Region:Asia

Author(s):Dev

Product Code:KRAA1503

Pages:90

Published On:August 2025

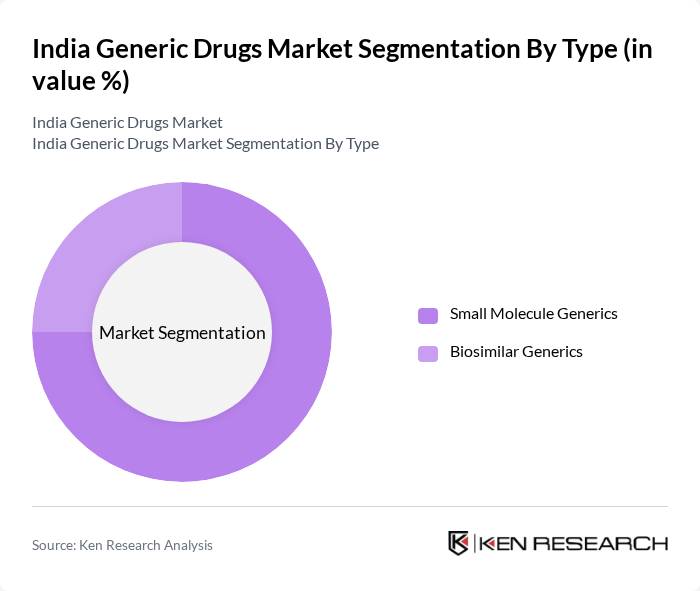

By Type:The market is segmented into two main types: Small Molecule Generics and Biosimilar Generics. Small Molecule Generics dominate the market due to their widespread use in treating various chronic conditions, including cardiovascular diseases and diabetes. The increasing number of patent expirations for branded drugs has further fueled the growth of this segment. Biosimilar Generics, while growing, still represent a smaller portion of the market as they require more complex manufacturing processes and regulatory approvals .

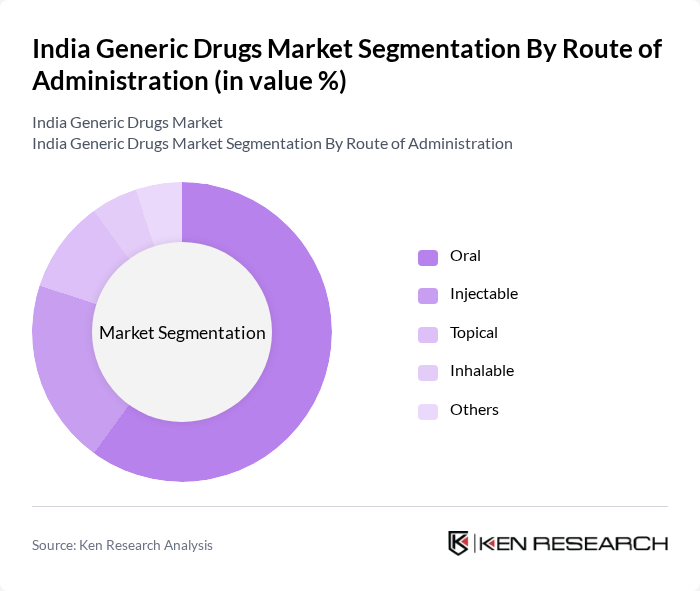

By Route of Administration:The market is categorized into Oral, Injectable, Topical, Inhalable, and Others. Oral administration is the most prevalent route, driven by the convenience and ease of use of oral medications. Injectable drugs are also significant, particularly in hospital settings for acute care. The demand for topical and inhalable medications is growing, especially for dermatological and respiratory conditions, respectively, as patients seek effective treatment options .

The India Generic Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sun Pharmaceutical Industries Ltd., Cipla Ltd., Dr. Reddy's Laboratories Ltd., Lupin Ltd., Aurobindo Pharma Ltd., Zydus Lifesciences Ltd., Torrent Pharmaceuticals Ltd., Alkem Laboratories Ltd., Glenmark Pharmaceuticals Ltd., Viatris Inc. (formerly Mylan N.V.), Intas Pharmaceuticals Ltd., Biocon Ltd., Wockhardt Ltd., Hetero Labs Ltd., Macleods Pharmaceuticals Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India generic drugs market appears promising, driven by increasing healthcare access and a growing emphasis on preventive care. With the government’s commitment to enhancing healthcare infrastructure and promoting affordable medications, the market is expected to witness significant advancements. Additionally, the integration of digital health solutions and e-pharmacies will likely reshape the distribution landscape, making generic drugs more accessible to consumers across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Small Molecule Generics Biosimilar Generics |

| By Route of Administration | Oral Injectable Topical Inhalable Others |

| By Therapeutic Area | Cardiovascular Central Nervous System Dermatology Oncology Diabetes Respiratory Others |

| By End-User | Hospitals/Clinics Retail Pharmacies Online Pharmacies Others |

| By Distribution Channel | Hospital Pharmacy Retail Pharmacy Online Pharmacy |

| By Brand | Branded Generics Pure Generics |

| By Region | North India South India East India West and Central India |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacy Sector Insights | 100 | Pharmacy Owners, Pharmacists |

| Healthcare Provider Perspectives | 80 | Doctors, Healthcare Administrators |

| Generic Drug Manufacturer Feedback | 60 | Product Managers, Marketing Directors |

| Regulatory Compliance Insights | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Patient Experience and Preferences | 70 | Patients, Caregivers |

The India Generic Drugs Market is valued at approximately USD 28 billion, driven by the increasing prevalence of chronic diseases, rising healthcare costs, and the demand for affordable medications. This market is expected to continue growing due to supportive government initiatives and healthcare infrastructure expansion.