Region:Middle East

Author(s):Rebecca

Product Code:KRAC8560

Pages:83

Published On:November 2025

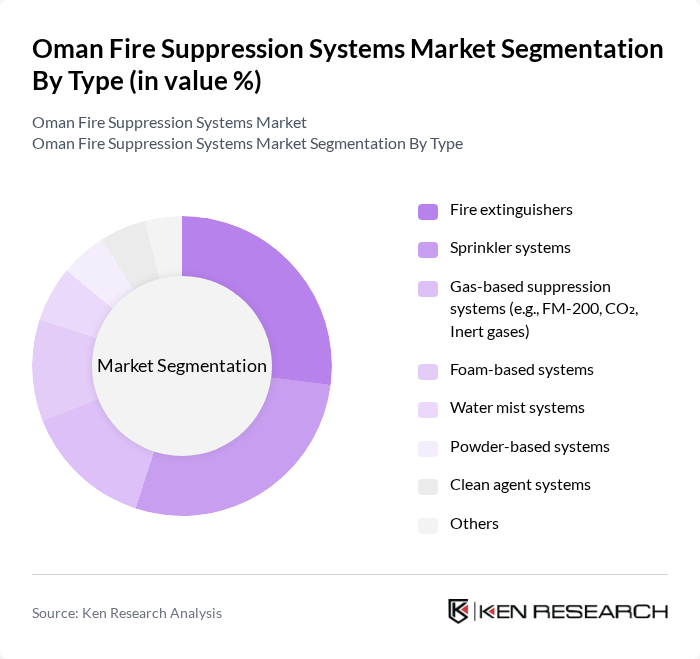

By Type:

Sprinkler systems and fire extinguishers together dominate the market, with sprinkler systems preferred in commercial and industrial facilities for their effectiveness in controlling large-scale fires, and fire extinguishers widely adopted for immediate response in both residential and business settings. The adoption of gas-based suppression systems is increasing, particularly in data centers, telecom, and sensitive industrial environments where water-based systems are unsuitable. Market trends also show a shift towards eco-friendly agents and integration of IoT-enabled monitoring for compliance and maintenance .

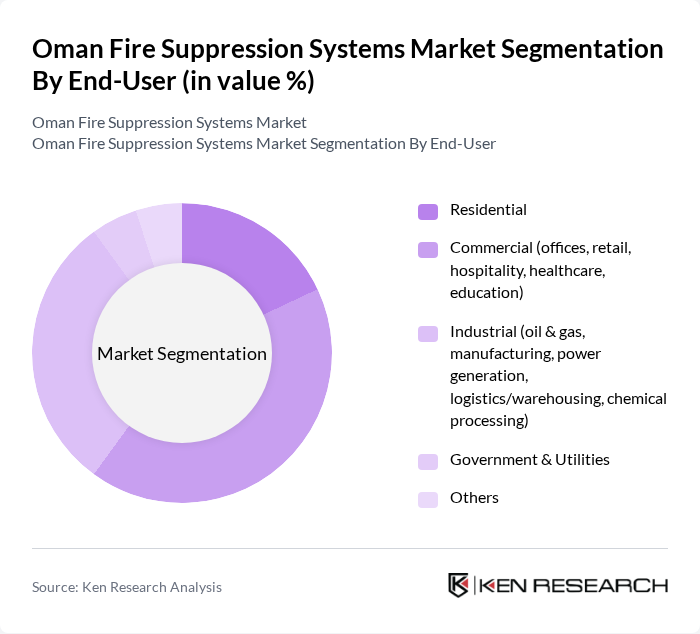

By End-User:

The commercial sector is the largest end-user, driven by strict safety regulations and compliance requirements in hospitality, healthcare, and retail. The industrial sector follows, with significant investments in fire safety due to the high-risk nature of oil & gas, manufacturing, and logistics operations. Residential demand is rising, especially in urban areas, as fire safety awareness and regulatory enforcement increase among homeowners and property developers .

The Oman Fire Suppression Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as NAFFCO (National Fire Fighting Manufacturing FZCO), SFFECO Global, Honeywell International Inc., Johnson Controls International plc, Siemens AG, Minimax Viking GmbH, Fike Corporation, Kidde Fire Systems (Carrier Global Corporation), Firetrace International, Hochiki Middle East FZE, Gentex Corporation, Halma plc, El Gendi Group, United Fire & Safety LLC (Oman), Muscat Fire & Safety Engineering LLC contribute to innovation, geographic expansion, and service delivery in this space .

The Oman fire suppression systems market is poised for significant evolution, driven by technological advancements and regulatory changes. The integration of IoT technologies is expected to enhance system efficiency and monitoring capabilities, while the push for eco-friendly solutions will reshape product offerings. Additionally, as urbanization continues, the demand for automated systems will rise, creating a dynamic landscape for innovation and investment in fire safety solutions, ensuring a safer environment for all stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire extinguishers Sprinkler systems Gas-based suppression systems (e.g., FM-200, CO?, Inert gases) Foam-based systems Water mist systems Powder-based systems Clean agent systems Others |

| By End-User | Residential Commercial (offices, retail, hospitality, healthcare, education) Industrial (oil & gas, manufacturing, power generation, logistics/warehousing, chemical processing) Government & Utilities Others |

| By Application | Fire detection and alarm systems Fire suppression systems Fire safety equipment Others |

| By Installation Type | New installations Retrofitting Maintenance and servicing Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Technology | Conventional systems Addressable systems Wireless systems IoT-enabled/smart systems Others |

| By Service Type | Installation services Maintenance services Consulting services Training and certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Fire Safety | 100 | Facility Managers, Safety Compliance Officers |

| Industrial Fire Suppression Systems | 80 | Operations Managers, Fire Safety Engineers |

| Residential Fire Safety Solutions | 60 | Homeowners, Property Managers |

| Oil & Gas Sector Fire Systems | 50 | Safety Managers, Compliance Officers |

| Hospitality Industry Fire Safety | 70 | Hotel Managers, Safety Consultants |

The Oman Fire Suppression Systems Market is valued at approximately USD 140 million, reflecting a five-year historical analysis of the industrial fire detection and suppression sector, driven by increased fire safety regulations and urbanization.