Region:Middle East

Author(s):Dev

Product Code:KRAC1044

Pages:97

Published On:December 2025

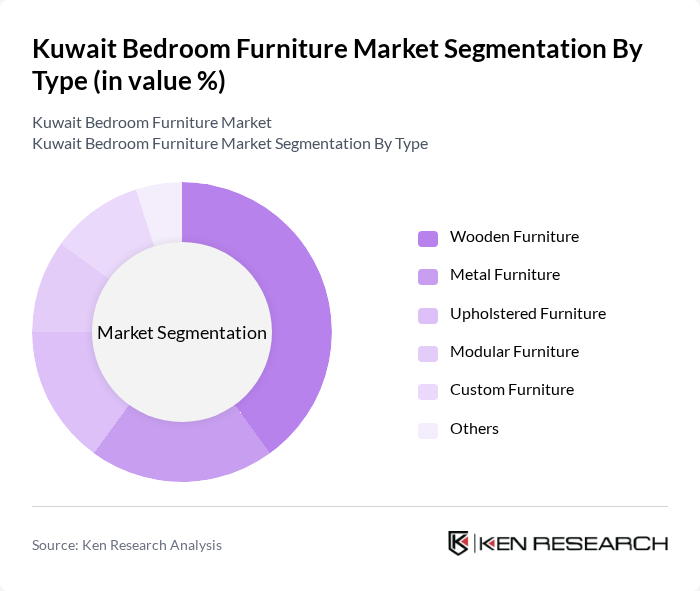

By Type:The market is segmented into various types of bedroom furniture, including wooden, metal, upholstered, modular, custom, and others. Among these, wooden furniture dominates the market due to its durability, aesthetic appeal, and traditional value in Kuwaiti households. The preference for solid wood and engineered wood products is driven by consumer demand for quality and longevity, making it a favored choice for both residential and commercial applications.

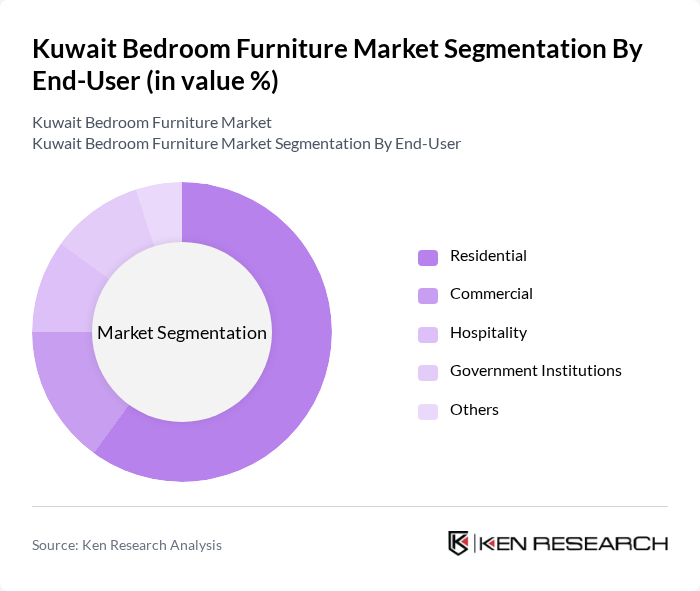

By End-User:The bedroom furniture market is segmented by end-user into residential, commercial, hospitality, government institutions, and others. The residential segment holds the largest share, driven by the growing trend of home renovations and the increasing number of new housing projects in Kuwait. Consumers are increasingly investing in quality furniture that enhances their living spaces, leading to a surge in demand for stylish and functional bedroom furniture.

The Kuwait Bedroom Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, Al-Futtaim Group, Royal Furniture, The One, Muji, Danube Home, Al-Muhalab Furniture, Al-Homaizi Group, Al-Manshar Group, Home Box, Mamas & Papas, KARE Design, and Al-Majed Group contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Kuwait bedroom furniture market appears cautiously optimistic, driven by anticipated growth in the non-oil sector, projected to increase by 2.7 percent in future. This growth is expected to enhance disposable incomes and stimulate demand for residential housing, thereby boosting furniture sales. Additionally, the rising consumer interest in sustainable and eco-friendly designs is likely to shape product offerings, aligning with global trends towards sustainability in furniture manufacturing.

| Segment | Sub-Segments |

|---|---|

| By Type | Wooden Furniture Metal Furniture Upholstered Furniture Modular Furniture Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Government Institutions Others |

| By Material | Solid Wood Engineered Wood Metal Fabric Others |

| By Design Style | Contemporary Traditional Rustic Modern Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Value Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Furniture Outlets | 100 | Store Managers, Sales Representatives |

| Online Furniture Retailers | 80 | E-commerce Managers, Digital Marketing Specialists |

| Interior Design Firms | 60 | Interior Designers, Project Managers |

| Consumer Households | 150 | Homeowners, Renters |

| Furniture Manufacturers | 70 | Production Managers, Product Development Heads |

The Kuwait Bedroom Furniture Market is valued at approximately USD 1.3 billion, reflecting a robust growth trajectory driven by rising disposable incomes, urbanization, and a preference for modern, durable designs suitable for the local climate.