Region:Asia

Author(s):Dev

Product Code:KRAA9657

Pages:85

Published On:November 2025

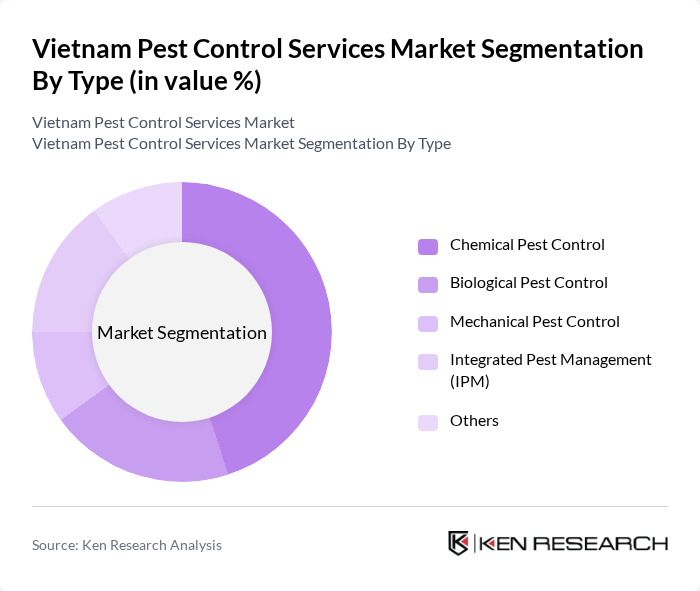

By Type:The pest control services market can be segmented into various types, including Chemical Pest Control, Biological Pest Control, Mechanical Pest Control, Integrated Pest Management (IPM), and Others. Each of these segments plays a crucial role in addressing different pest-related challenges faced by consumers and businesses .

The Chemical Pest Control segment dominates the market due to its widespread use in both residential and commercial applications. The effectiveness and quick results provided by chemical solutions make them a preferred choice for consumers. However, there is a growing trend towards Integrated Pest Management (IPM) and biological solutions as consumers and businesses become more environmentally conscious, leading to a gradual shift in preferences. Despite this, chemical solutions remain the most utilized method in pest control services .

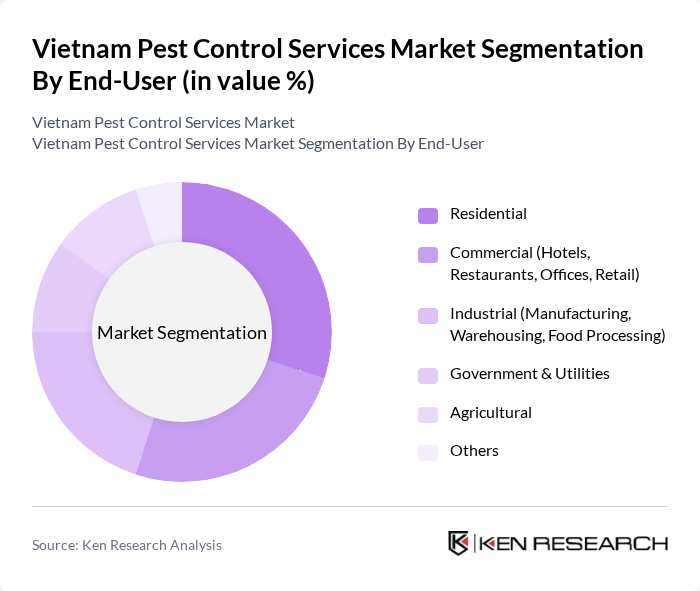

By End-User:The market can also be segmented based on end-users, which include Residential, Commercial (Hotels, Restaurants, Offices, Retail), Industrial (Manufacturing, Warehousing, Food Processing), Government & Utilities, Agricultural, and Others. Each end-user segment has unique pest control needs and requirements .

The Residential segment is the largest end-user category, driven by increasing awareness of pest-related health issues and the need for maintaining hygiene in homes. The Commercial segment follows closely, as businesses seek to protect their premises from pest infestations that could harm their reputation and customer satisfaction. The Agricultural sector also plays a significant role, as effective pest control is essential for crop protection and yield maximization .

The Vietnam Pest Control Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rentokil Initial Vietnam, Anticimex Vietnam, Terminix International Vietnam, Ecolab Vietnam, Orkin Vietnam (Rollins, Inc.), Saigon Pest Control, Vinaconex Pest Control, Bayer CropScience Vietnam, Syngenta Vietnam, FMC Vietnam, SC Johnson Professional Vietnam, EcoSMART Technologies, Clarke Vietnam, ADAMA Vietnam, UPL Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam pest control services market is poised for significant evolution, driven by technological advancements and increasing consumer demand for eco-friendly solutions. As urbanization continues, the integration of smart pest control technologies will enhance service efficiency and effectiveness. Additionally, the shift towards integrated pest management practices will likely gain traction, promoting sustainable approaches. These trends indicate a promising future for the industry, with opportunities for growth and innovation in pest management solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Pest Control Biological Pest Control Mechanical Pest Control Integrated Pest Management (IPM) Others |

| By End-User | Residential Commercial (Hotels, Restaurants, Offices, Retail) Industrial (Manufacturing, Warehousing, Food Processing) Government & Utilities Agricultural Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Application | Termite Control Rodent Control Insect Control (Mosquitoes, Cockroaches, Flies, etc.) Fumigation Services Others |

| By Service Type | Preventive Services Reactive Services Consulting & Audit Services Others |

| By Product Type | Insecticides Rodenticides Traps & Baits Biopesticides Others |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Pest Control Services | 120 | Homeowners, Property Managers |

| Commercial Pest Control Services | 90 | Facility Managers, Business Owners |

| Agricultural Pest Management | 60 | Farm Owners, Agricultural Consultants |

| Public Health Pest Control | 50 | Health Officials, Environmental Health Specialists |

| Integrated Pest Management Solutions | 70 | Pest Control Technicians, Service Supervisors |

The Vietnam Pest Control Services Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by urbanization, health awareness, and agricultural expansion. This market is expected to continue evolving as demand for effective pest management solutions increases.