Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9553

Pages:99

Published On:November 2025

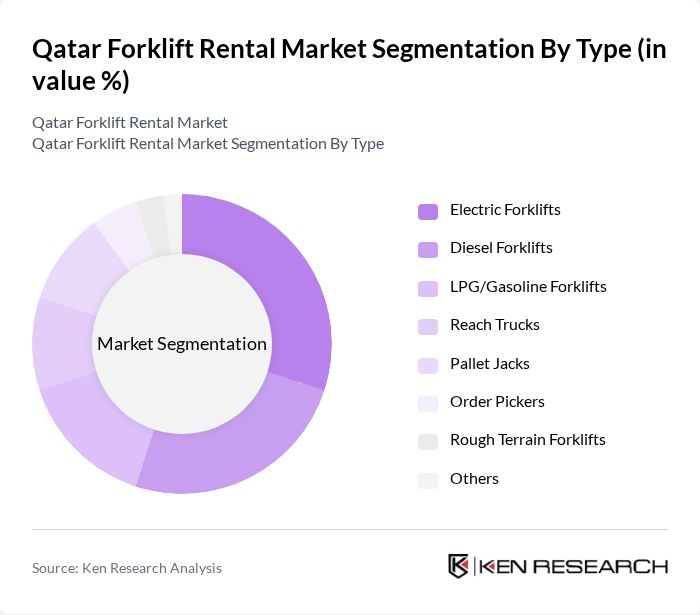

By Type:The market is segmented into various types of forklifts, including Electric Forklifts, Diesel Forklifts, LPG/Gasoline Forklifts, Reach Trucks, Pallet Jacks, Order Pickers, Rough Terrain Forklifts, and Others. Each type serves specific operational needs, with electric forklifts gaining popularity due to their environmental benefits, lower operating costs, and alignment with Qatar’s sustainability initiatives and increasing adoption of green logistics solutions .

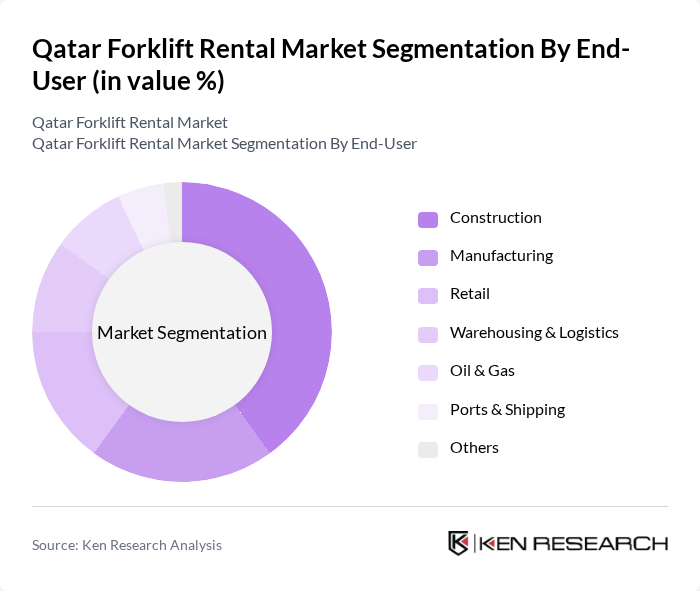

By End-User:The end-user segmentation includes Construction, Manufacturing, Retail, Warehousing & Logistics, Oil & Gas, Ports & Shipping, and Others. The construction sector is the largest end-user, driven by ongoing infrastructure projects, smart city developments, and the need for efficient material handling solutions. Manufacturing and warehousing are also significant, reflecting Qatar’s expanding industrial base and logistics network .

The Qatar Forklift Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jaidah Equipment, Al-Bahar (Caterpillar), Mannai Trading Co., Hertz Dayim Equipment Rental, Byrne Equipment Rental, Al Faris Equipment Rentals, United Gulf Equipment Rentals, Al Mulla Group, Kanoo Machinery, Al Jaber Group, Al Malki Group, Al Muraikhi Group, Qatar Industrial Equipment, Al Mufeed Group, Qatar Heavy Equipment contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar forklift rental market is poised for significant growth, driven by ongoing infrastructure projects and the increasing preference for rental services. As companies adapt to evolving market conditions, the integration of advanced technologies such as IoT and automation will enhance operational efficiency. Furthermore, the focus on sustainability will likely lead to a rise in demand for electric and hybrid forklifts, aligning with global trends towards eco-friendly solutions. This dynamic environment presents a promising landscape for stakeholders in the rental market.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Forklifts Diesel Forklifts LPG/Gasoline Forklifts Reach Trucks Pallet Jacks Order Pickers Rough Terrain Forklifts Others |

| By End-User | Construction Manufacturing Retail Warehousing & Logistics Oil & Gas Ports & Shipping Others |

| By Application | Indoor Operations Outdoor Operations Heavy Lifting Material Handling Container Handling Others |

| By Payload Capacity | Up to 3,500 kg (Up to 7,700 lbs) ,501 - 7,000 kg (7,701 - 15,400 lbs) ,001 - 10,000 kg (15,401 - 22,000 lbs) Above 10,000 kg (Above 22,000 lbs) Others |

| By Rental Duration | Short-term Rentals (up to 6 months) Long-term Rentals (over 6 months) Project-based Rentals Seasonal Rentals Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor Others |

| By Customer Type | Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Rental | 100 | Project Managers, Equipment Rental Coordinators |

| Logistics and Warehousing | 90 | Warehouse Managers, Operations Directors |

| Industrial Sector Forklift Usage | 60 | Facility Managers, Safety Officers |

| Event and Exhibition Rentals | 40 | Event Coordinators, Logistics Managers |

| Government and Public Sector Projects | 50 | Procurement Officers, Project Supervisors |

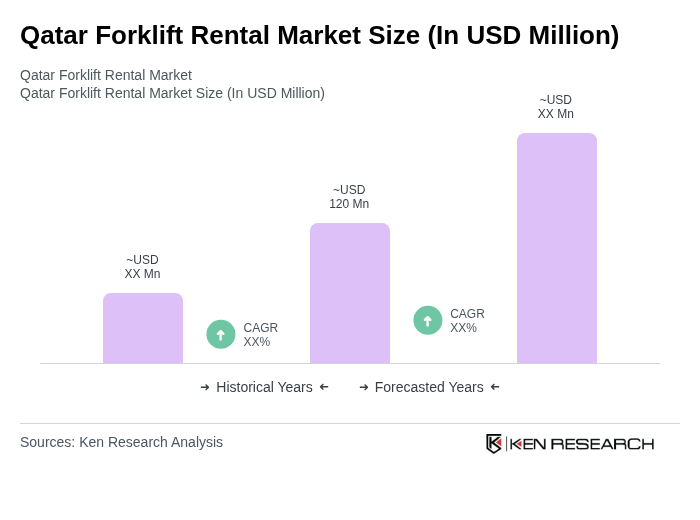

The Qatar Forklift Rental Market is valued at approximately USD 120 million, driven by the growth of the construction and logistics sectors, as well as the increasing demand for efficient material handling solutions.