Region:Middle East

Author(s):Dev

Product Code:KRAB1908

Pages:88

Published On:January 2026

By Service Type:The service type segmentation includes various categories such as Installation & Commissioning Services, Preventive Maintenance Services, Repair & Corrective Maintenance Services, Retrofit & Upgrade Services, Energy Audit & Optimization Services, HVAC Rental & Temporary Cooling Services, and Others (Inspection, Consulting, Balancing & Testing). Installation & Commissioning Services hold a leading share of the market, reflecting the high demand for new HVAC systems associated with continuous construction of residential towers, commercial complexes, hospitality assets, and mixed-use developments that require initial design, supply, and startup services. At the same time, Preventive Maintenance and Repair & Corrective Maintenance Services have been gaining importance as the installed base of equipment expands and asset owners focus on reliability, lifecycle cost optimization, and compliance with energy-efficiency programs.

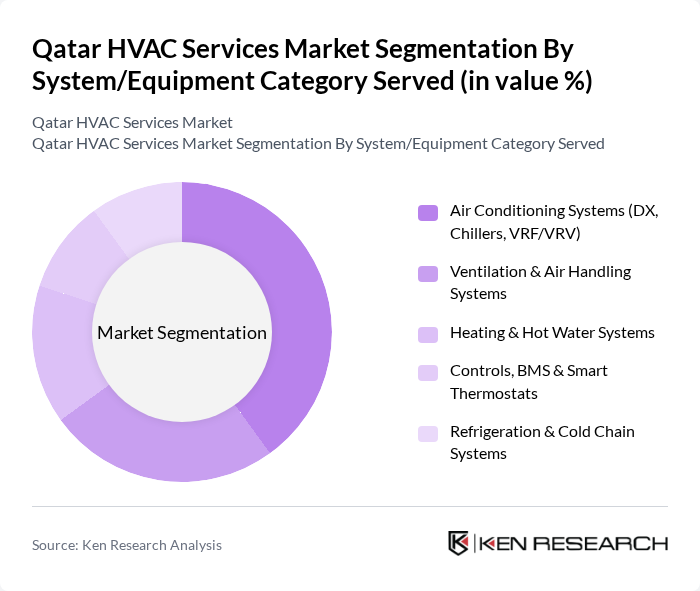

By System/Equipment Category Served:This segmentation includes Air Conditioning Systems (DX, Chillers, VRF/VRV), Ventilation & Air Handling Systems, Heating & Hot Water Systems, Controls, BMS & Smart Thermostats, and Refrigeration & Cold Chain Systems. Air Conditioning Systems are the leading category, driven by Qatar’s harsh desert climate, where temperatures routinely exceed 40°C in summer and cooling demand dominates building energy use in residential, commercial, and institutional properties. Ventilation & Air Handling Systems and advanced Controls, BMS & Smart Thermostats are increasingly adopted in premium and green buildings to improve indoor air quality, monitor energy consumption, and integrate with smart-city and district cooling infrastructure, while Refrigeration & Cold Chain Systems are supported by growth in food retail, logistics, and healthcare.

The Qatar HVAC Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Cool (Qatar District Cooling Company), United Development Company (HVAC & MEP Services), Al Malki Group (Qatar Electromechanical Solutions), Al Futtaim Engineering & Technologies – Qatar, Trane Technologies – Qatar Operations, Daikin Middle East & Africa – Qatar, Carrier Middle East – Qatar, Johnson Controls – Qatar, Imar Group (HVAC & Facilities Management), Al Mana Group – Engineering & HVAC Services, Kahramaa (Qatar General Electricity & Water Corporation – Energy Efficiency Programs), Qatar Building Company – MEP & HVAC Contracting, Marafeq Qatar (District Cooling & Utility Services), Consolidated Engineering Systems Company (CESC), Petroserv Limited – MEP & Industrial HVAC Services contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar HVAC services market is poised for significant transformation, driven by technological advancements and a strong focus on sustainability. As the government continues to invest in infrastructure and energy efficiency initiatives, the demand for innovative HVAC solutions will rise. The integration of smart technologies and automation will enhance system performance and user experience. Additionally, the emphasis on eco-friendly practices will shape the market, encouraging the adoption of sustainable refrigerants and energy-efficient systems, ultimately fostering a more resilient HVAC landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Installation & Commissioning Services Preventive Maintenance Services Repair & Corrective Maintenance Services Retrofit & Upgrade Services Energy Audit & Optimization Services HVAC Rental & Temporary Cooling Services Others (Inspection, Consulting, Balancing & Testing) |

| By System/Equipment Category Served | Air Conditioning Systems (DX, Chillers, VRF/VRV) Ventilation & Air Handling Systems Heating & Hot Water Systems Controls, BMS & Smart Thermostats Refrigeration & Cold Chain Systems |

| By End-User Industry | Residential Commercial (Offices, Retail, Hospitality) Industrial (Oil & Gas, Manufacturing) Infrastructure & Public Sector (Airports, Metro, Stadiums) Healthcare & Education |

| By Contract Type | Annual Maintenance Contracts (AMCs) Long-Term Service Agreements (LTSAs) On-Demand / Break-Fix Service Performance-Based / Energy-Savings Contracts (ESCO Models) |

| By Project Lifecycle Stage | New Construction Projects Retrofit & Renovation Projects Operations & Facilities Management |

| By Customer Type | Direct End-Users Facility Management Companies Real Estate Developers Government & Municipal Bodies |

| By Region | Doha & Al Rayyan Al Wakrah & Al Khor Umm Salal, Al Daayen & Al Shamal Industrial Zones & Special Economic Zones |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential HVAC Installations | 100 | Homeowners, HVAC Installers |

| Commercial HVAC Systems | 80 | Facility Managers, Building Owners |

| Industrial HVAC Solutions | 70 | Operations Managers, Plant Engineers |

| HVAC Maintenance Services | 60 | Service Technicians, Maintenance Supervisors |

| Energy-Efficient HVAC Technologies | 90 | Product Managers, Sustainability Officers |

The Qatar HVAC Services Market is valued at approximately USD 600 million, driven by rapid urbanization, infrastructural development, and a growing demand for energy-efficient HVAC solutions across residential, commercial, and institutional sectors, particularly in Doha.