Region:Global

Author(s):Dev

Product Code:KRAA1575

Pages:96

Published On:August 2025

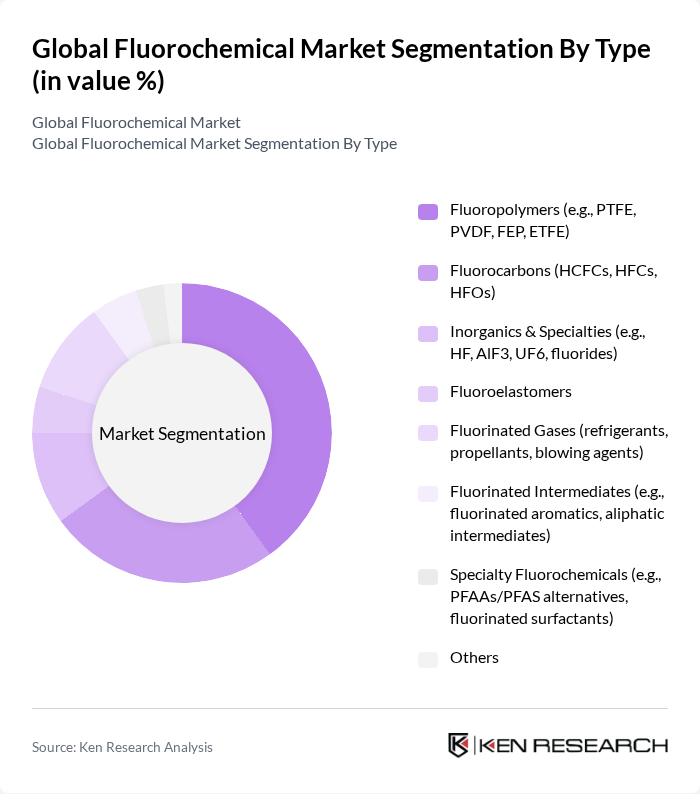

By Type:The fluorochemical market can be segmented into various types, including Fluoropolymers, Fluorocarbons, Inorganics & Specialties, Fluoroelastomers, Fluorinated Gases, Fluorinated Intermediates, Specialty Fluorochemicals, and Others. Among these, Fluoropolymers are the most dominant due to their extensive applications in industries such as automotive, electronics, and construction. Their unique properties, such as chemical resistance and thermal stability, make them highly sought after in various manufacturing processes .

By End-User:The fluorochemical market is also segmented by end-user industries, including Automotive & Transportation, Electrical & Electronics, Pharmaceuticals & Life Sciences, Industrial & Chemical Processing, Building, Construction & HVAC/R, Energy, Consumer Goods & Appliances, and Others. The Automotive & Transportation sector is the leading end-user, driven by the increasing demand for lightweight and durable materials that enhance fuel efficiency and reduce emissions. In parallel, electrical and electronics remain a major demand center due to semiconductor manufacturing needs and high?purity fluoropolymer applications .

The Global Fluorochemical Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Chemours Company, Daikin Industries, Ltd., 3M Company, Solvay S.A., Honeywell International Inc., Arkema S.A., BASF SE, Dongyue Group, Zhejiang Juhua Co., Ltd., Orbia – Koura (Koura Global), AGC Inc., Shanghai 3F New Materials Co., Ltd., Gujarat Fluorochemicals Limited (GFL), Sinochem Holdings Corporation Ltd., Linde plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fluorochemical market appears promising, driven by ongoing innovations and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly alternatives, the demand for sustainable fluorochemicals is expected to rise significantly. Furthermore, the integration of digital technologies in manufacturing processes will enhance efficiency and reduce costs. These trends indicate a dynamic market landscape, where adaptability and innovation will be key to capitalizing on emerging opportunities and addressing existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Fluoropolymers (e.g., PTFE, PVDF, FEP, ETFE) Fluorocarbons (HCFCs, HFCs, HFOs) Inorganics & Specialties (e.g., HF, AlF3, UF6, fluorides) Fluoroelastomers Fluorinated Gases (refrigerants, propellants, blowing agents) Fluorinated Intermediates (e.g., fluorinated aromatics, aliphatic intermediates) Specialty Fluorochemicals (e.g., PFAAs/PFAS alternatives, fluorinated surfactants) Others |

| By End-User | Automotive & Transportation Electrical & Electronics (including semiconductors, displays) Pharmaceuticals & Life Sciences Industrial & Chemical Processing Building, Construction & HVAC/R Energy (oil & gas, new energy, batteries, hydrogen) Consumer Goods & Appliances Others |

| By Application | Refrigerants & Thermal Management Coatings, Membranes & Linings Adhesives & Sealants Cleaning Agents & Etchants (including semiconductor etching gases) Firefighting Agents & Foam Alternatives Propellants & Blowing Agents Aluminum Production & Metallurgy Others |

| By Distribution Channel | Direct Sales (producers to OEMs/end-users) Distributors/Trading Houses Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Medium High |

| By Regulatory Compliance | REACH Compliance TSCA Compliance Kigali/HFC Phase-Down & F-Gas Regulations Other Local Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerant Manufacturers | 110 | Production Managers, R&D Directors |

| Fluoropolymer Producers | 85 | Quality Assurance Managers, Process Engineers |

| Surfactant Applications in Personal Care | 65 | Product Managers, Marketing Executives |

| Fluorochemical Regulatory Compliance | 55 | Compliance Officers, Environmental Managers |

| Emerging Applications in Electronics | 95 | Innovation Managers, Technical Sales Representatives |

The Global Fluorochemical Market is valued at approximately USD 26.5 billion, reflecting strong demand across various sectors such as electronics, HVAC/R, and materials applications. This valuation is based on a comprehensive five-year analysis of market trends and growth drivers.