Region:Global

Author(s):Dev

Product Code:KRAA2584

Pages:92

Published On:August 2025

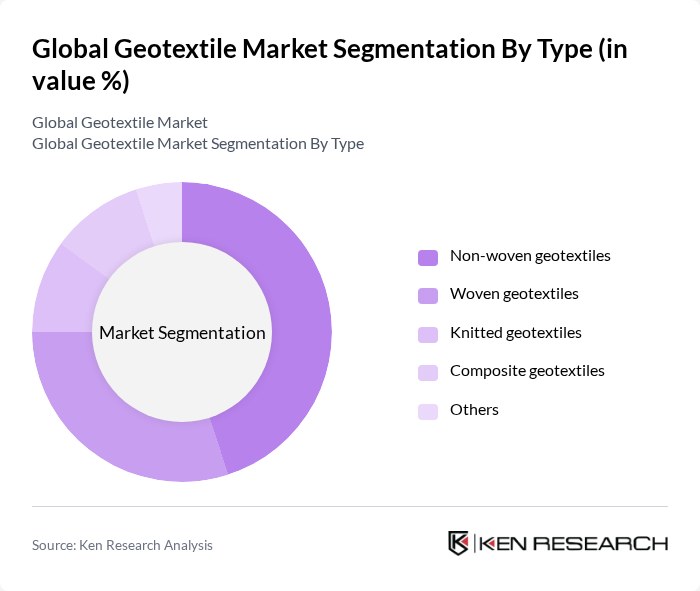

By Type:The market is segmented into various types of geotextiles, including non-woven, woven, knitted, composite, and others. Non-woven geotextiles are widely used due to their versatility, permeability, and cost-effectiveness, making them the dominant segment. Woven geotextiles are preferred for applications requiring high tensile strength and durability, such as road construction and reinforcement. Composite geotextiles combine the benefits of both non-woven and woven types, offering enhanced performance for specialized engineering applications. The demand for knitted geotextiles is growing in niche and specialized applications, while the 'others' category includes innovative and biodegradable materials targeting emerging environmental requirements .

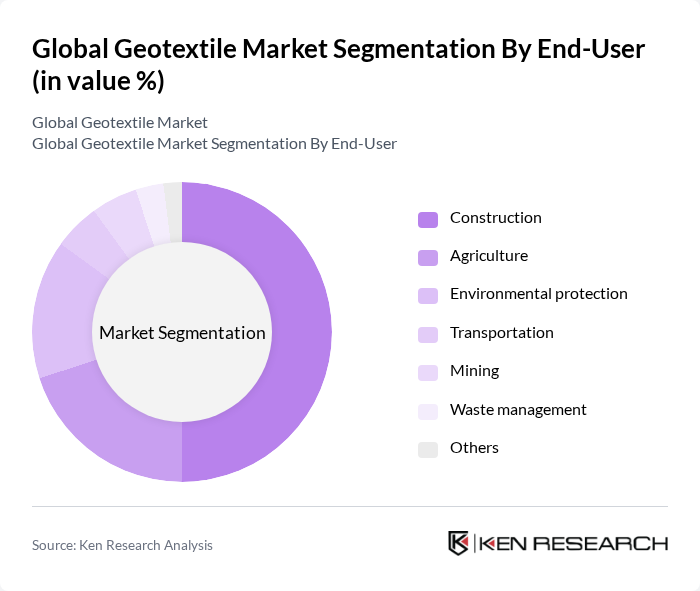

By End-User:The end-user segmentation includes construction, agriculture, environmental protection, transportation, mining, waste management, and others. The construction sector is the largest consumer of geotextiles, driven by the need for soil stabilization, erosion control, and infrastructure development. Agriculture utilizes geotextiles for soil protection, drainage, and crop management. Environmental protection applications focus on waste containment, filtration, and land reclamation. The transportation and mining sectors also contribute significantly, supported by increasing investments in infrastructure and resource extraction, while waste management applications benefit from geotextiles’ filtration and separation properties .

The Global Geotextile Market is characterized by a dynamic mix of regional and international players. Leading participants such as TenCate Geosynthetics, Solmax, GSE Environmental, HUESKER Synthetic GmbH, Maccaferri S.p.A., NAUE GmbH & Co. KG, Propex Global, Terram (a Berry Global company), Fibertex Nonwovens, AGRU America, Strata Systems, Inc., Officine Maccaferri S.p.A., Thrace Group, Global Synthetics, Koninklijke Ten Cate B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the geotextile market appears promising, driven by increasing environmental awareness and the push for sustainable construction practices. As governments worldwide implement stricter regulations on construction materials, the demand for eco-friendly geotextiles is expected to rise. Additionally, innovations in product development, such as biodegradable options and smart technologies, will likely enhance the functionality and appeal of geotextiles, positioning them as essential components in modern infrastructure projects.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-woven geotextiles Woven geotextiles Knitted geotextiles Composite geotextiles Others |

| By End-User | Construction Agriculture Environmental protection Transportation Mining Waste management Others |

| By Application | Erosion control Drainage Soil stabilization Road construction Reinforcement Filtration Separation Landfill/waste containment Others |

| By Material | Polypropylene Polyester Polyethylene Natural fibers (Jute, Coir, Ramie) Others |

| By Distribution Channel | Direct sales Distributors Online sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (France, Germany, U.K., Italy, Spain, Others) Asia-Pacific (China, India, Japan, Australia, Southeast Asia, Others) Latin America (Brazil, Others) Middle East & Africa (Saudi Arabia, UAE, South Africa, Others) |

| By Price Range | Low price Mid price High price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Projects | 100 | Project Managers, Civil Engineers |

| Geotextile Manufacturing | 60 | Production Managers, Quality Control Specialists |

| Environmental Applications | 50 | Sustainability Consultants, Environmental Engineers |

| Road Construction | 80 | Site Supervisors, Procurement Officers |

| Drainage Solutions | 40 | Landscape Architects, Urban Planners |

The Global Geotextile Market is valued at approximately USD 8.8 billion, driven by increasing demand across construction, agriculture, and environmental protection sectors. This growth reflects a significant trend towards sustainable infrastructure and eco-friendly construction practices.