Region:Global

Author(s):Geetanshi

Product Code:KRAA1274

Pages:84

Published On:August 2025

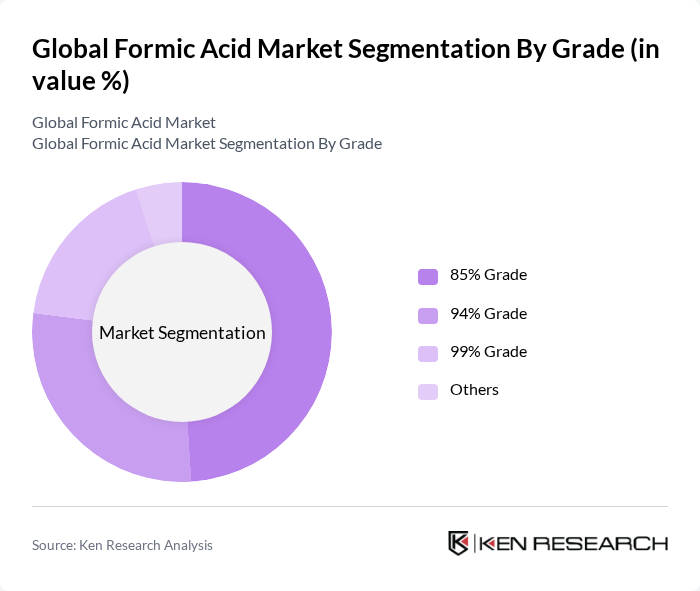

By Grade:The market is segmented into various grades of formic acid, including 85% Grade, 94% Grade, 99% Grade, and Others. The 85% Grade is widely used in agriculture and leather industries due to its cost-effectiveness and efficacy for these applications. The 94% and 99% Grades are preferred in specialized applications such as pharmaceuticals and high-end chemical manufacturing, where higher purity is required. The Others category includes formulations and blends tailored for specific industrial needs .

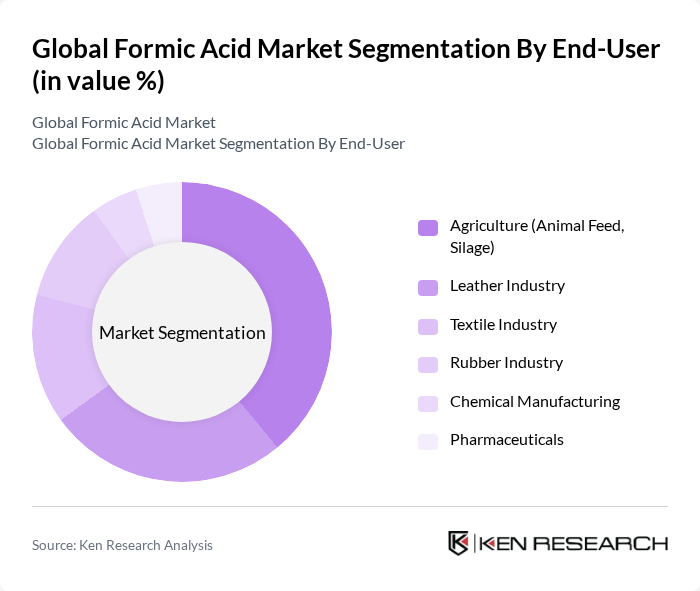

By End-User:The end-user segmentation includes Agriculture (Animal Feed, Silage), Leather Industry, Textile Industry, Rubber Industry, Chemical Manufacturing, and Pharmaceuticals. The Agriculture segment is the largest consumer of formic acid, primarily for use as a preservative in animal feed and silage. The Leather and Textile industries also contribute significantly to demand, utilizing formic acid in tanning and dyeing processes. The Chemical Manufacturing and Pharmaceuticals sectors are experiencing growth, driven by the need for high-purity formic acid in various applications .

The Global Formic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Eastman Chemical Company, Perstorp Holding AB, Feicheng Acid Chemical Co., Ltd., Mitsubishi Gas Chemical Company, Inc., Luxi Chemical Group Co., Ltd., Shandong Rongyue Chemical Co., Ltd., Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC), Taminco BVBA (now part of Eastman Chemical Company), Merck KGaA, Chongqing Chuandong Chemical (Group) Co., Ltd., Anhui Asahi Kasei Chemical Co., Ltd., Hubei Dazhong Chemical Co., Ltd., Shandong Jinling Chemical Co., Ltd., and Yara International ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the formic acid market appears promising, driven by increasing applications across various industries. The shift towards sustainable practices is expected to enhance the demand for bio-based formic acid, aligning with global sustainability goals. Additionally, technological advancements in production processes are likely to improve efficiency and reduce costs, making formic acid more accessible. As industries adapt to these trends, the market is poised for growth, particularly in emerging economies where demand is rising.

| Segment | Sub-Segments |

|---|---|

| By Grade | % Grade % Grade % Grade Others |

| By End-User | Agriculture (Animal Feed, Silage) Leather Industry Textile Industry Rubber Industry Chemical Manufacturing Pharmaceuticals |

| By Application | Preservatives Reducing Agents pH Regulators Leather Tanning Textile Dyeing Rubber Coagulation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Packaging Type | Drums IBC Totes Bulk Others |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Applications | 100 | Agronomists, Crop Protection Managers |

| Textile Industry Usage | 70 | Textile Engineers, Production Supervisors |

| Pharmaceutical Sector Insights | 60 | Pharmaceutical Chemists, Quality Control Managers |

| Industrial Applications | 80 | Manufacturing Managers, Process Engineers |

| Research and Development | 50 | R&D Directors, Innovation Managers |

The Global Formic Acid Market is valued at approximately USD 1.3 billion, driven by increasing demand in sectors such as agriculture, textiles, leather, and chemical manufacturing. This growth reflects a five-year historical analysis of market trends and consumer needs.