Region:Global

Author(s):Dev

Product Code:KRAD5223

Pages:91

Published On:December 2025

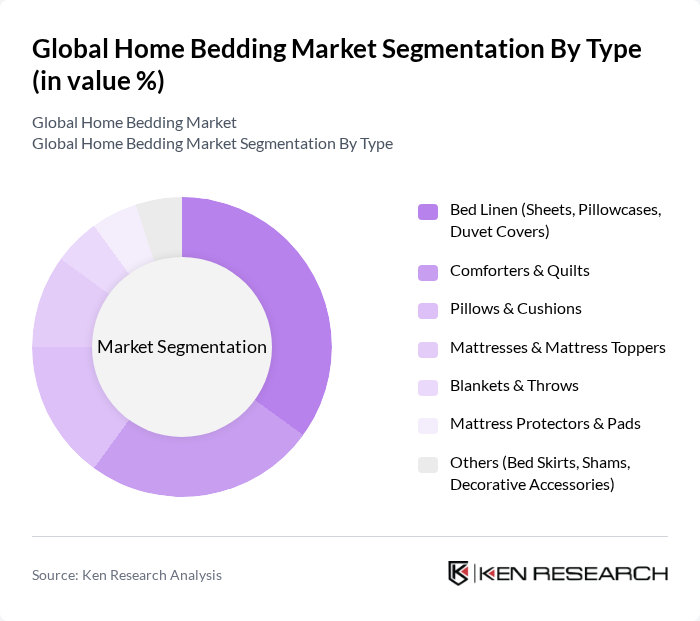

By Type:The bedding market is segmented into various types, including bed linen, comforters, pillows, mattresses, blankets, mattress protectors, and other accessories. Among these, bed linen, which includes sheets, pillowcases, and duvet covers, is the most dominant segment due to its essential role in bedding sets and frequent replacement cycles driven by fashion trends and consumer preferences for variety.

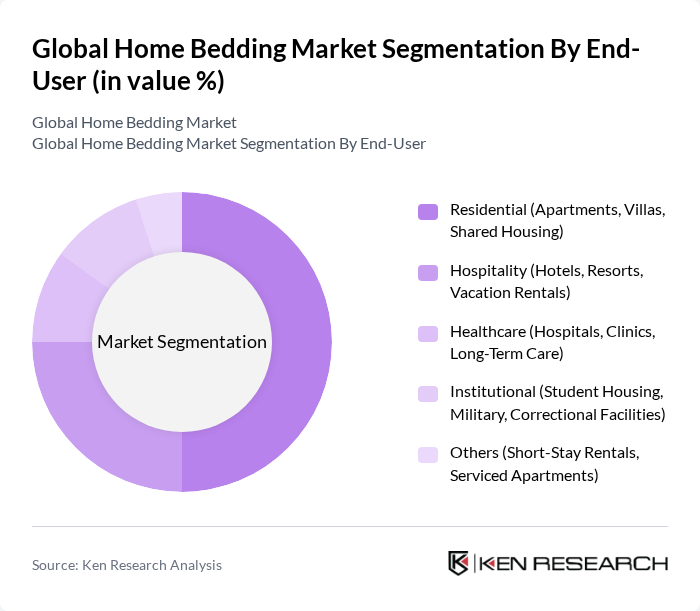

By End-User:The end-user segmentation includes residential, hospitality, healthcare, institutional, and other sectors. The residential segment leads the market, driven by the increasing trend of home decoration and the growing awareness of sleep quality. Consumers are investing more in their personal spaces, leading to a higher demand for various bedding products tailored to individual preferences.

The Global Home Bedding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Sleep Number Corporation, Serta Simmons Bedding, LLC, Sealy Corporation (Brand of Tempur Sealy), Casper Sleep Inc., Purple Innovation, Inc., IKEA Systems B.V., Williams-Sonoma, Inc. (West Elm & Pottery Barn), Macy's, Inc., Walmart Inc., Target Corporation, Amazon.com, Inc., Wayfair Inc., Brooklinen Inc., Parachute Home, Boll & Branch LLC, Coyuchi, Inc., Bed Bath & Beyond (Brand Assets under Overstock.com, Inc.), Ralph Lauren Corporation (Home Bedding), Trident Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home bedding market appears promising, driven by technological advancements and evolving consumer preferences. As smart bedding solutions gain traction, manufacturers are expected to innovate with integrated technology that enhances sleep quality. Additionally, the rise of subscription-based services will likely reshape purchasing behaviors, providing consumers with convenient access to premium bedding products. These trends indicate a dynamic market landscape, with opportunities for growth and differentiation in product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Bed Linen (Sheets, Pillowcases, Duvet Covers) Comforters & Quilts Pillows & Cushions Mattresses & Mattress Toppers Blankets & Throws Mattress Protectors & Pads Others (Bed Skirts, Shams, Decorative Accessories) |

| By End-User | Residential (Apartments, Villas, Shared Housing) Hospitality (Hotels, Resorts, Vacation Rentals) Healthcare (Hospitals, Clinics, Long-Term Care) Institutional (Student Housing, Military, Correctional Facilities) Others (Short-Stay Rentals, Serviced Apartments) |

| By Material | Cotton (Conventional & Organic) Polyester & Microfiber Blended Fabrics (Poly-Cotton, Linen Blends, etc.) Linen Silk & Satin Bamboo & Other Regenerated Cellulosic Fibers Wool, Down & Alternative Fills Others (Specialty & Performance Fabrics) |

| By Distribution Channel | Offline Retail – Specialty Bedding & Mattress Stores Offline Retail – Hypermarkets & Supermarkets Offline Retail – Department Stores & Home Décor Chains Online – E-commerce Marketplaces Online – Direct-to-Consumer Brand Websites B2B & Institutional Sales Others (Catalogues, TV Shopping, Pop-Up Stores) |

| By Price Range | Economy / Budget Mass-Market / Value Mid-Range Premium Luxury |

| By Region | North America (U.S., Canada, Rest of North America) Europe (Western Europe, Eastern Europe) Asia-Pacific (China, India, Japan, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Brand Type | Global National & International Brands Private Labels & Retailer Brands Luxury & Designer Brands Direct-to-Consumer (D2C) Digital-Native Brands Others (Local & Unorganized Brands) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bedding Sales | 150 | Store Managers, Category Buyers |

| Online Bedding Purchases | 100 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Bedding | 120 | Homeowners, Renters, Interior Designers |

| Trends in Sustainable Bedding | 80 | Sustainability Advocates, Product Development Managers |

| Luxury Bedding Market Insights | 70 | Luxury Retail Managers, Brand Strategists |

The Global Home Bedding Market is valued at approximately USD 120 billion, reflecting a significant growth trend driven by increased consumer spending on home decor and a rising awareness of sleep health.