Region:Global

Author(s):Dev

Product Code:KRAA1480

Pages:90

Published On:August 2025

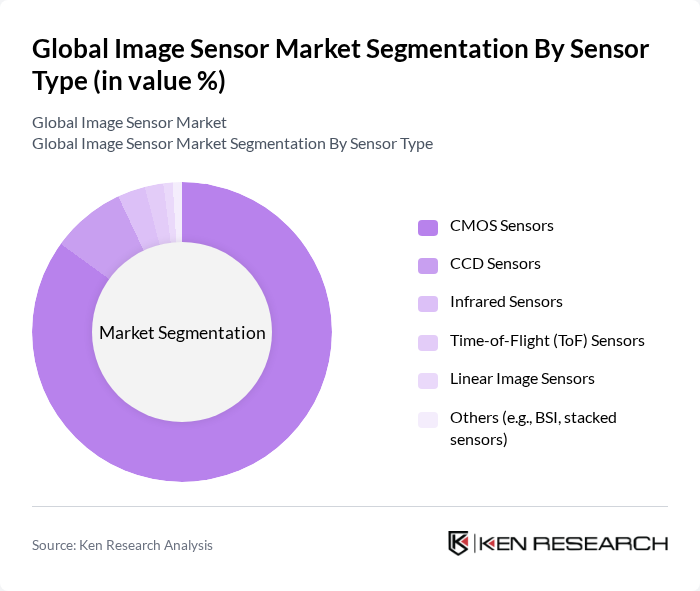

By Sensor Type:The image sensor market is segmented into CMOS Sensors, CCD Sensors, Infrared Sensors, Time-of-Flight (ToF) Sensors, Linear Image Sensors, and Others (e.g., BSI, stacked sensors). CMOS sensors overwhelmingly dominate the market, accounting for over 85% of market share, due to their low power consumption, high-speed performance, and integration capabilities in mobile devices. The demand for high-resolution imaging in smartphones and digital cameras continues to drive the growth of CMOS sensors, making them the preferred choice for manufacturers. CCD sensors remain relevant for specialized applications requiring high image quality and low-light performance, while ToF and infrared sensors are increasingly adopted in automotive and industrial automation for depth sensing and night vision.

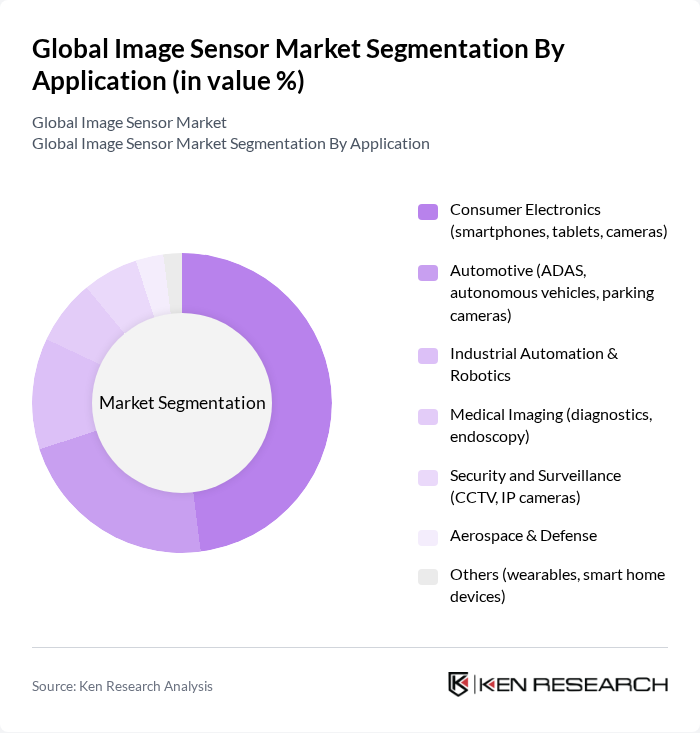

By Application:Image sensors are utilized in a wide range of applications, including Consumer Electronics (smartphones, tablets, cameras), Automotive (ADAS, autonomous vehicles, parking cameras), Industrial Automation & Robotics, Medical Imaging (diagnostics, endoscopy), Security and Surveillance (CCTV, IP cameras), Aerospace & Defense, and Others (wearables, smart home devices). The consumer electronics segment remains the largest, driven by continuous demand for high-quality imaging in smartphones and digital cameras. Automotive applications are rapidly growing due to the integration of ADAS and autonomous driving technologies, while industrial automation and robotics increasingly rely on image sensors for machine vision and quality control. Medical imaging and security/surveillance are also significant growth areas, supported by advancements in sensor technology and regulatory requirements.

The Global Image Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Samsung Electronics Co., Ltd., OmniVision Technologies, Inc., STMicroelectronics N.V., Canon Inc., Panasonic Corporation, ON Semiconductor Corporation, Teledyne Technologies Incorporated, Nikon Corporation, Himax Technologies, Inc., PixArt Imaging Inc., Teledyne e2v (formerly e2v Technologies plc), Vishay Intertechnology, Inc., Aptina Imaging Corporation, and Toshiba Electronic Devices & Storage Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the image sensor market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of artificial intelligence in imaging solutions is expected to enhance image processing capabilities, leading to smarter devices. Additionally, the growing demand for security and surveillance systems will further propel the adoption of advanced imaging technologies. As these trends continue to evolve, the market is likely to witness significant innovations and expansions in the coming years, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Sensor Type | CMOS Sensors CCD Sensors Infrared Sensors Time-of-Flight (ToF) Sensors Linear Image Sensors Others (e.g., BSI, stacked sensors) |

| By Application | Consumer Electronics (smartphones, tablets, cameras) Automotive (ADAS, autonomous vehicles, parking cameras) Industrial Automation & Robotics Medical Imaging (diagnostics, endoscopy) Security and Surveillance (CCTV, IP cameras) Aerospace & Defense Others (wearables, smart home devices) |

| By End-User Industry | Consumer Electronics Manufacturers Automotive OEMs Healthcare Providers Industrial & Manufacturing Companies Security Firms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sales Channel | Direct Sales Distributors Online Retail Others |

| By Component | Sensor Chip Lens Image Processing Unit Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Image Sensors | 60 | Product Engineers, Automotive Designers |

| Consumer Electronics Applications | 90 | Product Managers, R&D Engineers |

| Security and Surveillance Systems | 50 | Security System Integrators, Technical Directors |

| Medical Imaging Devices | 40 | Biomedical Engineers, Product Development Managers |

| Industrial Automation Sensors | 55 | Operations Managers, Automation Engineers |

The Global Image Sensor Market is valued at approximately USD 32 billion, driven by the increasing demand for high-resolution imaging across various sectors, including consumer electronics, automotive applications, and industrial automation.