Region:Middle East

Author(s):Shubham

Product Code:KRAD3612

Pages:100

Published On:November 2025

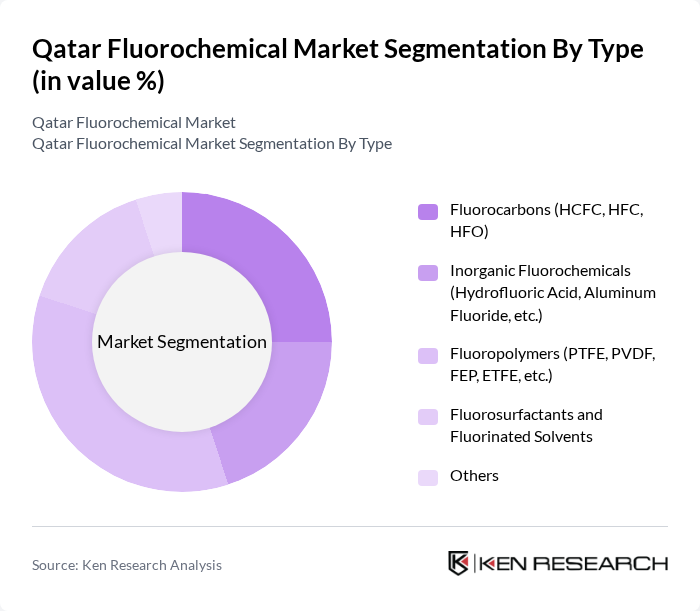

By Type:The market is segmented into various types of fluorochemicals, including Fluorocarbons, Inorganic Fluorochemicals, Fluoropolymers, Fluorosurfactants, and others. Among these, Fluoropolymers such as PTFE and PVDF are leading due to their extensive applications in industries requiring high-performance materials. The demand for these materials is driven by their unique properties, including chemical resistance, electrical insulation, and thermal stability, making them essential in electronics, automotive, and chemical processing sectors.

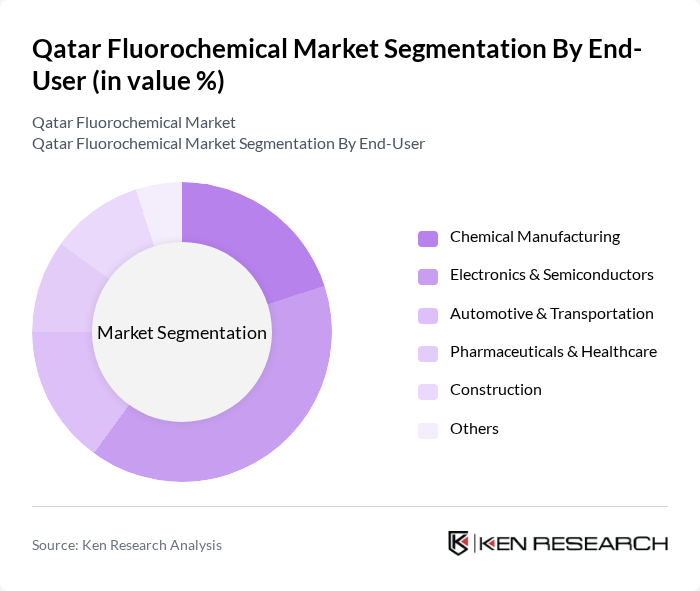

By End-User:The end-user segmentation includes Chemical Manufacturing, Electronics & Semiconductors, Automotive & Transportation, Pharmaceuticals & Healthcare, Construction, and others. The Electronics & Semiconductors sector is currently the dominant end-user, driven by the increasing demand for high-purity fluorochemicals used in semiconductor manufacturing, advanced electronic components, and efficient cooling solutions. Growth in this sector is propelled by rapid technological advancements, increased investment in electronics manufacturing, and the rising adoption of energy-efficient devices.

The Qatar Fluorochemical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Petrochemical Company (QAPCO), Industries Qatar (IQ), Gulf Fluor, Qatar Chemical Company (Q-Chem), Qatar Vinyl Company (QVC), Qatar National Chemical Company (QNCC), Qatar Industrial Manufacturing Company (QIMC), Qatar Fertilizer Company (QAFCO), Gulf Chlorine, Qatar Energy, Qatar Steel Company, Qatar National Cement Company, Qatar Aluminium (Qatalum), Qatar Chemical Industries Company (QCIC), Muntajat (Qatar Chemical and Petrochemical Marketing and Distribution Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar fluorochemical market appears promising, driven by increasing investments in sustainable practices and technological innovations. As the global demand for eco-friendly products rises, local manufacturers are likely to adapt by developing greener alternatives. Additionally, the expansion of the petrochemical industry will provide a stable supply of raw materials, fostering growth. Collaborations between industry players and research institutions will further enhance product development, ensuring Qatar remains competitive in the global fluorochemical landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fluorocarbons (HCFC, HFC, HFO) Inorganic Fluorochemicals (Hydrofluoric Acid, Aluminum Fluoride, etc.) Fluoropolymers (PTFE, PVDF, FEP, ETFE, etc.) Fluorosurfactants and Fluorinated Solvents Others |

| By End-User | Chemical Manufacturing Electronics & Semiconductors Automotive & Transportation Pharmaceuticals & Healthcare Construction Others |

| By Application | Refrigerants Aluminum Production Blowing Agents Coatings & Surface Treatments Cleaning Agents Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Product Form | Liquid Solid Gas Others |

| By Regulatory Compliance | REACH Compliance TSCA Compliance Local Environmental Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fluorochemical Manufacturers | 60 | Production Managers, R&D Directors |

| End-User Industries (Automotive) | 50 | Procurement Managers, Product Engineers |

| Construction Sector Applications | 40 | Project Managers, Material Specialists |

| Electronics Manufacturing | 40 | Supply Chain Managers, Quality Assurance Heads |

| Regulatory Bodies and Associations | 40 | Policy Makers, Environmental Compliance Officers |

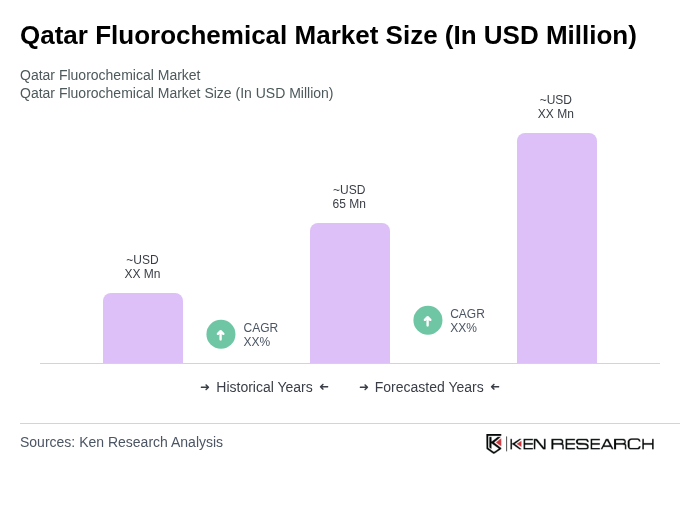

The Qatar Fluorochemical Market is valued at approximately USD 65 million, reflecting a five-year historical analysis and its share within the Middle East market. This valuation is influenced by the growing demand for fluorinated products across various sectors.