Global Frozen Dessert Market Overview

- The Global Frozen Dessert Market was valued at USD 130 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for convenient and indulgent dessert options, along with the rising popularity of plant-based, low-sugar, and healthier alternatives. The market has seen a surge in innovation, with brands introducing new flavors, premium ingredients, and novel formulations to cater to diverse consumer preferences. Technological advancements in freezing and packaging, as well as sustainability concerns, are also shaping product development and market expansion .

- Key players in this market include the United States, which dominates due to its large consumer base and established distribution networks, followed by countries like Italy and Japan, known for their rich dessert traditions and innovative flavors. The growing trend of premium and artisanal products, including low-fat and dairy-free options, has further solidified their positions in the global market .

- In 2023, the European Union implemented regulations aimed at reducing sugar content in frozen desserts, mandating that products must contain no more than 10 grams of sugar per 100 grams. This regulation is part of a broader initiative to promote healthier eating habits and reduce obesity rates across member states, impacting product formulations and marketing strategies in the frozen dessert sector .

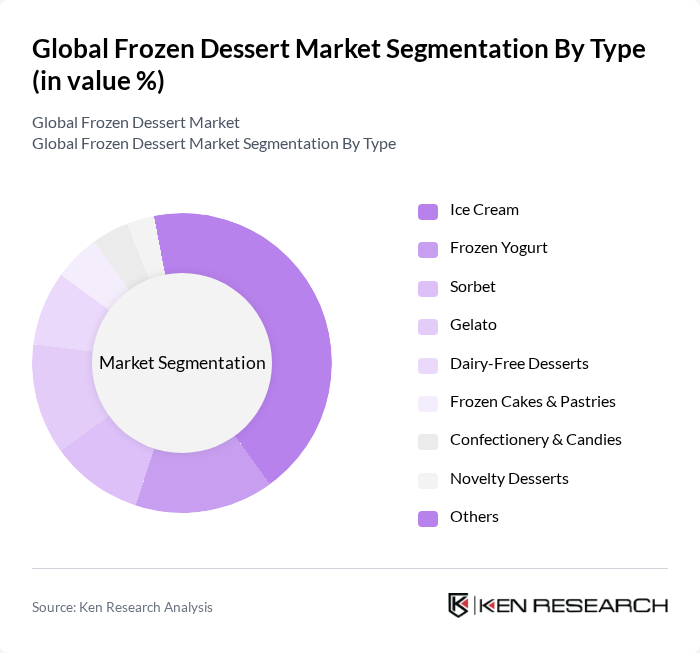

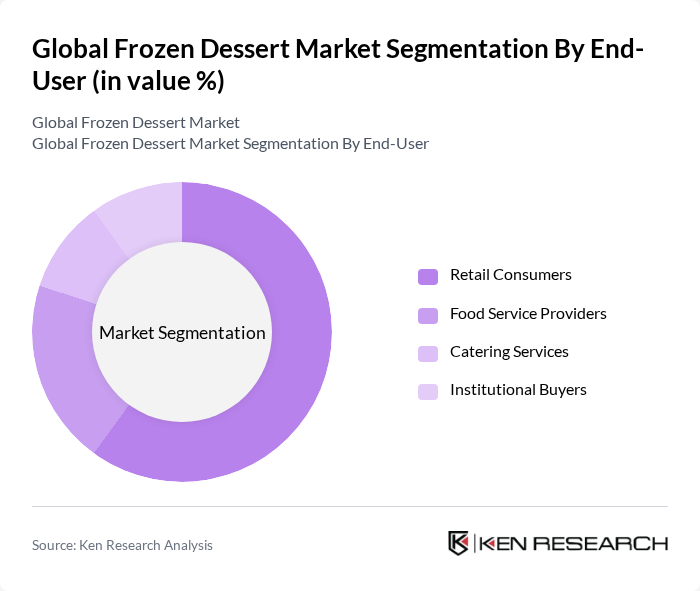

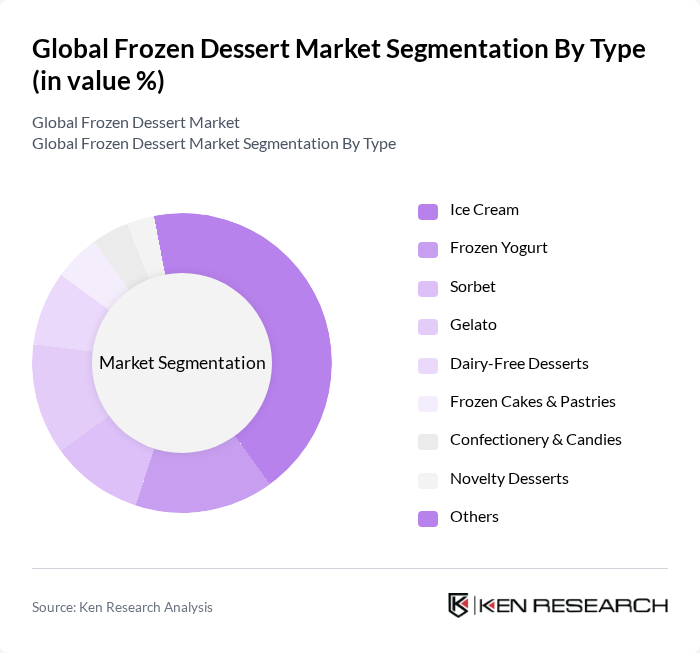

Global Frozen Dessert Market Segmentation

By Type:The frozen dessert market is segmented into various types, including Ice Cream, Frozen Yogurt, Sorbet, Gelato, Dairy-Free Desserts, Frozen Cakes & Pastries, Confectionery & Candies, Novelty Desserts, and Others. Among these, Ice Cream remains the dominant segment due to its widespread popularity and versatility in flavors and formats. The increasing trend towards premium, artisanal, and health-focused ice creams, such as low-fat and plant-based options, has further fueled its growth, appealing to consumers seeking indulgent yet healthier experiences .

By End-User:The market is also segmented by end-user categories, including Retail Consumers, Food Service Providers, Catering Services, and Institutional Buyers. Retail Consumers dominate the market, driven by the increasing availability of frozen desserts in supermarkets and convenience stores. The trend towards at-home consumption, especially during the pandemic, has further solidified this segment's leadership, as consumers seek indulgent treats in the comfort of their homes. Food service providers and catering services are also expanding their offerings to include premium and health-focused frozen desserts, reflecting evolving consumer preferences .

Global Frozen Dessert Market Competitive Landscape

The Global Frozen Dessert Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever plc, Nestlé S.A., General Mills, Inc., Häagen-Dazs (General Mills), Ben & Jerry's (Unilever), Mars, Incorporated, Conagra Brands, Inc., Blue Bell Creameries, Dairy Farmers of America, Inc., Talenti Gelato & Sorbetto (Unilever), So Delicious Dairy Free (Danone S.A.), Breyers (Unilever), Baskin-Robbins (Inspire Brands), Amy's Kitchen, Inc., Yasso, Inc., Dunkin' Brands Group, Inc., Wells Enterprises, Inc. (Blue Bunny), Froneri Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Frozen Dessert Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Convenient Dessert Options:The global trend towards convenience has significantly influenced the frozen dessert market, with sales reaching approximately 12 billion units in future. As busy lifestyles become the norm, consumers are increasingly seeking quick and easy dessert solutions. The World Bank reports that global urbanization has reached approximately 56% of the world’s population, supporting increased demand for ready-to-eat products. This shift is expected to bolster the frozen dessert segment, particularly in urban areas where convenience is paramount.

- Rising Popularity of Plant-Based and Dairy-Free Alternatives:The plant-based food market is projected to reach $74 billion in future, with frozen desserts being a significant contributor. In future, sales of dairy-free frozen desserts accounted for 15% of the total frozen dessert market, reflecting a growing consumer preference for healthier options. The increasing awareness of lactose intolerance and veganism is driving this trend, supported by the International Food Information Council's report indicating that 39% of consumers are actively reducing dairy intake.

- Expansion of Distribution Channels Including Online Platforms:E-commerce sales in the food sector are expected to surpass $200 billion in future, with frozen desserts being a key category. The COVID-19 pandemic accelerated the shift towards online shopping, with 30% of consumers reporting increased online grocery purchases. This trend is supported by the rise of delivery services, which have made frozen desserts more accessible, allowing brands to reach a broader audience and cater to changing consumer shopping habits.

Market Challenges

- Intense Competition Among Established Brands:The frozen dessert market is characterized by fierce competition, with major players like Unilever and Nestlé dominating the landscape. In future, these companies held over 40% of the market share, making it challenging for new entrants to gain traction. The competitive environment necessitates significant marketing investments, with industry reports indicating that leading brands spend approximately $1 billion annually on advertising to maintain their market positions.

- Fluctuating Raw Material Prices:The volatility of raw material prices poses a significant challenge for frozen dessert manufacturers. For instance, the price of dairy products has seen fluctuations of up to 20% in the past year due to supply chain disruptions and climate change impacts. According to the Food and Agriculture Organization, these price changes can directly affect production costs, leading to increased retail prices and potentially reduced consumer demand for frozen desserts.

Global Frozen Dessert Market Future Outlook

The future of the frozen dessert market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to shape purchasing decisions, brands are likely to invest in developing low-calorie and functional desserts. Additionally, the expansion into emerging markets, particularly in Asia and Africa, presents significant growth potential. Companies that adapt to these trends and leverage technology for distribution will likely thrive in this dynamic landscape, ensuring sustained market relevance and profitability.

Market Opportunities

- Growth in Health-Conscious Consumer Segments:The increasing focus on health and wellness is creating opportunities for frozen dessert brands to innovate. Products that are low in sugar, high in protein, or enriched with vitamins are gaining traction. The health food market is projected to reach $1 trillion in future, indicating a substantial opportunity for frozen dessert manufacturers to cater to this growing segment.

- Expansion into Emerging Markets:Emerging markets, particularly in Asia-Pacific, are witnessing a surge in demand for frozen desserts. The region's market is expected to grow by $5 billion in future, driven by rising disposable incomes and changing dietary habits. Companies that strategically enter these markets can capitalize on the increasing consumer spending on premium and indulgent frozen dessert options.