Region:Global

Author(s):Geetanshi

Product Code:KRAA2361

Pages:92

Published On:August 2025

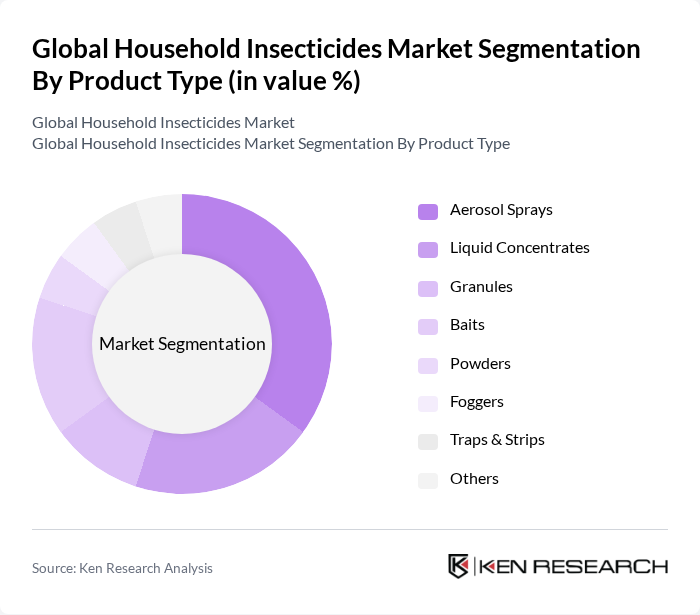

By Product Type:The product type segmentation includes various forms of household insecticides, each catering to different consumer preferences and usage scenarios. The subsegments are Aerosol Sprays, Liquid Concentrates, Granules, Baits, Powders, Foggers, Traps & Strips, and Others. Among these, aerosol sprays are particularly popular due to their ease of use and effectiveness in quickly eliminating pests. The convenience of application and immediate results make aerosol sprays a preferred choice for consumers, driving their dominance in the market. The market is also witnessing increased demand for natural and botanical-based products, reflecting the shift toward safer and environmentally friendly options .

By Insect Type:This segmentation focuses on the types of insects targeted by household insecticides, including Mosquitoes & Flies, Termites, Bedbugs & Beetles, Ants & Cockroaches, Rats & Other Rodents, and Other Insect Types. Mosquitoes and flies are the most common pests, leading to a significant demand for insecticides designed to combat these insects. The increasing awareness of the health risks associated with mosquito-borne diseases has further propelled the market for products targeting these pests. Seasonal spikes in vector-borne diseases and public health campaigns also contribute to the demand for insecticide products .

The Global Household Insecticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as S. C. Johnson & Son, Inc., Reckitt Benckiser Group plc, Bayer AG, Syngenta AG, BASF SE, Terminix Global Holdings, Inc., Rentokil Initial plc, Ecolab Inc., Godrej Consumer Products Limited, Spectrum Brands Holdings, Inc., Central Garden & Pet Company, Amvac Chemical Corporation, FMC Corporation, Sumitomo Chemical Co., Ltd., Earth Chemical Co., Ltd., Dabur India Limited, Jyothy Laboratories Ltd., Tiger Brands Limited, Pelgar International Limited, Amplecta AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the household insecticides market appears promising, driven by increasing urbanization and a growing focus on health and safety. As consumers become more aware of pest-related health risks, the demand for effective insecticides is expected to rise. Additionally, the trend towards eco-friendly products will likely shape product development, pushing manufacturers to innovate. Companies that embrace sustainable practices and advanced technologies will be well-positioned to capture market share in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Aerosol Sprays Liquid Concentrates Granules Baits Powders Foggers Traps & Strips Others |

| By Insect Type | Mosquitoes & Flies Termites Bedbugs & Beetles Ants & Cockroaches Rats & Other Rodents Other Insect Types |

| By Chemical Type | Synthetic (e.g., Pyrethroids, Organophosphates) Natural (e.g., Citronella Oil, Geraniol Oil) |

| By Application | Indoor Use Outdoor Use |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales |

| By Packaging Type | Bottles Cans Pouches Bulk Packaging |

| By Price Range | Low Price Mid Price Premium Price |

| By Geography | North America Europe Asia-Pacific South America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Household Decision Makers, Pest Control Users |

| Distribution Channel Analysis | 80 | Wholesalers, Distributors |

| Regulatory Impact Assessment | 60 | Compliance Officers, Environmental Consultants |

| Market Trend Evaluation | 70 | Market Analysts, Industry Experts |

The Global Household Insecticides Market is valued at approximately USD 17.9 billion, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and increased health awareness regarding pest control solutions.