Region:Global

Author(s):Shubham

Product Code:KRAC0693

Pages:86

Published On:August 2025

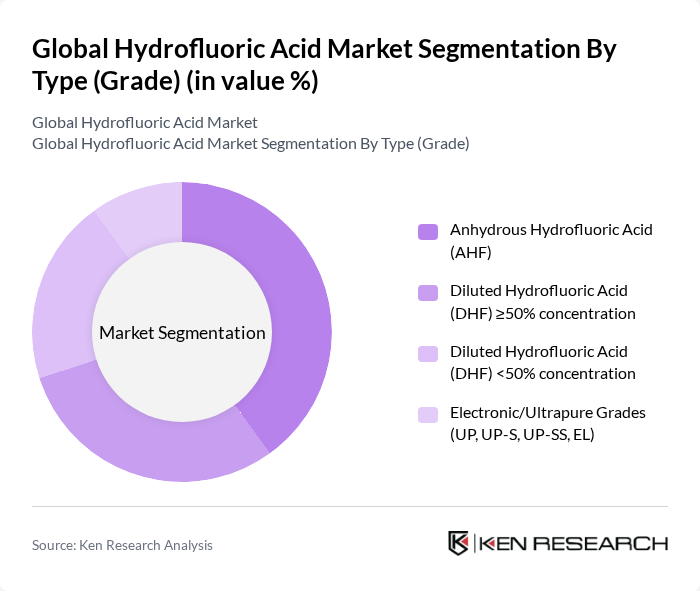

By Type (Grade):The hydrofluoric acid market is segmented into four main types: Anhydrous Hydrofluoric Acid (AHF), Diluted Hydrofluoric Acid (DHF) ?50% concentration, Diluted Hydrofluoric Acid (DHF) <50% concentration, and Electronic/Ultrapure Grades (UP, UP-S, UP-SS, EL). Each type serves different industrial applications, with AHF widely used in chemical synthesis (fluorocarbons, fluoropolymers, aluminum fluoride) and DHF in metal pickling, glass etching, and cleaning/etching processes in electronics manufacturing.

The Anhydrous Hydrofluoric Acid (AHF) segment dominates due to its extensive use as a precursor for fluorinated chemicals (fluorocarbons, fluoropolymers) and aluminum fluoride, with demand reinforced by refrigerant transitions and the use of fluoropolymers in automotive, aerospace, and electronics.

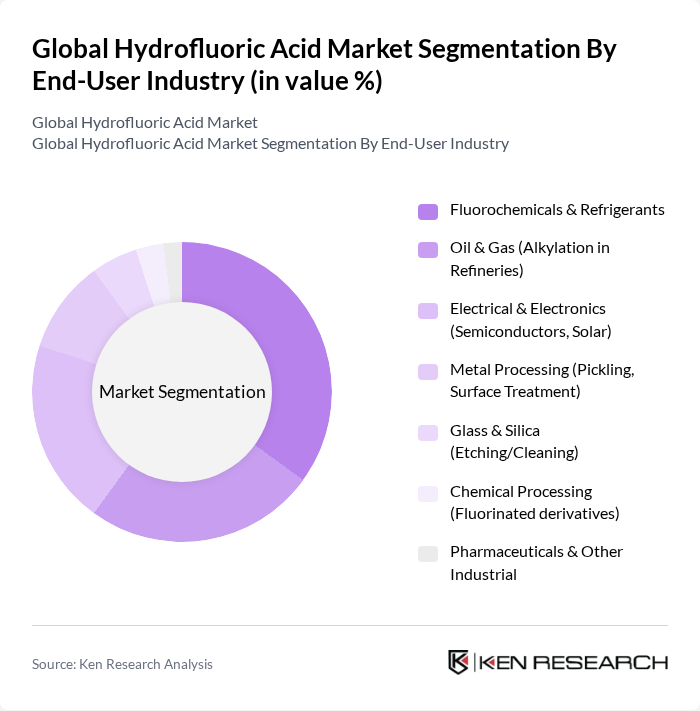

By End-User Industry:The hydrofluoric acid market is segmented by end-user industries, including Fluorochemicals & Refrigerants, Oil & Gas (Alkylation in Refineries), Electrical & Electronics (Semiconductors, Solar), Metal Processing (Pickling, Surface Treatment), Glass & Silica (Etching/Cleaning), Chemical Processing (Fluorinated derivatives), and Pharmaceuticals & Other Industrial. Each industry utilizes hydrofluoric acid for specific applications, contributing to overall market demand.

The Fluorochemicals & Refrigerants segment leads due to HF’s role in synthesizing fluorocarbons and hydrofluoroolefins and as feedstock for fluoropolymers, while electronics demand is supported by HF use in wafer etching/cleaning and specialty glass processing for displays and solar.

The Global Hydrofluoric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Chemours Company, Honeywell International Inc., Solvay S.A., Dongyue Group, Zhejiang Juhua Co., Ltd. (Juhua Group Corporation), Air Products and Chemicals, Inc., Orbia Advance Corporation, S.A.B. de C.V. (Koura), OCI Company Ltd., Morita Chemical Industries Co., Ltd., Stella Chemifa Corporation, Sinochem International Corporation, Tokuyama Corporation, Daikin Industries, Ltd., Arkema S.A., Gujarat Fluorochemicals Limited (GFL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrofluoric acid market in None appears promising, driven by technological advancements and increasing applications across various industries. The shift towards sustainable practices is likely to influence production methods, leading to more eco-friendly alternatives. Additionally, the growing demand for specialty chemicals and innovations in hydrofluoric acid applications will create new opportunities for market players. As industries adapt to changing regulations and consumer preferences, the hydrofluoric acid market is expected to evolve, presenting both challenges and growth potential.

| Segment | Sub-Segments |

|---|---|

| By Type (Grade) | Anhydrous Hydrofluoric Acid (AHF) Diluted Hydrofluoric Acid (DHF) ?50% concentration Diluted Hydrofluoric Acid (DHF) <50% concentration Electronic/Ultrapure Grades (UP, UP-S, UP-SS, EL) |

| By End-User Industry | Fluorochemicals & Refrigerants Oil & Gas (Alkylation in Refineries) Electrical & Electronics (Semiconductors, Solar) Metal Processing (Pickling, Surface Treatment) Glass & Silica (Etching/Cleaning) Chemical Processing (Fluorinated derivatives) Pharmaceuticals & Other Industrial |

| By Application | Fluorocarbon (HFC/HFO) and Fluorinated Derivatives Production Fluoropolymer Production (e.g., PTFE, PVDF, FKM) Petroleum Alkylation Metal Pickling and Surface Treatment Glass Etching and Cleaning Uranium Fuel Processing Semiconductor and Solar Wafer Etching/Clean |

| By Distribution Channel | Direct (Producer to End-User) Industrial Distributors Long-term Offtake/Contract Sales Spot/Bulk Trading |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk ISO Containers / Tank Trucks Drums / IBCs Cylinders (anhydrous) Specialized Lined Containers |

| By Purity Range | Industrial Grade (<99.9%) High Purity (?99.9%) Ultrapure/Electronic Grade (ppb-level metals) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 120 | Process Engineers, Production Managers |

| Glass Etching Applications | 90 | R&D Managers, Quality Control Specialists |

| Metal Surface Treatment | 80 | Operations Managers, Chemical Engineers |

| Fluoropolymer Production | 70 | Product Development Managers, Procurement Officers |

| Pharmaceutical Applications | 60 | Regulatory Affairs Specialists, Production Supervisors |

The Global Hydrofluoric Acid Market is valued at approximately USD 3.5 billion, based on a five-year historical analysis. This valuation reflects the market's growth driven by various industrial applications, particularly in electronics and chemical manufacturing.