Region:Global

Author(s):Shubham

Product Code:KRAA1823

Pages:91

Published On:August 2025

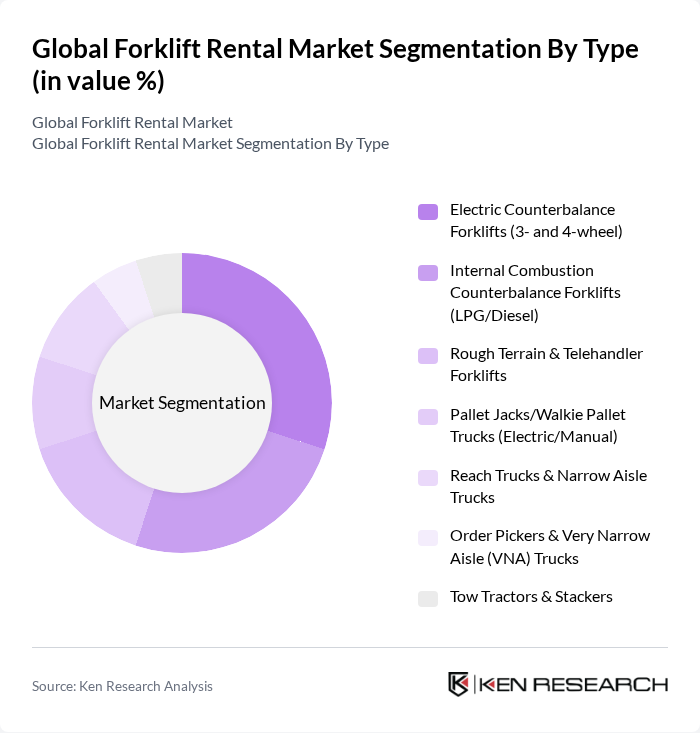

By Type:The forklift rental market includes Electric Counterbalance Forklifts, Internal Combustion Counterbalance Forklifts, Rough Terrain & Telehandler Forklifts, Pallet Jacks/Walkie Pallet Trucks, Reach Trucks & Narrow Aisle Trucks, Order Pickers & Very Narrow Aisle Trucks, and Tow Tractors & Stackers. Electric Counterbalance Forklifts are gaining traction due to zero local emissions, lower operating costs, and lithium-ion adoption, which improve uptime and charging flexibility. Demand for Internal Combustion Counterbalance Forklifts remains resilient in heavy-duty, outdoor, and rough-terrain applications. Adoption of telematics, predictive maintenance, and fleet management tools in rental contracts is further boosting utilization across electric and ICE categories.

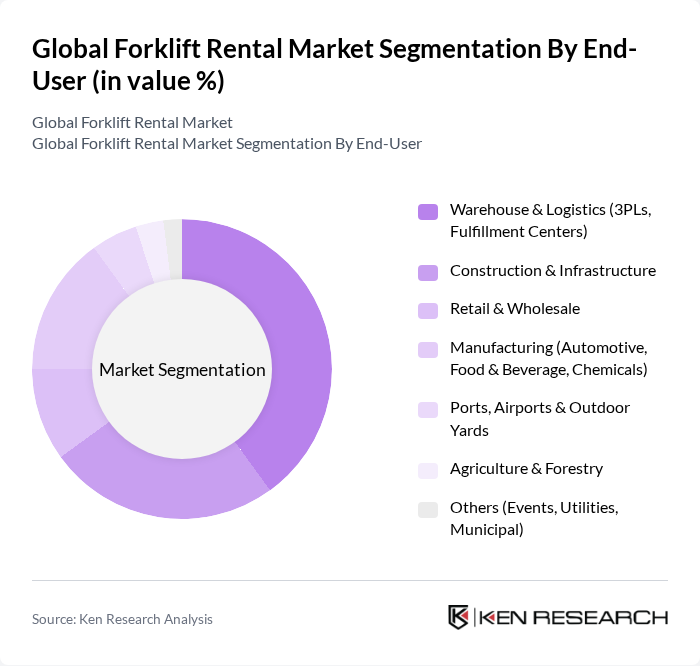

By End-User:The end-user segmentation of the forklift rental market includes Warehouse & Logistics, Construction & Infrastructure, Retail & Wholesale, Manufacturing, Ports, Airports & Outdoor Yards, Agriculture & Forestry, and Others. Warehouse & Logistics is the largest end-user, supported by e-commerce growth, 3PL expansion, and the need to scale fleets for seasonal peaks without capex. Construction & Infrastructure continues to utilize rough-terrain and telehandler units for short- and mid-term projects, while automation and uptime requirements in manufacturing sustain steady rental demand.

The Global Forklift Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as United Rentals, Inc., Sunbelt Rentals, Inc. (Ashtead Group plc), Herc Rentals Inc., Ahern Rentals, Inc. (a division of The Ahern Family of Companies), LOXAM, Ramirent (a Loxam company; formerly Cramo Oyj), Riwal Holding Group, Nishio Rent All Co., Ltd., Kanamoto Co., Ltd., Sunbelt Rentals UK (Ashtead Group plc; formerly A-Plant), Aggreko plc, Toyota Material Handling (Toyota Industries Corporation), Crown Equipment Corporation, KION Group (Linde Material Handling, STILL) – Rental & Used, Jungheinrich AG – Rental & Intralogistics, H&E Equipment Services, Inc., Boels Rental, United Forklift and Access Solutions (Australia), Briggs Equipment (UK & U.S.), TVH Group (Rental & Short-term Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the forklift rental market appears promising, driven by technological advancements and a shift towards sustainable practices. As companies increasingly adopt electric forklifts, the demand for eco-friendly rental options is expected to rise. Additionally, the integration of IoT technology in fleet management will enhance operational efficiency, allowing rental companies to optimize their services. This trend is likely to attract new customers seeking innovative solutions, further expanding the market landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Counterbalance Forklifts (3- and 4-wheel) Internal Combustion Counterbalance Forklifts (LPG/Diesel) Rough Terrain & Telehandler Forklifts Pallet Jacks/Walkie Pallet Trucks (Electric/Manual) Reach Trucks & Narrow Aisle Trucks Order Pickers & Very Narrow Aisle (VNA) Trucks Tow Tractors & Stackers |

| By End-User | Warehouse & Logistics (3PLs, Fulfillment Centers) Construction & Infrastructure Retail & Wholesale Manufacturing (Automotive, Food & Beverage, Chemicals) Ports, Airports & Outdoor Yards Agriculture & Forestry Others (Events, Utilities, Municipal) |

| By Application | Material Handling & Put-away Loading/Unloading & Cross-Docking Inventory Management & Picking Indoor vs Outdoor Handling Specialized Handling (Cold Chain, Hazardous Areas) |

| By Rental Duration | Short-term (Daily/Weekly) Medium-term (Monthly/Quarterly) Long-term & Full-Service Lease (12–60 months) |

| By Pricing Model | Time-based (Hourly/Daily/Weekly/Monthly) Usage-based (Hours-meter/Throughput) Subscription & Full-Maintenance Contracts Performance-based (Uptime/SLAs) |

| By Fleet Size | Small Fleet (1–10 units) Medium Fleet (11–50 units) Large Fleet (51+ units) |

| By Capacity Class | Below 5 Ton –30 Ton Above 30 Ton |

| By Power Source | Electric (Lead-acid, Lithium-ion) Internal Combustion (LPG/CNG/Diesel) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Rental | 120 | Project Managers, Equipment Rental Supervisors |

| Warehouse Forklift Utilization | 100 | Warehouse Managers, Operations Directors |

| Logistics and Supply Chain Rentals | 80 | Logistics Managers, Supply Chain Analysts |

| Industrial Equipment Rental Trends | 70 | Procurement Managers, Facility Operations Heads |

| Regional Market Insights | 90 | Regional Sales Managers, Business Development Executives |

The Global Forklift Rental Market is valued at approximately USD 5 billion, driven by increasing demand for material handling equipment across various sectors such as logistics, construction, and manufacturing, where rental options provide cost-effective solutions.