Region:Global

Author(s):Shubham

Product Code:KRAA1136

Pages:87

Published On:August 2025

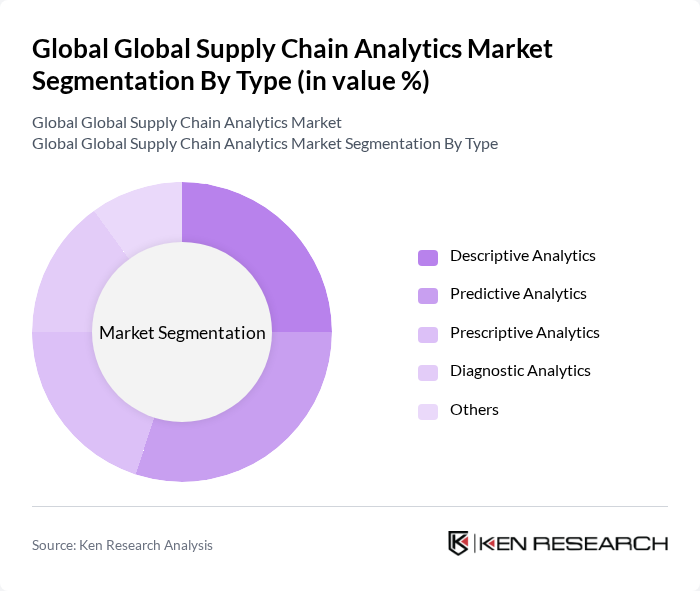

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, and Others. Each of these sub-segments plays a crucial role in helping organizations make informed decisions based on data analysis. Descriptive analytics focuses on historical data to understand trends, predictive analytics leverages statistical models and forecasting to anticipate future scenarios, prescriptive analytics recommends optimal actions, and diagnostic analytics identifies causes of issues within the supply chain .

The Predictive Analytics sub-segment is currently dominating the market due to its ability to forecast future trends and behaviors based on historical data. Organizations are increasingly adopting predictive analytics to enhance decision-making processes, optimize inventory levels, and improve customer satisfaction. The growing emphasis on data-driven strategies, supply chain visibility, and the need for agility in supply chain management are key factors contributing to the rise of predictive analytics .

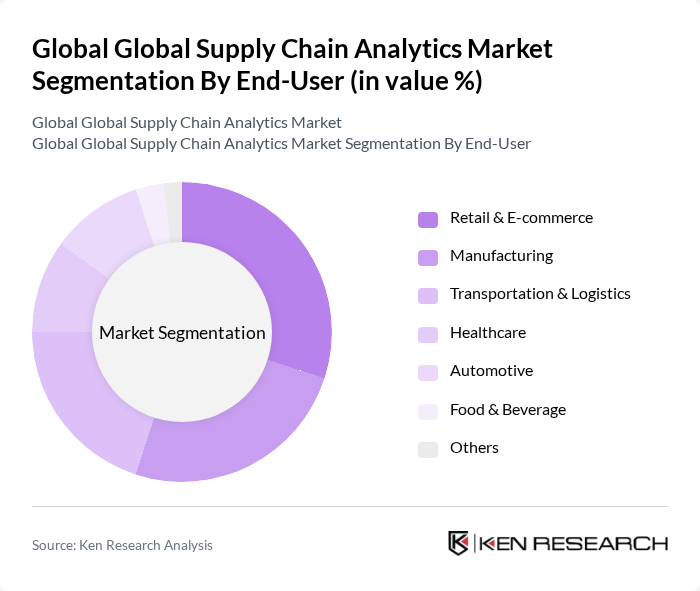

By End-User:The market is segmented by end-users, including Retail & E-commerce, Manufacturing, Transportation & Logistics, Healthcare, Automotive, Food & Beverage, and Others. Each sector utilizes supply chain analytics to address specific challenges and improve operational efficiency. Retail & E-commerce leverages analytics for inventory optimization and customer experience, manufacturing uses it for production planning and demand forecasting, transportation & logistics focus on route optimization and cost reduction, while healthcare and automotive sectors utilize analytics for supply assurance and risk mitigation .

The Retail & E-commerce sector is leading the market due to the rapid growth of online shopping and the need for efficient inventory management. Companies in this sector leverage supply chain analytics to enhance customer experience, optimize logistics, and reduce operational costs. The increasing competition in the retail space and the adoption of omnichannel strategies further drive the adoption of advanced analytics solutions .

The Global Supply Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Kinaxis Inc., Infor, Inc., Tableau Software, LLC (a Salesforce Company), QlikTech International AB, SAS Institute Inc., TIBCO Software Inc., Coupa Software Incorporated, Manhattan Associates, Inc., E2open, LLC, Oracle NetSuite contribute to innovation, geographic expansion, and service delivery in this space.

The future of supply chain analytics is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt cloud-based solutions, the agility and scalability of analytics tools will enhance operational capabilities. Furthermore, the integration of AI and machine learning will enable predictive analytics, allowing businesses to anticipate market trends and optimize supply chain strategies. This evolution will foster resilience and adaptability in an ever-changing global landscape, ensuring sustained growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Others |

| By End-User | Retail & E-commerce Manufacturing Transportation & Logistics Healthcare Automotive Food & Beverage Others |

| By Application | Demand Forecasting Inventory Management Supplier Performance Management Procurement Analytics Risk Management Logistics Analytics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Analytics | 120 | Supply Chain Managers, Operations Directors |

| Retail Inventory Management Solutions | 60 | Inventory Analysts, Retail Operations Managers |

| Healthcare Logistics Optimization | 50 | Healthcare Supply Chain Executives, Procurement Managers |

| Transportation Analytics in Logistics | 40 | Logistics Coordinators, Fleet Managers |

| Data-Driven Decision Making in E-commerce | 45 | E-commerce Managers, Data Analysts |

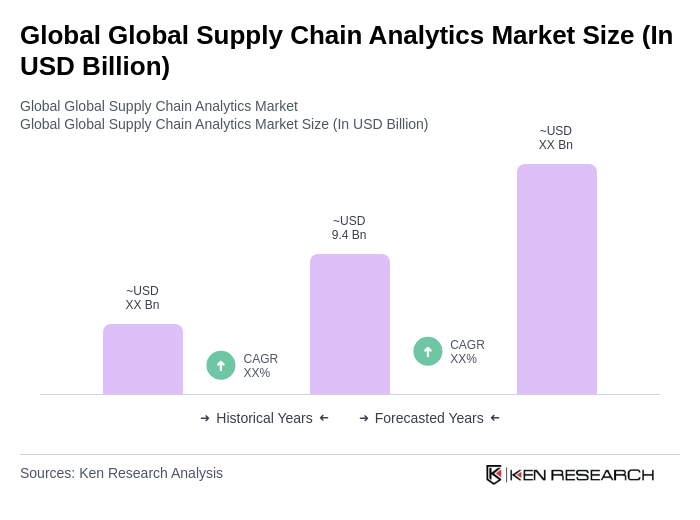

The Global Supply Chain Analytics Market is valued at approximately USD 9.4 billion, reflecting a significant growth trend driven by the need for businesses to optimize supply chain operations and enhance efficiency through advanced analytics solutions.