Region:North America

Author(s):Shubham

Product Code:KRAD0714

Pages:93

Published On:August 2025

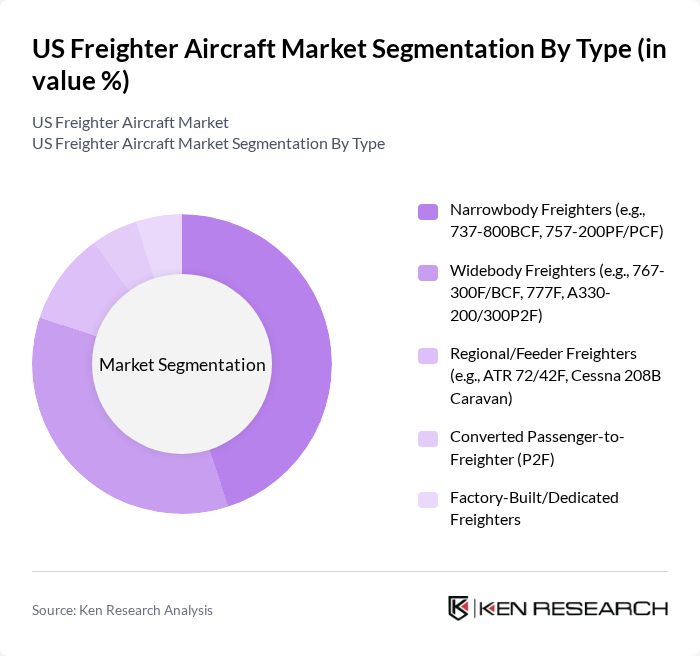

By Type:The market is segmented into various types of freighter aircraft, including narrowbody freighters, widebody freighters, regional/feeders, converted passenger-to-freighter (P2F), and factory-built/dedicated freighters. Among these, narrowbody freighters are gaining traction due to their operational efficiency and lower costs, making them a preferred choice for regional and short-haul operations. Widebody freighters, on the other hand, dominate long-haul routes, catering to the growing demand for international cargo transport.

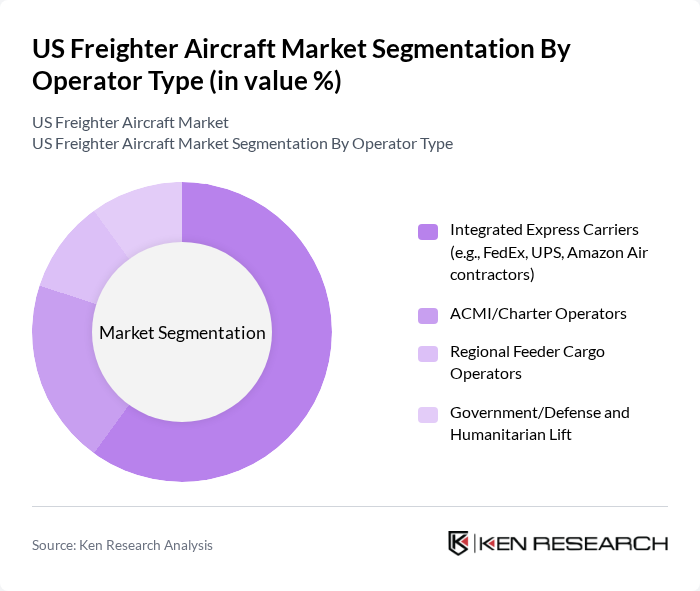

By Operator Type:The operator type segmentation includes integrated express carriers, ACMI/charter operators, regional feeder cargo operators, and government/defense and humanitarian lift. Integrated express carriers dominate the market due to their extensive networks and ability to provide fast delivery services. The rise of e-commerce has further solidified their position, as they are equipped to handle high volumes of packages efficiently.

The US Freighter Aircraft Market is characterized by a dynamic mix of regional and international players. Leading participants such as FedEx Express (FedEx Corporation), UPS Airlines (United Parcel Service, Inc.), Amazon Air (Prime Air), Atlas Air Worldwide Holdings, Inc., Air Transport Services Group, Inc. (ATSG), Kalitta Air, LLC, Western Global Airlines, LLC, Ameriflight, LLC, Empire Airlines, Inc., Sun Country Airlines (cargo operations for Amazon), DHL Express (DHL Aviation / Southern Air legacy operations), The Boeing Company (freighter OEM & BCF programs), Airbus S.A.S. (A330P2F/A321P2F programs), Israel Aerospace Industries (IAI Bedek Aviation Group), Aeronautical Engineers, Inc. (AEI) contribute to innovation, geographic expansion, and service delivery in this space.

The US freighter aircraft market is poised for significant transformation as e-commerce continues to reshape logistics. With advancements in technology and a growing emphasis on sustainability, operators are likely to adopt more efficient aircraft designs and sustainable fuels. Additionally, the increasing demand for last-mile delivery services will drive innovation in fleet management and operational efficiency. As the market adapts to these trends, stakeholders can expect enhanced collaboration and investment opportunities that will redefine the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Narrowbody Freighters (e.g., 737-800BCF, 757-200PF/PCF) Widebody Freighters (e.g., 767-300F/BCF, 777F, A330-200/300P2F) Regional/Feeder Freighters (e.g., ATR 72/42F, Cessna 208B Caravan) Converted Passenger-to-Freighter (P2F) Factory-Built/Dedicated Freighters |

| By Operator Type | Integrated Express Carriers (e.g., FedEx, UPS, Amazon Air contractors) ACMI/Charter Operators Regional Feeder Cargo Operators Government/Defense and Humanitarian Lift |

| By Payload Class | Light: Up to 5 tons Medium: >5 to 20 tons Heavy: >20 to 60 tons Super Heavy: Above 60 tons |

| By Range Capability | Short-Haul: Up to 1,500 nm Medium-Haul: 1,501–3,500 nm Long-Haul: Above 3,500 nm |

| By Acquisition Channel | Direct OEM Purchase Passenger-to-Freighter Conversions (via STC providers) Operating Lease/ACMI |

| By Maintenance Scope | Airframe & Heavy Checks (C/D checks) Engine & APU MRO Components & Modifications (e.g., cargo door, floor strengthening) |

| By Financing Structure | Operating Lease Finance Lease Direct Purchase (Cash/Loan) Sale-Leaseback |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cargo Airlines Operations | 120 | Fleet Managers, Operations Directors |

| Aircraft Manufacturing Insights | 90 | Product Development Managers, Sales Executives |

| Logistics and Freight Forwarding | 80 | Logistics Coordinators, Supply Chain Analysts |

| Regulatory Compliance and Safety | 70 | Compliance Officers, Safety Managers |

| Market Trends and Forecasting | 60 | Market Analysts, Economic Advisors |

The US Freighter Aircraft Market is valued at approximately USD 5 billion, driven by increasing demand for e-commerce logistics and global trade expansion. This market is expected to grow as businesses seek efficient air cargo solutions to meet consumer expectations.