Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4173

Pages:96

Published On:December 2025

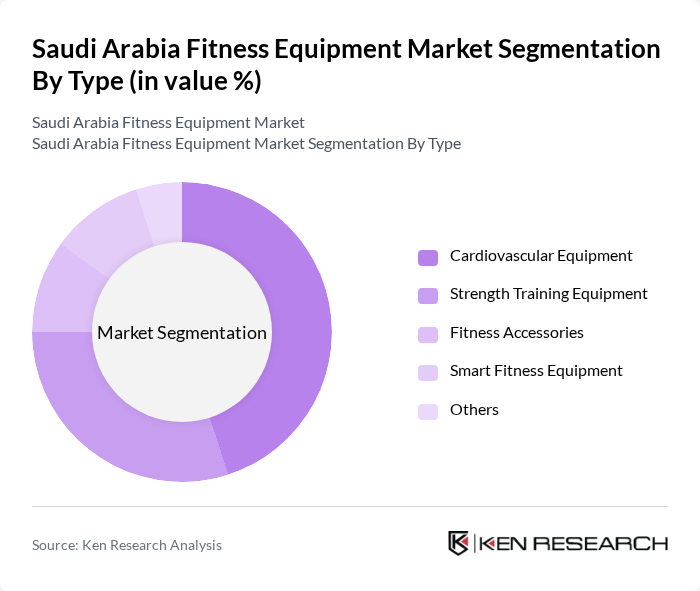

By Type:The fitness equipment market can be segmented into various types, including cardiovascular equipment, strength training equipment, fitness accessories, smart fitness equipment, and others. This aligns with leading market analyses that classify the Saudi gym equipment space into cardiovascular machines, strength training equipment, plate-loaded and free-weight equipment, and other related categories. Among these, cardiovascular equipment is currently the leading sub-segment, driven by the increasing popularity of activities such as running and cycling, and the central role of treadmills, bikes, and ellipticals in both commercial gyms and home setups. The rise in health consciousness has led consumers to prioritize cardiovascular health, resulting in a higher demand for treadmills, stationary bikes, and elliptical machines, often with integrated connectivity and performance tracking features. Strength training equipment also sees significant interest, particularly as more individuals seek to build muscle, follow functional training programs, and adopt free-weight and plate-loaded routines that are increasingly common in budget and premium gyms across the country.

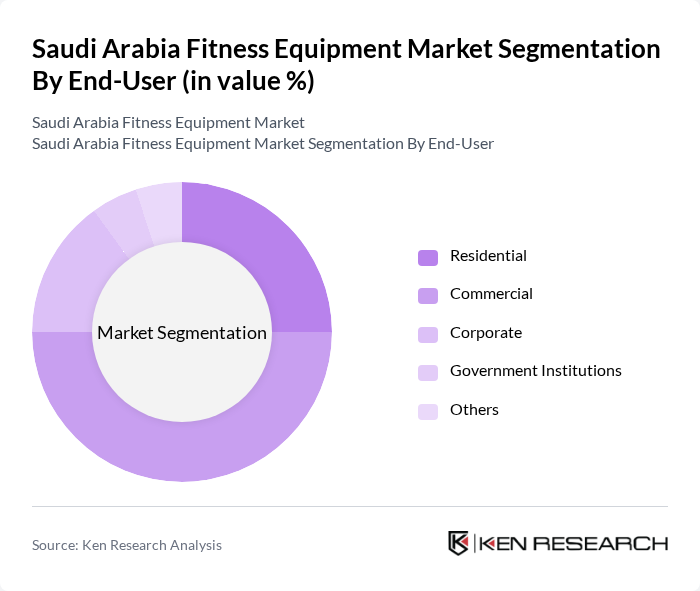

By End-User:The market can also be segmented based on end-users, including residential, commercial, corporate, government institutions, and others. The commercial segment is the most significant contributor to the market, driven by the proliferation of gyms, health and fitness clubs, boutique studios, hotel gyms, and mixed-use community facilities across Saudi Arabia. The increasing number of fitness enthusiasts, the expansion of budget and premium chains, and the trend towards group fitness classes, functional training zones, and women-only facilities have led to a surge in demand for commercial-grade fitness equipment. Residential users are also becoming more prominent, particularly as home workouts, compact multi-gyms, and connected/smart equipment gain popularity, supported by higher internet penetration and digital fitness content following the pandemic-driven shift towards at-home exercise.

The Saudi Arabia Fitness Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Technogym S.p.A., Life Fitness (a subsidiary of KPS Capital Partners), Precor (a subsidiary of Peloton Interactive, Inc.), Cybex International (a subsidiary of Johnson Health Tech), Nautilus, Inc., Matrix Fitness (a brand of Johnson Health Tech), Hammer Strength (a division of Life Fitness), Star Trac (a brand of Johnson Health Tech), Schwinn Fitness (a brand of Nautilus, Inc.), ProForm (a brand of ICON Health & Fitness), Bowflex (a brand of Nautilus, Inc.), Octane Fitness, LLC, Sole Fitness (a brand of ICON Health & Fitness), Vision Fitness (a brand of Johnson Health Tech), and Horizon Fitness (a brand of Johnson Health Tech) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia fitness equipment market appears promising, driven by increasing health awareness and government initiatives aimed at promoting physical activity. As disposable incomes rise, more consumers are likely to invest in fitness solutions, including home equipment and gym memberships. Additionally, the expansion of e-commerce platforms will facilitate easier access to fitness products. The market is expected to adapt to trends such as sustainable equipment and technological advancements, ensuring a dynamic and responsive industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cardiovascular Equipment Strength Training Equipment Fitness Accessories Smart Fitness Equipment Others |

| By End-User | Residential Commercial Corporate Government Institutions Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand | Local Brands International Brands Private Labels Others |

| By Usage | Home Use Gym Use Professional Training Others |

| By Technology | Traditional Equipment Smart Equipment Connected Equipment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Gym Equipment Purchases | 120 | Gym Owners, Fitness Center Managers |

| Home Fitness Equipment Sales | 100 | Retail Managers, E-commerce Executives |

| Corporate Wellness Programs | 90 | HR Managers, Corporate Wellness Coordinators |

| Fitness Equipment Rental Services | 80 | Rental Service Providers, Operations Managers |

| Fitness Equipment Maintenance Services | 70 | Service Technicians, Equipment Maintenance Managers |

The Saudi Arabia Fitness Equipment Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by increasing health awareness and government initiatives aimed at promoting fitness and wellness among the population.