Region:Global

Author(s):Rebecca

Product Code:KRAA1401

Pages:84

Published On:August 2025

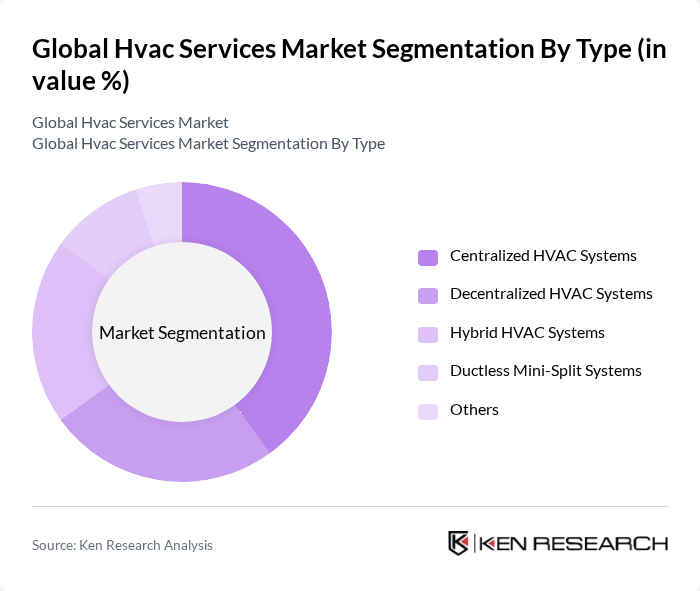

By Type:The HVAC services market can be segmented into Centralized HVAC Systems, Decentralized HVAC Systems, Hybrid HVAC Systems, Ductless Mini-Split Systems, and Others.Centralized HVAC Systemscontinue to dominate the market due to their efficiency in large buildings and commercial spaces, providing consistent temperature control and air quality. The adoption ofHybrid HVAC Systemsis rising, driven by the trend toward energy efficiency, integration of smart building technologies, and the need for flexible solutions that combine centralized and decentralized approaches.

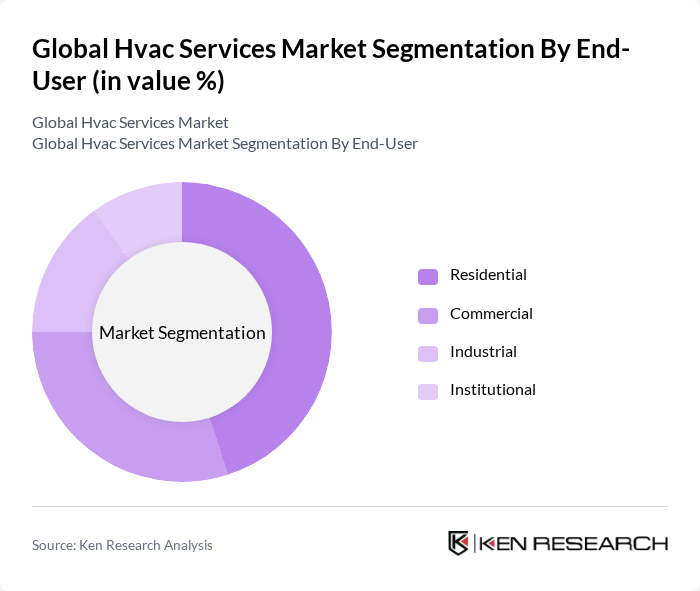

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Institutional sectors. TheResidential segmentis the largest, driven by increasing demand for home comfort, energy-efficient solutions, and the integration of HVAC systems with home automation and smart home technologies. TheCommercial segmentis also significant, fueled by the need for advanced climate control in office buildings, retail spaces, and public infrastructure.

The Global HVAC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrier Global Corporation, Trane Technologies plc, Daikin Industries, Ltd., Johnson Controls International plc, Lennox International Inc., Rheem Manufacturing Company, Mitsubishi Electric Corporation, York International Corporation, Bosch Thermotechnology Corp., Fujitsu General Limited, Hitachi, Ltd., Panasonic Corporation, Goodman Manufacturing Company, L.P., Gree Electric Appliances, Inc., ABM Industries Incorporated, EMCOR Group Inc., Comfort Systems USA Inc., Southland Industries, Service Logic Corporation, Honeywell International Inc., Siemens AG (Building Technologies), and Schneider Electric SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the HVAC services market appears promising, driven by technological advancements and a growing emphasis on sustainability. As smart technologies become more integrated into HVAC systems, efficiency and user experience will improve significantly. Additionally, the increasing focus on indoor air quality and energy conservation will likely propel demand for innovative solutions. Companies that adapt to these trends and invest in research and development will be well-positioned to capture market share in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Centralized HVAC Systems Decentralized HVAC Systems Hybrid HVAC Systems Ductless Mini-Split Systems Others |

| By End-User | Residential Commercial Industrial Institutional |

| By Component | Heating Equipment Ventilation Equipment Air Conditioning Equipment Controls and Thermostats Others |

| By Application | Residential Buildings Commercial Buildings Industrial Facilities Institutional Buildings |

| By Service Type | Installation Maintenance & Repair Replacement Consulting & Auditing |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential HVAC Systems | 100 | Homeowners, HVAC Installers |

| Commercial HVAC Solutions | 90 | Facility Managers, Building Owners |

| Industrial HVAC Applications | 60 | Operations Managers, Plant Engineers |

| HVAC Maintenance Services | 50 | Service Technicians, Maintenance Supervisors |

| Energy-Efficient HVAC Technologies | 40 | Energy Auditors, Sustainability Consultants |

The Global HVAC Services Market is valued at approximately USD 150 billion, driven by factors such as urbanization, rising disposable incomes, and a focus on energy-efficient HVAC systems. This market is expected to grow further as demand for improved indoor air quality increases.