Region:Global

Author(s):Rebecca

Product Code:KRAC0204

Pages:90

Published On:August 2025

By Type:The market is segmented into various types of fire suppression systems, including water-based systems, foam-based systems, gas-based systems, powder-based systems, chemical-based systems, hybrid systems, and portable and mobile units. Among these, water-based systems—particularly sprinklers and mist systems—are the most widely used due to their proven effectiveness, cost-efficiency, and compliance with regulatory requirements in multiple applications .

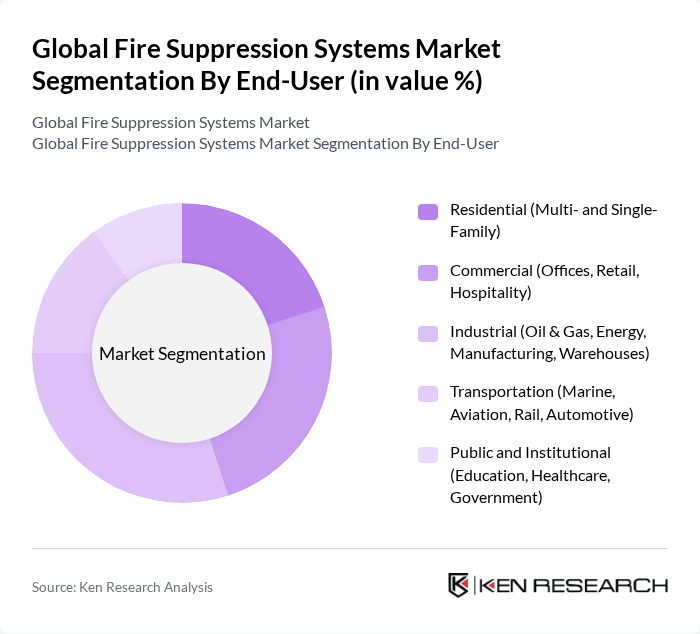

By End-User:The end-user segmentation includes residential, commercial, industrial, transportation, and public and institutional sectors. The industrial segment leads the market, driven by high demand for fire suppression systems in manufacturing facilities, warehouses, oil & gas, and energy sectors, where fire risks and regulatory compliance requirements are highest .

The Global Fire Suppression Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Controls International plc, Honeywell International Inc., Siemens AG, Carrier Global Corporation (formerly UTC Fire & Security), Minimax Viking GmbH, Bosch Sicherheitssysteme GmbH (Bosch Security Systems), Ansul (a brand of Johnson Controls), Firetrace International LLC, Fike Corporation, Amerex Corporation, Kidde-Fenwal, Inc. (a Carrier company), SFFECO Global, National Fire Equipment Ltd., Marioff Corporation Oy (a Carrier company), and Halma plc (Advanced fire suppression brands) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the fire suppression systems market appears promising, driven by technological advancements and increasing regulatory pressures. As industries prioritize safety, the integration of IoT and automation in fire safety solutions is expected to gain traction. Furthermore, the growing focus on sustainability will likely lead to the development of eco-friendly fire suppression systems, aligning with global environmental goals. These trends indicate a dynamic market landscape poised for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based systems (Sprinkler, Mist) Foam-based systems (AFFF, Fluorine-free) Gas-based systems (Clean Agent: FM-200, Novec 1230, Inert Gas; CO? systems) Powder-based systems (Dry-Chemical Powder) Chemical-based systems Hybrid systems (Inert-Gas and Water-Mist) Portable and Mobile Units |

| By End-User | Residential (Multi- and Single-Family) Commercial (Offices, Retail, Hospitality) Industrial (Oil & Gas, Energy, Manufacturing, Warehouses) Transportation (Marine, Aviation, Rail, Automotive) Public and Institutional (Education, Healthcare, Government) |

| By Application | Manufacturing facilities Warehouses Data centers Transportation hubs Energy & Utilities |

| By Component | Detection systems Suppression systems Control panels Alarms and notifications Nozzles, Valves, and Cylinders |

| By Sales Channel | Direct sales Distributors System Integrators and EPC Contractors OEM/Equipment Manufacturers Online sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Budget Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Fire Safety | 100 | Facility Managers, Safety Compliance Officers |

| Industrial Fire Suppression Systems | 80 | Plant Managers, Safety Engineers |

| Residential Fire Safety Solutions | 60 | Homeowners, Property Managers |

| Fire Department Equipment Procurement | 50 | Fire Chiefs, Procurement Officers |

| Fire Safety Technology Innovations | 40 | R&D Managers, Product Development Engineers |

The Global Fire Suppression Systems Market is valued at approximately USD 28.5 billion, driven by increasing safety regulations, technological advancements, and heightened awareness of fire safety across various sectors, including residential, commercial, and industrial.