Region:Global

Author(s):Geetanshi

Product Code:KRAA2329

Pages:98

Published On:August 2025

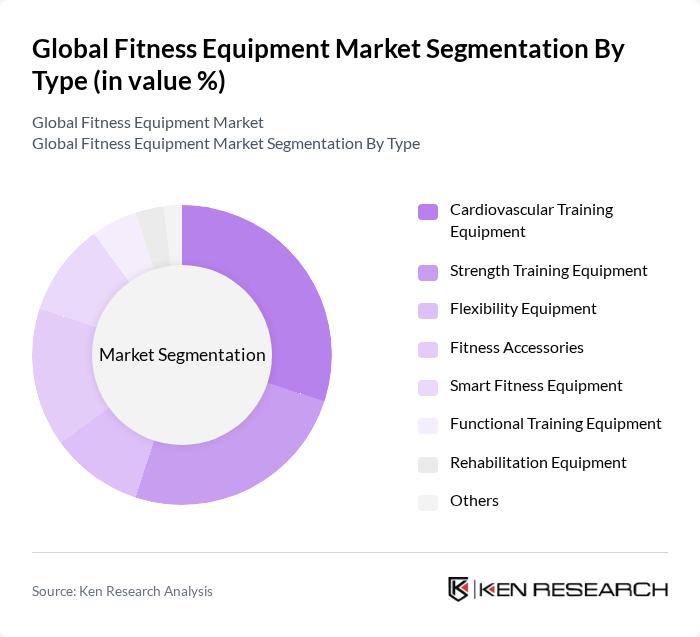

By Type:The fitness equipment market can be segmented into various types, including cardiovascular training equipment, strength training equipment, flexibility equipment, fitness accessories, smart fitness equipment, functional training equipment, rehabilitation equipment, and others. Each of these segments caters to different consumer needs and preferences, with specific equipment designed for various fitness goals. Cardiovascular and strength training equipment remain the largest segments, while smart and connected equipment are rapidly gaining traction due to the integration of digital features and demand for personalized fitness experiences .

The cardiovascular training equipment segment is currently dominating the market due to the increasing popularity of activities such as running, cycling, and rowing. This trend is driven by a growing awareness of cardiovascular health and the benefits of aerobic exercise. Additionally, the rise of home fitness solutions has led to a surge in demand for treadmills, stationary bikes, and elliptical machines, making this segment a key player in the overall fitness equipment market. The integration of digital connectivity and virtual training content further boosts demand for these products .

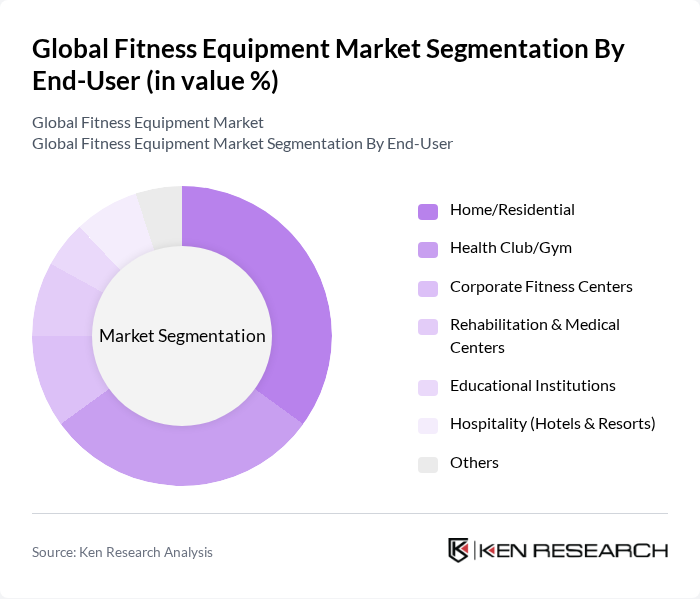

By End-User:The market can also be segmented based on end-users, including home/residential, health clubs/gym, corporate fitness centers, rehabilitation & medical centers, educational institutions, hospitality (hotels & resorts), and others. Each end-user category has distinct requirements and preferences for fitness equipment, influencing purchasing decisions. The home/residential segment has seen significant growth, driven by the shift to home-based workouts and the demand for compact, multifunctional equipment. Health clubs and gyms remain major consumers, but corporate wellness programs and hospitality venues are increasingly investing in fitness facilities to enhance employee and guest experiences .

The home/residential segment is leading the market, driven by the increasing trend of home workouts and the convenience of having fitness equipment readily available. The COVID-19 pandemic has accelerated this trend, as many consumers have shifted to home-based fitness routines. This shift has resulted in a significant rise in demand for compact and multifunctional fitness equipment that can be easily stored and used in limited spaces. The adoption of smart home fitness solutions and virtual training platforms continues to support this segment’s growth .

The Global Fitness Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nautilus, Inc., Life Fitness (Brunswick Corporation), Technogym S.p.A., Precor Incorporated (Peloton Interactive, Inc.), Cybex International, Inc., Johnson Health Tech Co., Ltd., ICON Health & Fitness, Inc. (iFIT Health & Fitness Inc.), Matrix Fitness (Johnson Health Tech), Rogue Fitness, Bowflex (Nautilus, Inc.), ProForm (iFIT Health & Fitness Inc.), Octane Fitness (Nautilus, Inc.), Hammer Strength (Life Fitness), Stages Cycling, Schwinn (Nautilus, Inc.), Echelon Fitness Multimedia, LLC, Peloton Interactive, Inc., True Fitness Technology, Inc., Woodway USA, Inc., Star Trac (Core Health & Fitness, LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The fitness equipment market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As more individuals prioritize health and wellness, the demand for innovative, smart fitness solutions will increase. Additionally, the rise of virtual fitness classes and online platforms will further shape the market landscape. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge, ensuring long-term success in this dynamic industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Cardiovascular Training Equipment Strength Training Equipment Flexibility Equipment Fitness Accessories Smart Fitness Equipment Functional Training Equipment Rehabilitation Equipment Others |

| By End-User | Home/Residential Health Club/Gym Corporate Fitness Centers Rehabilitation & Medical Centers Educational Institutions Hospitality (Hotels & Resorts) Others |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors/Dealers Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| By Material | Steel Plastic Rubber Composite/Hybrid Materials Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Gym Equipment Purchases | 100 | Gym Owners, Fitness Center Managers |

| Home Fitness Equipment Trends | 80 | Home Gym Enthusiasts, Fitness Influencers |

| Corporate Wellness Programs | 60 | HR Managers, Corporate Wellness Coordinators |

| Fitness Equipment Retail Insights | 90 | Retail Managers, Sales Executives |

| Emerging Fitness Technology Adoption | 50 | Product Developers, Tech Innovators in Fitness |

The Global Fitness Equipment Market is valued at approximately USD 18 billion, reflecting a significant growth trend driven by increasing health consciousness, fitness trends, and the expansion of gyms and fitness centers worldwide.