Region:Global

Author(s):Geetanshi

Product Code:KRAA2334

Pages:96

Published On:August 2025

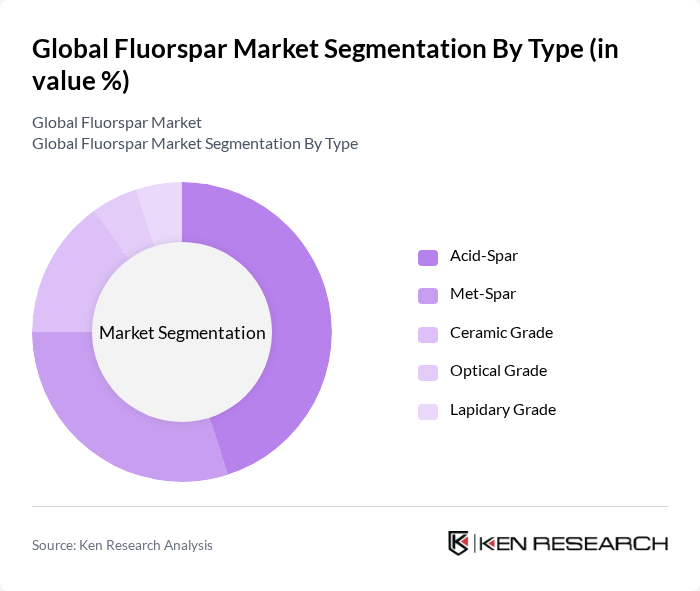

By Type:The market is segmented into Acid-Spar, Met-Spar, Ceramic Grade, Optical Grade, and Lapidary Grade. Acid-Spar leads due to its critical role in hydrofluoric acid production, essential for chemical manufacturing and refrigerant applications. Met-Spar is primarily used in the metallurgical sector, notably for aluminum and steel production. Demand for Ceramic Grade and Optical Grade is rising, supported by technological advancements and expanding use in ceramics, optics, and high-performance materials.

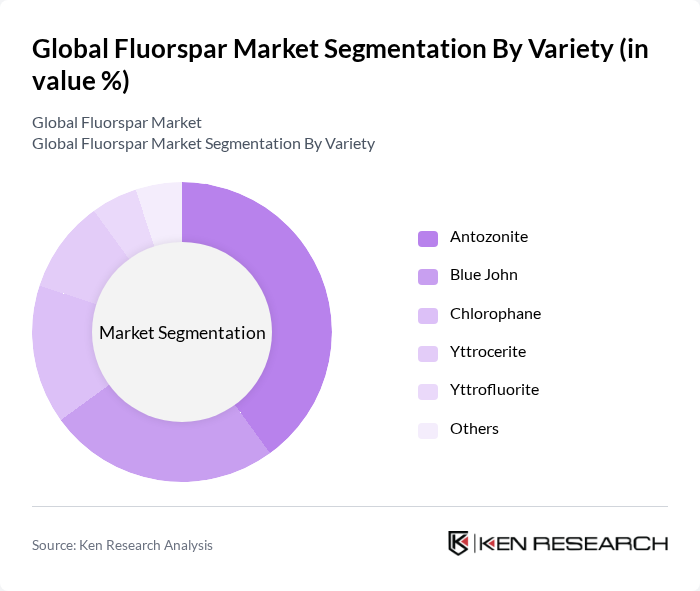

By Variety:The market is categorized into Antozonite, Blue John, Chlorophane, Yttrocerite, Yttrofluorite, and Others. Antozonite is notable for its unique chemical properties and industrial applications. Blue John, valued for its aesthetic qualities, is increasingly popular in decorative and niche markets. Chlorophane and Yttrocerite are in demand for specialized uses in chemical and metallurgical sectors, reflecting broader diversification in fluorspar utilization.

The Global Fluorspar Market features a diverse mix of regional and international companies. Leading players such as China Minmetals Corporation, Fluorsid S.p.A., Orbia (formerly Mexichem S.A.B. de C.V.), Minersa Group, Seaforth Mineral & Ore Co., DuPont de Nemours, Inc., Inner Mongolia Baotou Steel Union Co., Ltd., Mongolrostsvetmet SOE, China Kings Resources Group Co., Ltd., Central Fluorspar Company, Ares Strategic Mining Inc., British Fluorspar Limited, Yunnan Tsinghua Fluorspar Co., Ltd., Hunan Nonferrous Chenzhou Fluoride Chemical Co., Ltd., and Global Fluorspar Solutions drive innovation, geographic expansion, and service delivery in the sector.

Sources:

The future of the fluorspar market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly practices, the demand for sustainably sourced fluorspar is expected to rise. Additionally, the ongoing research and development in fluorine applications will likely open new avenues for growth, particularly in energy-efficient technologies and innovative materials. This evolving landscape presents opportunities for companies to enhance their competitive edge and expand their market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Acid-Spar Met-Spar Ceramic Grade Optical Grade Lapidary Grade |

| By Variety | Antozonite Blue John Chlorophane Yttrocerite Yttrofluorite Others |

| By End-User | Chemical Industry Metallurgical Industry Construction Industry Automotive Industry Ceramics & Glass Industry Others |

| By Application | Aluminum Production Hydrofluoric Acid Production Glass Manufacturing Cement Production Lithium-ion Battery Manufacturing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Policy Support | Subsidies for mining operations Tax incentives for production Research grants for fluorine applications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fluorspar Mining Operations | 60 | Mining Engineers, Operations Managers |

| Fluorspar Processing Facilities | 50 | Plant Managers, Quality Control Supervisors |

| End-User Industries (Metallurgy) | 40 | Procurement Managers, Production Supervisors |

| Fluorspar Traders and Distributors | 40 | Sales Directors, Supply Chain Analysts |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Environmental Compliance Officers |

The Global Fluorspar Market is valued at approximately USD 2.37 billion, driven by increasing demand for fluorine-based products across various industries, including chemicals, metallurgy, and ceramics.