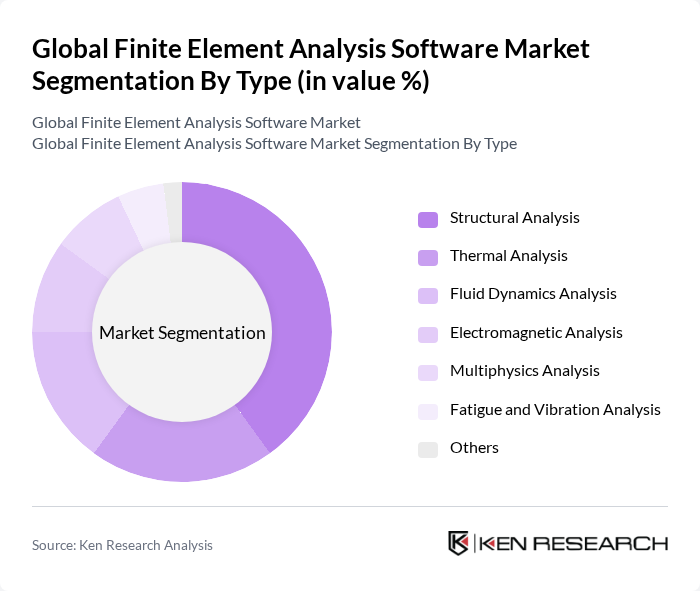

By Type:The market is segmented into various types of finite element analysis software, including Structural Analysis, Thermal Analysis, Fluid Dynamics Analysis, Electromagnetic Analysis, Multiphysics Analysis, Fatigue and Vibration Analysis, and Others. Each of these types serves specific engineering needs, withStructural Analysisbeing the most widely used due to its critical role in ensuring the integrity and safety of structures across multiple industries .

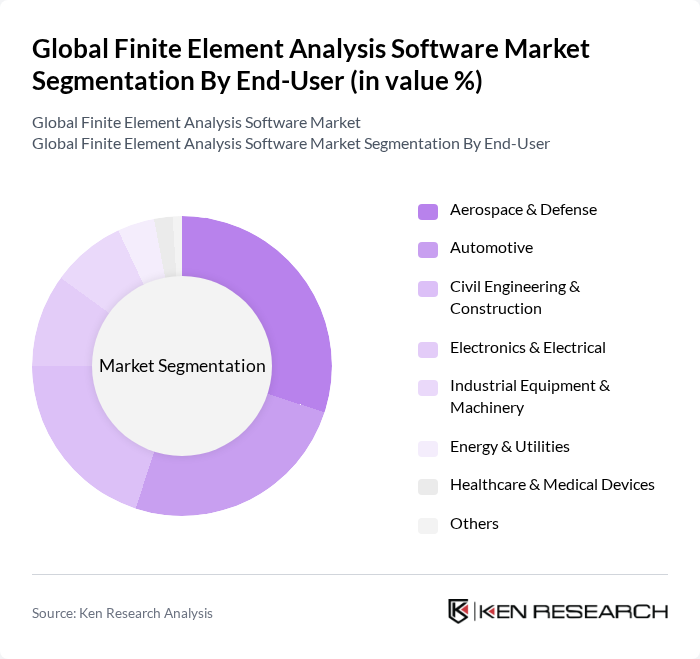

By End-User:The finite element analysis software market is also segmented by end-user industries, including Aerospace & Defense, Automotive, Civil Engineering & Construction, Electronics & Electrical, Industrial Equipment & Machinery, Energy & Utilities, Healthcare & Medical Devices, and Others. TheAerospace & Defensesector is a significant contributor to the market, driven by the need for high-precision simulations to ensure safety and compliance with stringent regulations. The automotive and electronics sectors are also witnessing robust adoption due to the increasing complexity of product designs and the demand for lightweight, energy-efficient solutions .

The Global Finite Element Analysis Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as ANSYS, Inc., Dassault Systèmes SE, Siemens Digital Industries Software, Altair Engineering, Inc., COMSOL AB, Autodesk, Inc., PTC Inc., Hexagon AB, MSC Software Corporation (Hexagon), ESI Group, BETA CAE Systems S.A., Livermore Software Technology Corporation (LSTC), Zuken Inc., Simulia (Dassault Systèmes), Siemens NX (Siemens Digital Industries Software) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the finite element analysis software market appears promising, driven by technological advancements and evolving industry needs. As organizations increasingly prioritize digital transformation, the integration of AI and machine learning into FEA tools is expected to enhance predictive capabilities and streamline workflows. Additionally, the shift towards subscription-based models will make these tools more accessible, particularly for SMEs. This evolving landscape will likely foster innovation and collaboration among software providers, ensuring the market remains dynamic and responsive to user demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Structural Analysis Thermal Analysis Fluid Dynamics Analysis Electromagnetic Analysis Multiphysics Analysis Fatigue and Vibration Analysis Others |

| By End-User | Aerospace & Defense Automotive Civil Engineering & Construction Electronics & Electrical Industrial Equipment & Machinery Energy & Utilities Healthcare & Medical Devices Others |

| By Application | Product Design & Development Research and Development Quality Assurance & Testing Prototyping & Virtual Prototyping Failure Analysis Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based One-Time License Pay-Per-Use |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Engineering Applications | 100 | Design Engineers, Simulation Specialists |

| Aerospace Structural Analysis | 70 | Project Managers, Aerospace Engineers |

| Civil Engineering Projects | 60 | Structural Engineers, Project Coordinators |

| Academic Research in Computational Mechanics | 50 | Professors, Graduate Researchers |

| Manufacturing Process Optimization | 80 | Manufacturing Engineers, Quality Assurance Managers |

The Global Finite Element Analysis Software Market is valued at approximately USD 8.9 billion, reflecting significant growth driven by the demand for advanced simulation tools across various industries, including automotive, aerospace, and civil engineering.