Region:Global

Author(s):Rebecca

Product Code:KRAB0265

Pages:88

Published On:August 2025

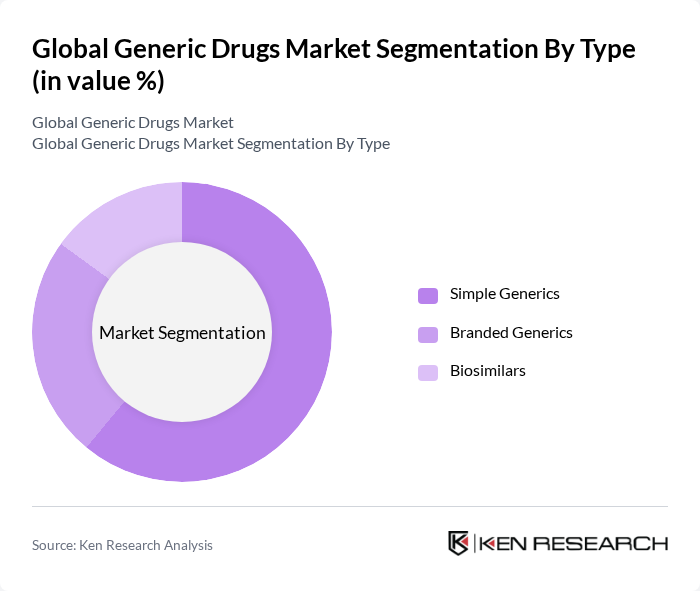

By Type:The market is segmented into Simple Generics, Branded Generics, and Biosimilars. Simple Generics are the most widely used due to their cost-effectiveness and ease of production. Branded Generics, while slightly more expensive, offer brand recognition and trust among consumers. Biosimilars are gaining traction as they provide similar efficacy to biologics at a lower cost, catering to the growing demand for affordable biologic therapies. The simple generics segment holds the largest market share, reflecting the market's focus on affordability and broad accessibility .

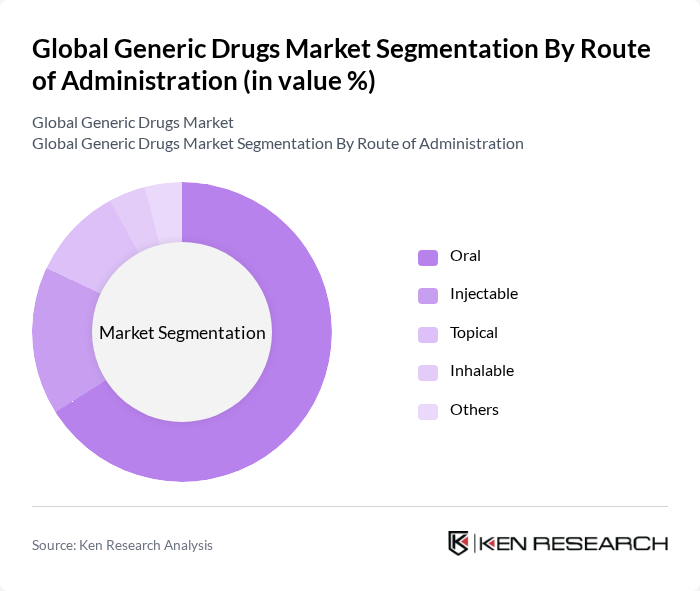

By Route of Administration:This segmentation includes Oral, Injectable, Topical, Inhalable, and Others. Oral administration dominates due to its convenience, patient preference, and broad applicability across therapeutic areas. Injectable forms are essential for rapid drug delivery, especially in hospital and acute care settings. Topical applications are significant for dermatological and localized conditions, while inhalable forms cater to respiratory diseases, reflecting the diverse needs of patients. The oral segment accounts for the largest revenue share in the market .

The Global Generic Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teva Pharmaceutical Industries Ltd., Sandoz International GmbH (Novartis AG), Viatris Inc. (formerly Mylan N.V.), Sun Pharmaceutical Industries Ltd., Aurobindo Pharma Ltd., Cipla Ltd., Dr. Reddy's Laboratories Ltd., Lupin Pharmaceuticals, Inc., Hikma Pharmaceuticals PLC, Zydus Lifesciences Ltd. (formerly Zydus Cadila), Apotex Inc., Fresenius Kabi AG, Endo International plc, Torrent Pharmaceuticals Ltd., Glenmark Pharmaceuticals Ltd., STADA Arzneimittel AG, Pfizer Inc. (Generics Division), Sanofi SA (Generics Division), Amneal Pharmaceuticals Inc., Alkem Laboratories Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the generic drugs market appears promising, driven by ongoing advancements in technology and increasing consumer awareness. As digital health technologies gain traction, the integration of telemedicine and online pharmacies is expected to enhance access to generic medications. Furthermore, the growing emphasis on preventive healthcare will likely lead to increased demand for affordable treatment options, positioning generic drugs as a vital component of healthcare strategies worldwide, particularly in underserved regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Simple Generics Branded Generics Biosimilars |

| By Route of Administration | Oral Injectable Topical Inhalable Others |

| By Molecule Type | Antibiotics Analgesics Antidepressants Antihistamines Antivirals Diuretics Others |

| By Therapeutic Area | Cardiovascular Disorders Oncology Neurology Disorders Infectious Diseases Metabolic Diseases Respiratory Disorders Immunology Rare Diseases Others |

| By End-User | Hospitals Retail Pharmacies Online Pharmacies Clinics |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | CEOs, Product Managers, Regulatory Affairs Specialists |

| Healthcare Providers | 80 | Pharmacists, Physicians, Nurse Practitioners |

| Patients Using Generic Drugs | 120 | Chronic Illness Patients, General Consumers |

| Healthcare Payers | 60 | Insurance Analysts, Claims Managers |

| Market Analysts and Researchers | 40 | Market Research Analysts, Industry Consultants |

The Global Generic Drugs Market is valued at approximately USD 445 billion, driven by factors such as the increasing prevalence of chronic diseases, demand for affordable medications, and the expiration of patents for several blockbuster drugs.