Region:Middle East

Author(s):Dev

Product Code:KRAD3450

Pages:80

Published On:November 2025

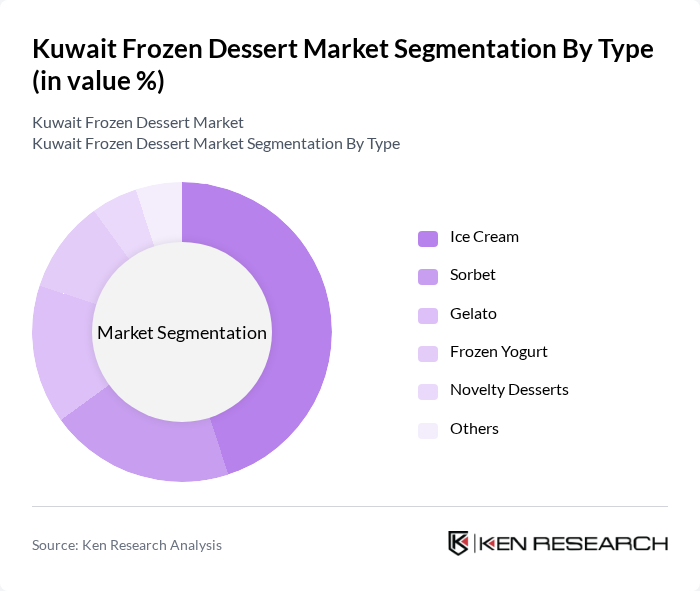

By Type:The frozen dessert market can be segmented into various types, including Ice Cream, Sorbet, Gelato, Frozen Yogurt, Novelty Desserts, and Others. Among these, Ice Cream is the most popular choice among consumers due to its wide variety of flavors and textures, appealing to both children and adults. The trend towards premium and artisanal ice creams has further fueled its dominance, as consumers are willing to pay more for high-quality products. Sorbet and Gelato are also gaining traction, particularly among health-conscious consumers seeking dairy-free options.

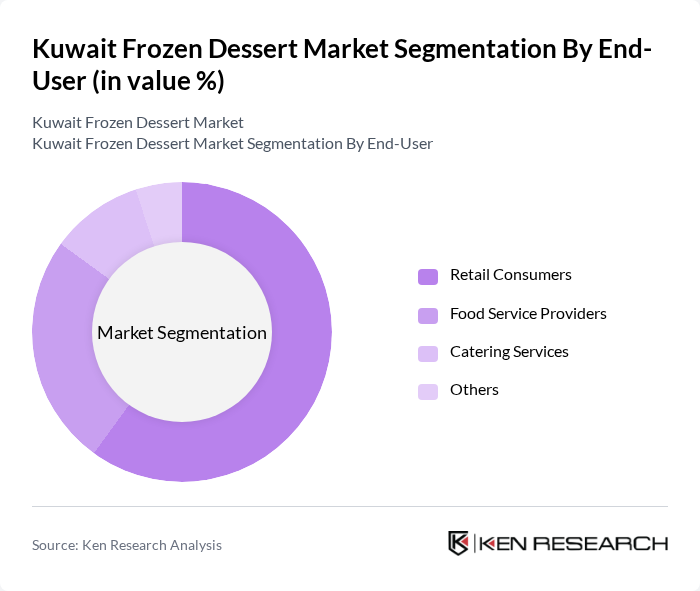

By End-User:The market can be segmented based on end-users, including Retail Consumers, Food Service Providers, Catering Services, and Others. Retail Consumers dominate the market, driven by the increasing availability of frozen desserts in supermarkets and convenience stores. The growing trend of home consumption, especially during the summer months, has led to a surge in demand from this segment. Food Service Providers, including restaurants and cafes, are also significant contributors, as they offer unique dessert options to enhance their menus.

The Kuwait Frozen Dessert Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai, Americana Group, Baskin-Robbins, Gelato Divino, Dairy Queen, Cold Stone Creamery, Haagen-Dazs, Movenpick Ice Cream, KDD (Kuwait Dairy Company), Al-Ahlia Ice Cream, Saffron Ice Cream, Fawaz Al-Hasawi Group, Al-Fawz Ice Cream, Al-Mansour Ice Cream, Al-Sultan Ice Cream contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait frozen dessert market appears promising, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, brands are likely to focus on developing healthier options, including low-calorie and plant-based desserts. Additionally, the integration of technology in distribution channels will enhance accessibility, allowing consumers to explore a wider variety of products. The market is expected to adapt to these trends, fostering growth and encouraging new entrants to innovate and differentiate their offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Ice Cream Sorbet Gelato Frozen Yogurt Novelty Desserts Others |

| By End-User | Retail Consumers Food Service Providers Catering Services Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Flavor Profile | Traditional Flavors Exotic Flavors Seasonal Flavors Custom Flavors Others |

| By Packaging Type | Cups Cones Tubs Pints Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Dessert Sales | 150 | Store Managers, Category Buyers |

| Consumer Preferences for Frozen Desserts | 200 | General Consumers, Families with Children |

| Food Service Sector Insights | 100 | Restaurant Owners, Catering Managers |

| Market Trends and Innovations | 80 | Product Development Managers, Marketing Executives |

| Health and Wellness Impact on Frozen Desserts | 70 | Nutritionists, Health-Conscious Consumers |

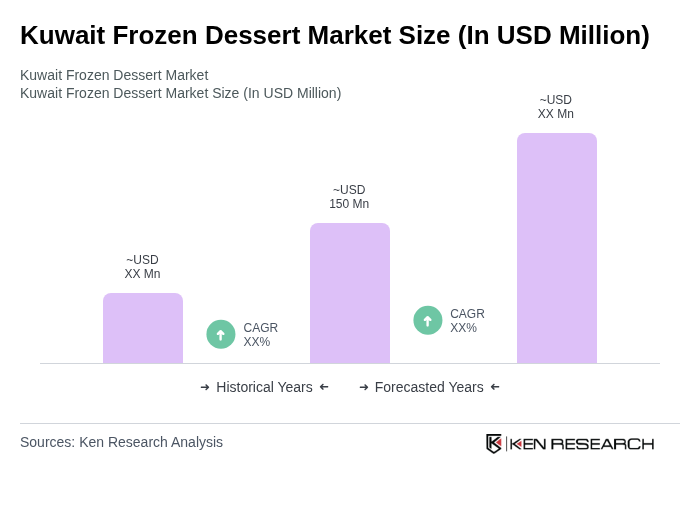

The Kuwait Frozen Dessert Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is attributed to rising consumer demand for indulgent treats and a shift towards premium and healthier dessert options.