Region:Global

Author(s):Rebecca

Product Code:KRAC0183

Pages:90

Published On:August 2025

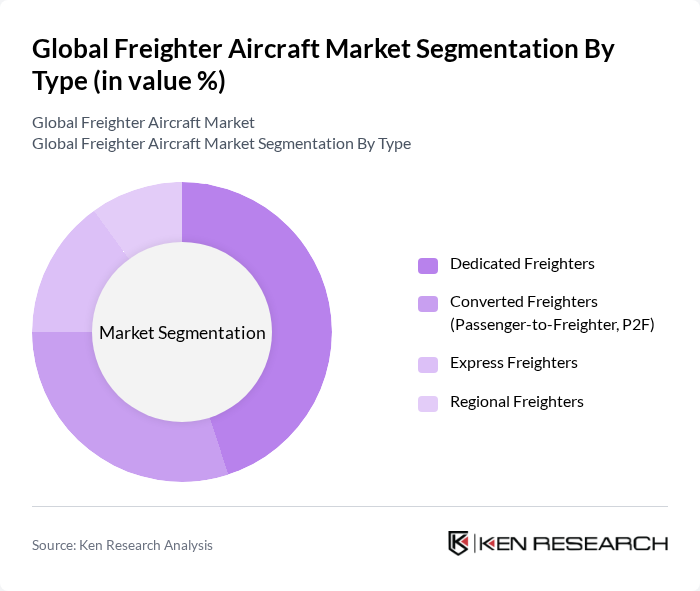

By Type:

The Dedicated Freighters segment is the leading sub-segment in the market, primarily due to the increasing demand for specialized cargo transport solutions. These aircraft are designed specifically for freight operations, offering higher payload capacities and operational efficiencies compared to converted freighters. The rise of e-commerce has further fueled the need for dedicated freighter services, as companies seek to ensure timely deliveries and optimize their logistics networks. Additionally, the market has seen a surge in passenger-to-freighter conversions, addressing capacity constraints and supporting the growth of lighter, high-volume cargo such as e-commerce packages .

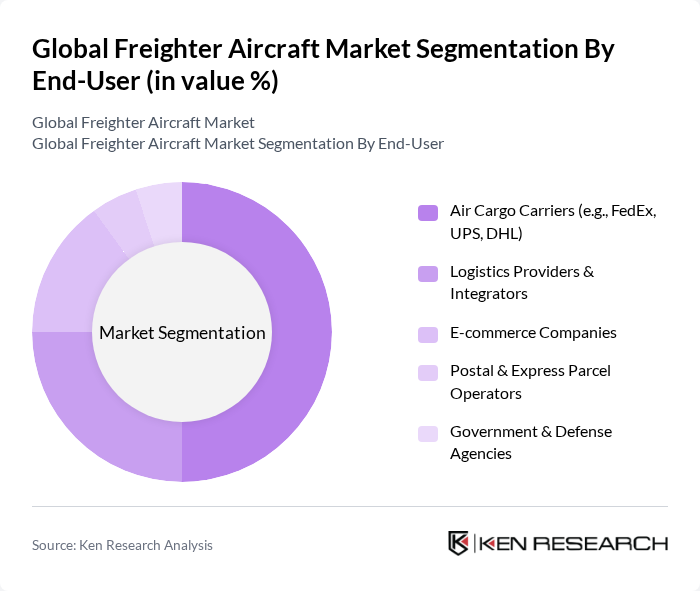

By End-User:

Air Cargo Carriers dominate the end-user segment, driven by their extensive networks and established infrastructure for handling large volumes of freight. Companies like FedEx and UPS have invested heavily in their fleets and logistics capabilities, allowing them to meet the growing demand for air cargo services. The rise of e-commerce has also led to increased partnerships between air cargo carriers and online retailers, further solidifying their market leadership. Logistics providers and integrators are expanding their offerings to include multimodal solutions, while e-commerce companies increasingly rely on air freight for rapid fulfillment .

The Global Freighter Aircraft Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Boeing Company, Airbus S.A.S., Lockheed Martin Corporation, Textron Aviation Inc., Embraer S.A., Bombardier Inc., Atlas Air Worldwide Holdings, Inc., FedEx Express (FedEx Corporation), UPS Airlines (United Parcel Service, Inc.), Cargolux Airlines International S.A., Qatar Airways Cargo, Singapore Airlines Cargo, Lufthansa Cargo AG, Korean Air Cargo, China Airlines Cargo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the freighter aircraft market appears promising, driven by technological advancements and a growing emphasis on sustainability. As logistics companies increasingly adopt automation and digital solutions, operational efficiencies are expected to improve. Furthermore, the rise of hybrid and electric aircraft is likely to reshape the market landscape, offering environmentally friendly alternatives. The demand for on-demand freight services will also continue to grow, catering to the evolving needs of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Dedicated Freighters Converted Freighters (Passenger-to-Freighter, P2F) Express Freighters Regional Freighters |

| By End-User | Air Cargo Carriers (e.g., FedEx, UPS, DHL) Logistics Providers & Integrators E-commerce Companies Postal & Express Parcel Operators Government & Defense Agencies |

| By Payload Capacity | Less than 10 Tons –30 Tons –60 Tons Above 60 Tons |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Sales Channel | Direct Sales (OEM to Operator) Aircraft Leasing Companies Conversion Specialists Distributors/Brokers |

| By Maintenance Type | Line Maintenance Base Maintenance Engine Overhaul Component Repair & Replacement |

| By Financing Options | Operating Lease Finance Lease Outright Purchase Sale & Leaseback |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Global Cargo Airlines | 120 | Fleet Managers, Operations Directors |

| Aircraft Manufacturers | 80 | Product Development Managers, Sales Executives |

| Logistics Service Providers | 60 | Supply Chain Managers, Business Development Leads |

| Regulatory Bodies | 40 | Aviation Policy Analysts, Compliance Officers |

| Freight Forwarders | 70 | Operations Managers, Customer Service Representatives |

The Global Freighter Aircraft Market is valued at approximately USD 6.2 billion, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for air cargo services, particularly in e-commerce and logistics sectors.