Region:Global

Author(s):Geetanshi

Product Code:KRAA2273

Pages:96

Published On:August 2025

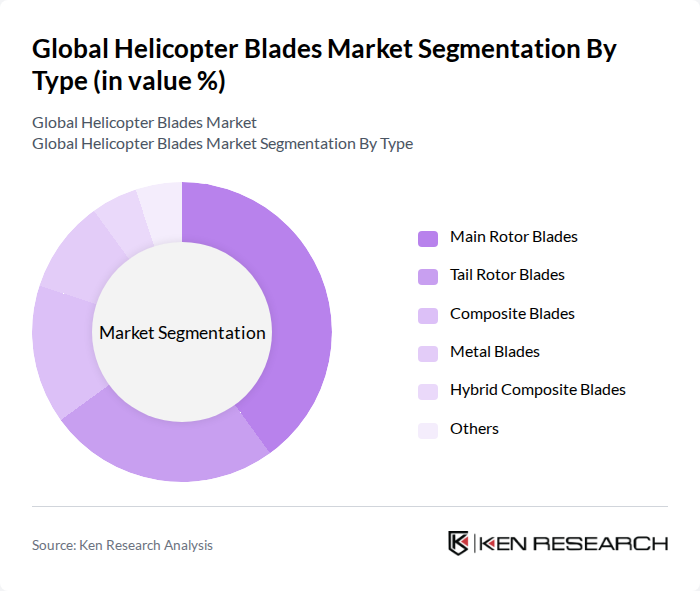

By Type:The helicopter blades market can be segmented into various types, including Main Rotor Blades, Tail Rotor Blades, Rigid Blades, Semi-Rigid Blades, Fully Articulated Blades, Composite Blades, Metal Blades, and Others. Among these, Main Rotor Blades are the most significant segment due to their critical role in helicopter flight dynamics and performance. The demand for advanced materials and designs in Main Rotor Blades is driven by the need for improved efficiency, reduced noise levels, and compliance with stricter safety and environmental standards .

By End-User:The market can also be segmented by end-user applications, including Military Helicopters, Civil Helicopters, Emergency Services, Oil & Gas Operations, Tourism, and Others. Military Helicopters represent the largest segment due to ongoing defense budgets, modernization programs, and increased procurement of advanced rotorcraft. The growing use of helicopters in civil applications, especially in emergency medical services, oil and gas transport, and tourism, is also contributing to market growth .

The Global Helicopter Blades Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Helicopters, Bell Textron Inc., Leonardo S.p.A., Sikorsky Aircraft Corporation (Lockheed Martin), Boeing Defense, Space & Security, MD Helicopters, LLC, Robinson Helicopter Company, Enstrom Helicopter Corporation, Kaman Aerospace Corporation, Hindustan Aeronautics Limited (HAL), Russian Helicopters JSC, Kawasaki Heavy Industries, Ltd., Safran Helicopter Engines, Carson Helicopters, Inc., Van Horn Aviation, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the helicopter blades market appears promising, driven by technological advancements and increasing demand across various sectors. The shift towards eco-friendly materials and designs is expected to gain momentum, aligning with global sustainability goals. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and reduce costs. As the market adapts to these trends, opportunities for growth will emerge, particularly in emerging markets and through collaborations with aerospace companies, fostering innovation and expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Main Rotor Blades Tail Rotor Blades Rigid Blades Semi-Rigid Blades Fully Articulated Blades Composite Blades Metal Blades Others |

| By End-User | Military Helicopters Civil Helicopters Emergency Services Oil & Gas Operations Tourism Others |

| By Application | OEM (Original Equipment Manufacturer) Aftermarket (Replacement/Upgrade) Search and Rescue Surveillance Agricultural Operations Others |

| By Material | Composite Materials (e.g., Carbon Fiber, Glass Fiber) Metallic Materials (e.g., Aluminum, Steel) Others |

| By Size | Small Blades (less than 6 feet) Medium Blades (6-12 feet) Large Blades (over 12 feet) |

| By Region | North America (U.S., Canada, Mexico) Europe (U.K., Germany, France, Italy, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Rest of Latin America) Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa) |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Helicopter Manufacturers | 60 | Design Engineers, Product Managers |

| Military Helicopter Procurement | 50 | Procurement Officers, Defense Analysts |

| Helicopter Maintenance and Repair Services | 40 | Maintenance Managers, Operations Supervisors |

| Helicopter Blade Material Suppliers | 40 | Supply Chain Managers, Materials Engineers |

| Aerospace Research Institutions | 40 | Research Scientists, Aerospace Engineers |

The Global Helicopter Blades Market is valued at approximately USD 1.05 billion, reflecting a five-year historical analysis. This valuation is influenced by the rising demand for helicopters in both military and civil applications, alongside advancements in blade technology.