Region:Global

Author(s):Dev

Product Code:KRAC0457

Pages:97

Published On:August 2025

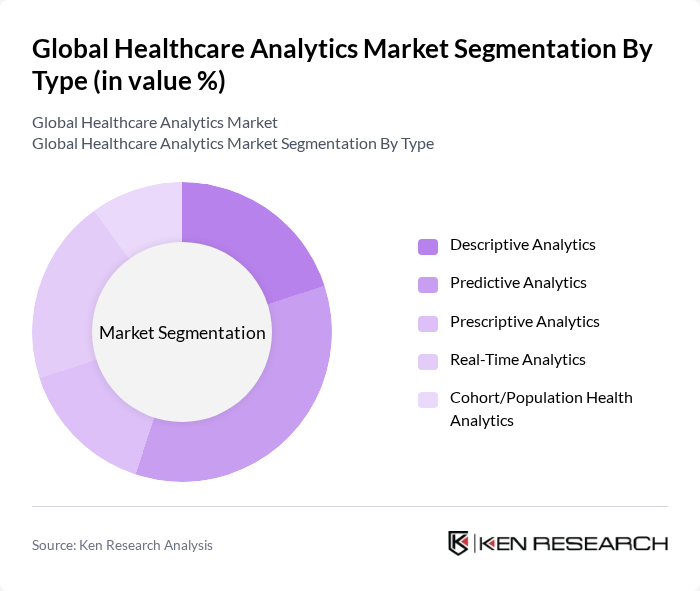

By Type:The market is segmented into various types, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Real-Time Analytics, and Cohort/Population Health Analytics. Predictive analytics is a principal growth area due to forecasting of patient outcomes, risk stratification, and resource optimization; however, descriptive analytics remains a substantial base layer in many deployments across providers and payers. Drivers include integration of AI/ML for risk prediction, personalization, and proactive care management across clinical and financial workflows.

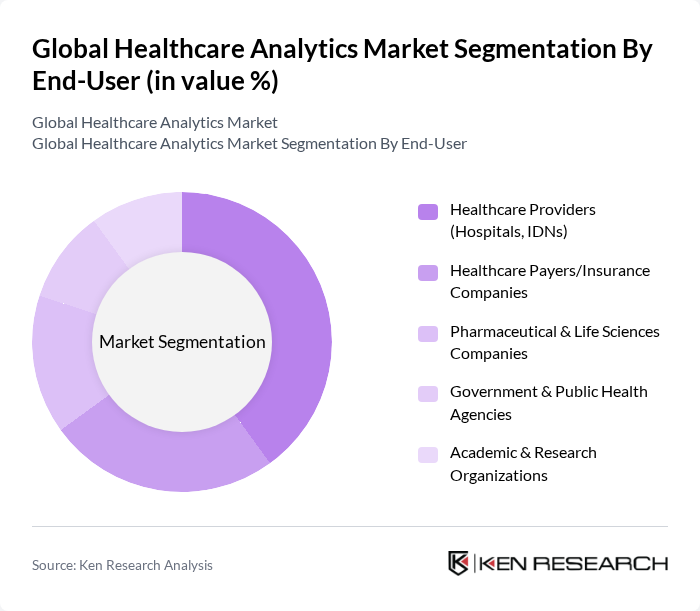

By End-User:The end-user segmentation includes Healthcare Providers (Hospitals, IDNs), Healthcare Payers/Insurance Companies, Pharmaceutical & Life Sciences Companies, Government & Public Health Agencies, and Academic & Research Organizations. Healthcare Providers lead due to value-based care imperatives, clinical decision support integration, throughput and capacity optimization, and quality reporting. Payers are expanding analytics for fraud/waste/abuse detection, prior authorization, and member risk adjustment, while life sciences increasingly leverage RWD/RWE for trial optimization and outcomes research.

The Global Healthcare Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation (IBM Watson Health assets now Merative), SAS Institute Inc., Oracle Corporation (Oracle Health, incl. Cerner), Oracle Health (formerly Cerner Corporation), McKesson Corporation, Altera Digital Health (formerly part of Allscripts), Koninklijke Philips N.V. (Philips Healthcare), Optum, Inc. (UnitedHealth Group), Cognizant Technology Solutions, Health Catalyst, Inc., Tableau Software, LLC (Salesforce, Tableau), Microsoft Corporation, GE HealthCare Technologies Inc., Siemens Healthineers AG, Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of healthcare analytics is poised for transformative growth, driven by technological advancements and evolving patient care models. As organizations increasingly adopt artificial intelligence and machine learning, the ability to analyze real-time data will enhance decision-making processes. Furthermore, the integration of telehealth services is expected to expand, providing new avenues for data collection and analysis. These trends will not only improve patient outcomes but also streamline operational efficiencies across the healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Real-Time Analytics Cohort/Population Health Analytics |

| By End-User | Healthcare Providers (Hospitals, IDNs) Healthcare Payers/Insurance Companies Pharmaceutical & Life Sciences Companies Government & Public Health Agencies Academic & Research Organizations |

| By Application | Clinical Analytics (Quality & Outcomes) Financial & Revenue Cycle Analytics Operational & Administrative Analytics Population Health Management & Risk Stratification Fraud, Waste & Abuse Analytics |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Component | Software/Platforms Services (Managed & Professional) Hardware |

| By Sales Channel | Direct Enterprise Sales System Integrators & VARs Cloud Marketplaces & Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Analytics Implementation | 120 | Chief Information Officers, Data Analysts |

| Healthcare Provider Analytics Usage | 100 | Healthcare Administrators, IT Managers |

| Insurance Analytics Strategies | 80 | Actuaries, Risk Management Officers |

| Pharmaceutical Data Analytics | 70 | Market Research Analysts, Product Managers |

| Public Health Analytics Trends | 60 | Public Health Officials, Epidemiologists |

The Global Healthcare Analytics Market is valued at approximately USD 23 billion, driven by the increasing adoption of advanced analytics solutions aimed at improving patient outcomes and operational efficiency within healthcare organizations.