Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6635

Pages:93

Published On:October 2025

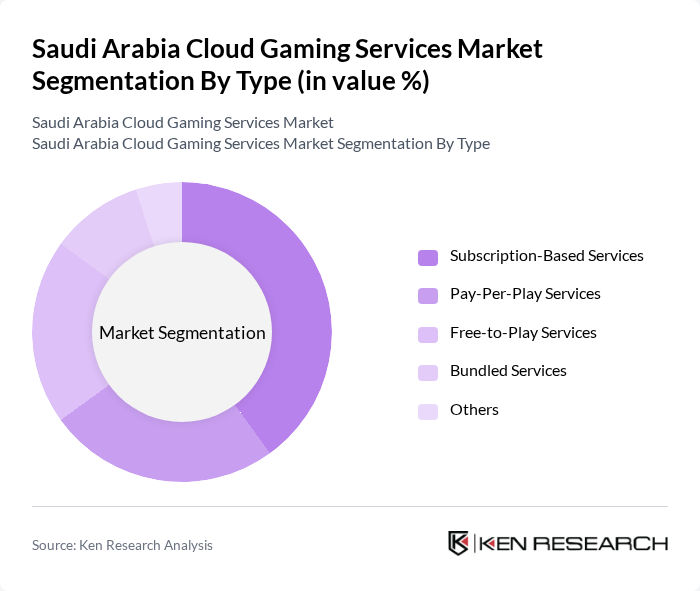

By Type:The market is segmented into various types, including Subscription-Based Services, Pay-Per-Play Services, Free-to-Play Services, Bundled Services, and Others. Subscription-Based Services are gaining traction due to their affordability and access to a wide range of games. Pay-Per-Play Services cater to casual gamers who prefer to pay only for the games they play. Free-to-Play Services attract a large user base, while Bundled Services offer value through package deals. The Others category includes niche offerings that cater to specific gamer preferences.

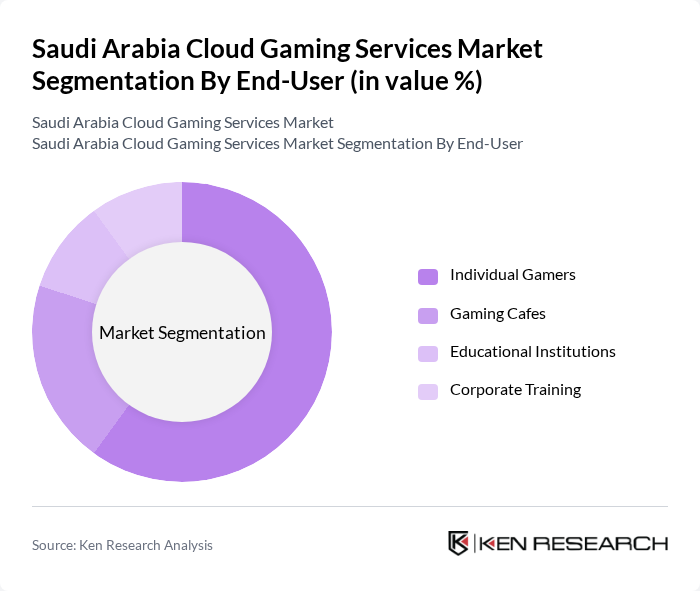

By End-User:The end-user segmentation includes Individual Gamers, Gaming Cafes, Educational Institutions, and Corporate Training. Individual Gamers represent the largest segment, driven by the increasing number of gamers in the region. Gaming Cafes are popular social hubs for gamers, while Educational Institutions are beginning to adopt gaming for educational purposes. Corporate Training is a growing segment as companies recognize the potential of gamification in employee training.

The Saudi Arabia Cloud Gaming Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tencent Games, Microsoft Corporation, Sony Interactive Entertainment, Google LLC, NVIDIA Corporation, Amazon Game Studios, Electronic Arts Inc., Activision Blizzard Inc., Ubisoft Entertainment S.A., Riot Games, Inc., Epic Games, Inc., Bandai Namco Entertainment Inc., Take-Two Interactive Software, Inc., Square Enix Holdings Co., Ltd., SEGA Sammy Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of cloud gaming services in Saudi Arabia appears promising, driven by technological advancements and increasing consumer interest. The expansion of 5G networks is expected to enhance connectivity, enabling smoother gaming experiences. Additionally, partnerships with local developers can foster innovation and create tailored content for the Saudi market. As consumer awareness grows, the adoption of cloud gaming is likely to increase, positioning the sector for significant growth in the coming years, particularly among younger demographics.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription-Based Services Pay-Per-Play Services Free-to-Play Services Bundled Services Others |

| By End-User | Individual Gamers Gaming Cafes Educational Institutions Corporate Training |

| By Platform | Mobile Devices PCs Consoles Smart TVs |

| By Genre | Action/Adventure Sports Role-Playing Games (RPG) Strategy Games |

| By Distribution Channel | Online Platforms Retail Stores Direct Sales |

| By Pricing Model | Freemium Subscription One-Time Purchase |

| By User Demographics | Age Group Gender Income Level Geographic Location |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Casual Gamers | 150 | Individuals aged 18-35, frequent mobile gamers |

| Hardcore Gamers | 100 | Individuals aged 18-45, console and PC gamers |

| Game Developers | 50 | Professionals working in game design and development |

| Cloud Service Providers | 30 | Executives and managers in cloud computing firms |

| Gaming Influencers | 40 | Content creators and streamers with a focus on gaming |

The Saudi Arabia Cloud Gaming Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by high-speed internet penetration, mobile gaming popularity, and the rise of esports among the youth demographic.