Region:Middle East

Author(s):Rebecca

Product Code:KRAE0934

Pages:93

Published On:December 2025

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Others. Descriptive Analytics is currently the leading sub-segment, as it provides essential insights into historical data, helping healthcare providers make informed decisions. Predictive Analytics is gaining traction due to its ability to forecast patient outcomes and optimize resource allocation, while Prescriptive Analytics is emerging as a valuable tool for recommending actions based on data analysis.

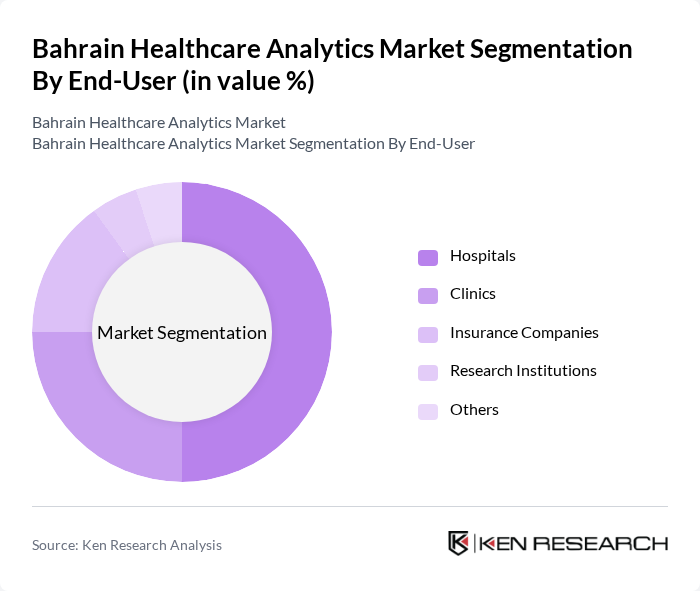

By End-User:The end-user segmentation includes Hospitals, Clinics, Insurance Companies, Research Institutions, and Others. Hospitals are the dominant end-user, leveraging analytics for patient management, operational efficiency, and financial performance. Clinics are increasingly adopting analytics to enhance patient care and streamline operations, while insurance companies utilize analytics for risk assessment and fraud detection. Research institutions are also significant users, employing analytics for clinical studies and health outcomes research.

The Bahrain Healthcare Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Watson Health, Cerner Corporation, Optum, Philips Healthcare, McKesson Corporation, Allscripts Healthcare Solutions, SAS Institute, Oracle Health Sciences, GE Healthcare, Medtronic, Siemens Healthineers, Health Catalyst, Epic Systems Corporation, Change Healthcare, Verily Life Sciences contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain healthcare analytics market appears promising, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence and machine learning is expected to enhance predictive analytics capabilities, allowing for more personalized patient care. Additionally, the expansion of telehealth services will likely create new avenues for data collection and analysis, further driving the adoption of analytics solutions. As the government continues to support digital health initiatives, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Others |

| By End-User | Hospitals Clinics Insurance Companies Research Institutions Others |

| By Application | Patient Management Operational Efficiency Financial Analytics Clinical Analytics Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Technology | Artificial Intelligence Machine Learning Big Data Analytics Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Analytics Implementation | 100 | IT Managers, Chief Information Officers |

| Health Insurance Data Utilization | 80 | Data Analysts, Underwriting Managers |

| Public Health Data Analytics | 70 | Public Health Officials, Epidemiologists |

| Telehealth Analytics Solutions | 60 | Telehealth Coordinators, Healthcare IT Specialists |

| Patient Engagement Analytics | 90 | Patient Experience Managers, Marketing Directors |

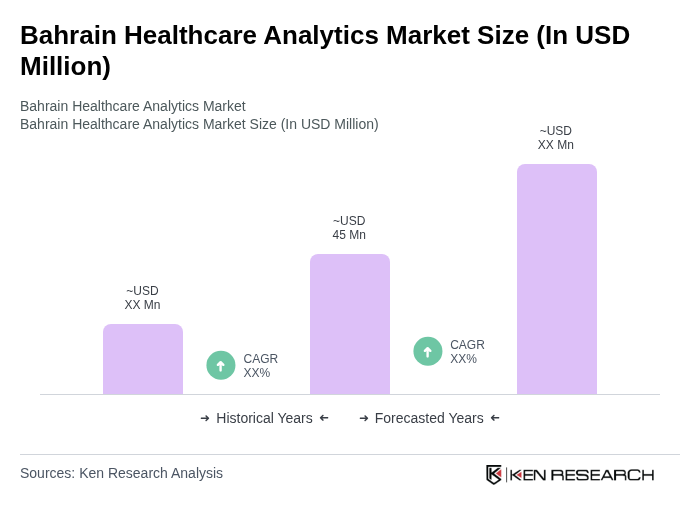

The Bahrain Healthcare Analytics Market is valued at approximately USD 45 million, driven by the increasing adoption of digital health systems and the integration of AI and cloud technologies, along with a rising demand for remote patient monitoring.