Region:Middle East

Author(s):Dev

Product Code:KRAC4822

Pages:96

Published On:October 2025

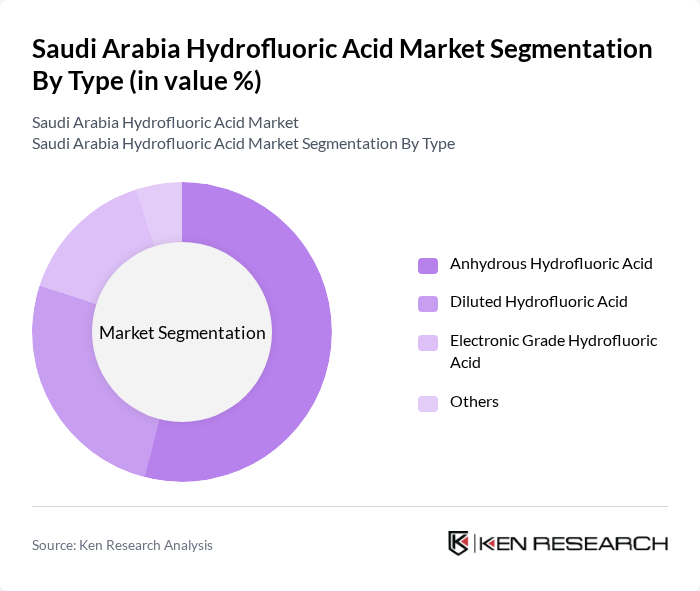

By Type:

The hydrofluoric acid market is segmented into four main types: Anhydrous Hydrofluoric Acid, Diluted Hydrofluoric Acid, Electronic Grade Hydrofluoric Acid, and Others. Among these, Anhydrous Hydrofluoric Acid remains the leading subsegment, accounting for the largest share due to its extensive use in petrochemical processes and fluorinated compound production. Electronic Grade Hydrofluoric Acid is experiencing notable growth, driven by the expanding electronics manufacturing sector and increased demand for high-purity chemicals in semiconductor fabrication. The versatility of these products in diverse industrial applications continues to support their market dominance .

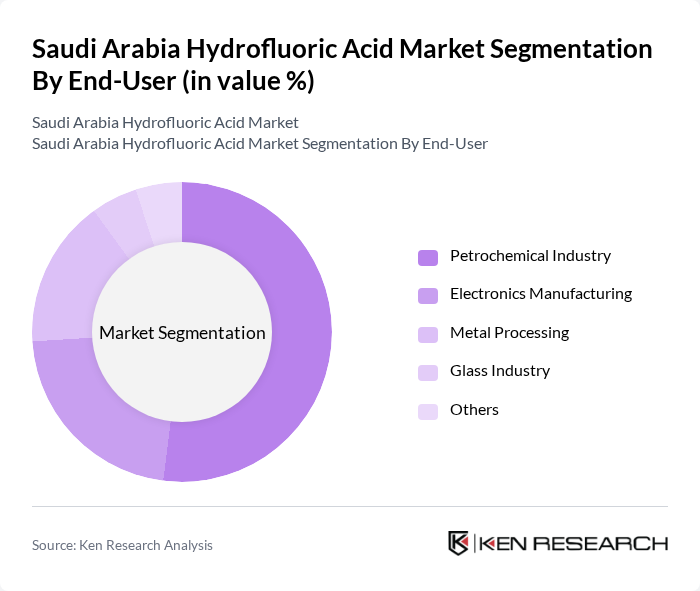

By End-User:

The end-user segmentation includes the Petrochemical Industry, Electronics Manufacturing, Metal Processing, Glass Industry, and Others. The Petrochemical Industry is the dominant segment, utilizing hydrofluoric acid for alkylation processes and the production of fluorinated chemicals. Electronics Manufacturing is a rapidly growing segment, driven by increased investment in semiconductor fabrication and the need for ultra-high purity chemicals. Metal Processing and Glass Industry also constitute significant shares, leveraging hydrofluoric acid for metal surface treatment and glass etching, respectively .

The Saudi Arabia Hydrofluoric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Gulf Fluor LLC, Daikin Industries, Ltd., Solvay S.A., Honeywell International Inc., DuPont de Nemours, Inc., Arkema S.A., Chemours Company, Koura Global (Orbia Advance Corporation, formerly Mexichem), Lanxess AG, Stella Chemifa Corporation, Linde plc, Air Products and Chemicals, Inc., BASF SE, Sinochem Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia hydrofluoric acid market is poised for significant growth, driven by increasing demand from key sectors such as petrochemicals and electronics. As companies adapt to stringent environmental regulations, investments in sustainable production methods will become crucial. Additionally, the market is likely to see innovations in applications, particularly in pharmaceuticals and specialty chemicals, which will further enhance growth prospects. Strategic partnerships and regional exports will also play a vital role in shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Anhydrous Hydrofluoric Acid Diluted Hydrofluoric Acid Electronic Grade Hydrofluoric Acid Others |

| By End-User | Petrochemical Industry Electronics Manufacturing Metal Processing Glass Industry Others |

| By Application | Glass Etching and Cleaning Oil Refining (Alkylation) Fluorocarbon Production Fluoropolymer Production Chemical Synthesis Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Packaging Type | Cylinders Drums Bulk Containers Others |

| By Price Range | Low Price Mid Price High Price |

| By Region | Central Region Eastern Region Western Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Petrochemical Industry Users | 100 | Procurement Managers, Chemical Engineers |

| Electronics Manufacturing Sector | 60 | Production Supervisors, Quality Control Managers |

| Metal Processing Companies | 50 | Operations Managers, Safety Officers |

| Pharmaceutical Manufacturers | 40 | Research & Development Heads, Compliance Officers |

| Academic and Research Institutions | 40 | Research Scientists, Laboratory Managers |

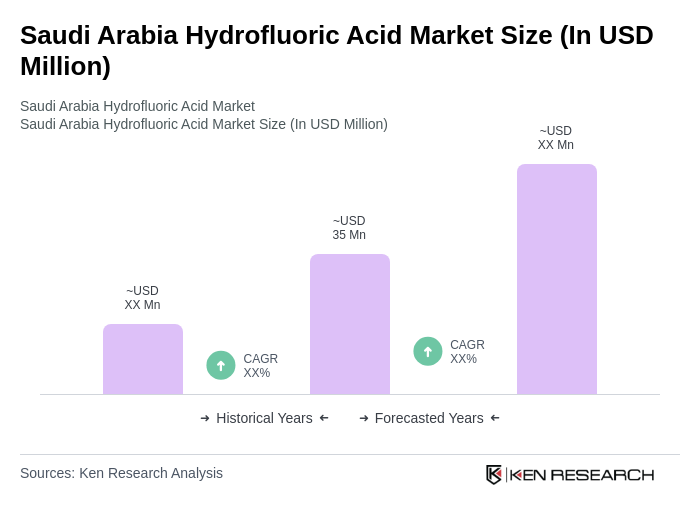

The Saudi Arabia Hydrofluoric Acid Market is valued at approximately USD 35 million, driven by demand from the petrochemical and electronics industries, as well as advancements in production technologies and industrial activities.