Region:Global

Author(s):Geetanshi

Product Code:KRAC0073

Pages:100

Published On:August 2025

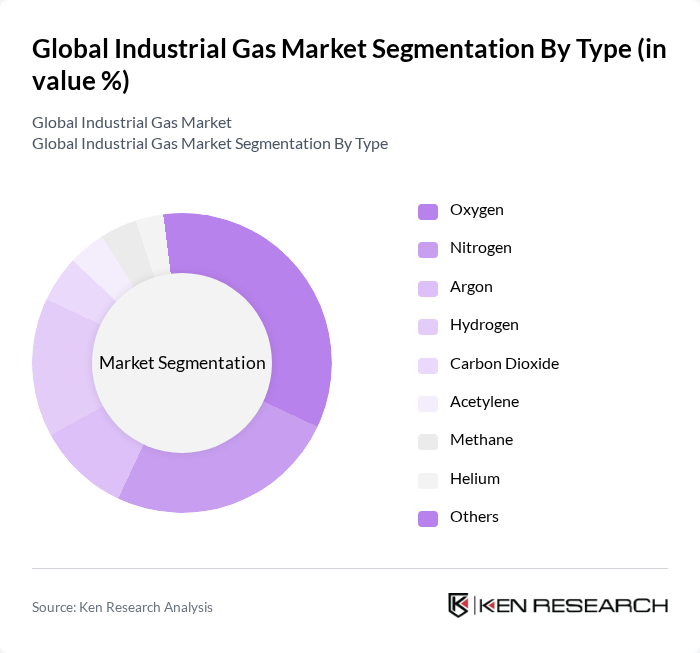

By Type:The industrial gas market is segmented into various types, including oxygen, nitrogen, argon, hydrogen, carbon dioxide, acetylene, methane, helium, and others. Among these, oxygen and nitrogen are the most widely used gases, primarily due to their extensive applications in healthcare, manufacturing, and food processing. The demand for hydrogen is also increasing, driven by its role in clean energy solutions and fuel cell technologies. Oxygen holds the largest revenue share among gases, accounting for about one-third of the market, followed by nitrogen and hydrogen .

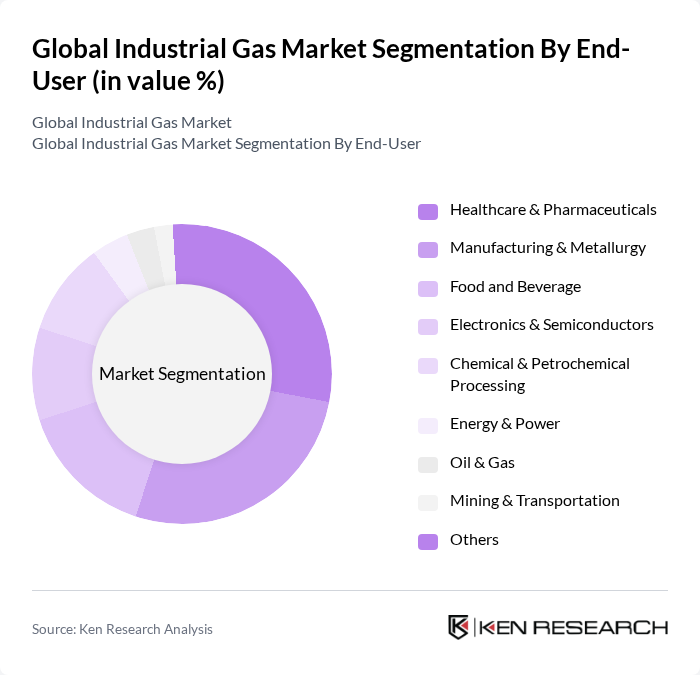

By End-User:The industrial gas market serves various end-user industries, including healthcare and pharmaceuticals, manufacturing and metallurgy, food and beverage, electronics and semiconductors, chemical and petrochemical processing, energy and power, oil and gas, mining and transportation, and others. The healthcare sector is a significant consumer of industrial gases, particularly oxygen and nitrogen, due to their critical roles in medical applications and patient care. Manufacturing and metallurgy remain the largest industrial consumers, driven by the demand for gases in steelmaking, welding, and cutting processes .

The Global Industrial Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Praxair Technology, Inc., Air Liquide S.A., Messer SE & Co. KGaA, Taiyo Nippon Sanso Corporation, Matheson Tri-Gas, Inc., Iwatani Corporation, Nippon Sanso Holdings Corporation, Universal Industrial Gases, Inc., BOC Group Limited, Airgas, Inc., Gulf Cryo, Southern Industrial Gas Sdn Bhd, Yingde Gases Group Company Limited, Air Water Inc., Coregas Pty Ltd., SOL S.p.A., Norco, Inc., Buzwair Industrial Gases Factories, Guangdong Huate Gas Co., Ltd., Asia Technical Gas Co Pte Ltd., Chemix Specialty Gases and Equipment, Goyal Group, BASF SE contribute to innovation, geographic expansion, and service delivery in this space.

The industrial gas market is poised for transformative growth, driven by the increasing integration of digital technologies and a shift towards sustainable practices. As companies adopt smart manufacturing techniques, the demand for gases that support these innovations will rise. Furthermore, the focus on reducing carbon footprints will lead to the development of cleaner production methods. Strategic partnerships and investments in emerging markets will also play a crucial role in shaping the future landscape of the industry, fostering resilience and adaptability.

| Segment | Sub-Segments |

|---|---|

| By Type | Oxygen Nitrogen Argon Hydrogen Carbon Dioxide Acetylene Methane Helium Others |

| By End-User | Healthcare & Pharmaceuticals Manufacturing & Metallurgy Food and Beverage Electronics & Semiconductors Chemical & Petrochemical Processing Energy & Power Oil & Gas Mining & Transportation Others |

| By Application | Metal Fabrication Welding and Cutting Chemical Synthesis Food Preservation Medical Applications Carbon Capture & Storage Electronics Manufacturing Others |

| By Distribution Channel | On-site (Tonnage Supply) Packaged/Cylinder Supply Bulk Delivery Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Cost-Plus Pricing Others |

| By Customer Type | Large Enterprises SMEs Government Agencies Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Gas Usage | 100 | Hospital Administrators, Medical Gas Suppliers |

| Manufacturing Industry Applications | 110 | Production Managers, Quality Control Supervisors |

| Food Processing Gas Applications | 80 | Food Safety Officers, Operations Managers |

| Energy Sector Gas Utilization | 90 | Energy Analysts, Plant Managers |

| Research and Development in Gas Technologies | 60 | R&D Directors, Chemical Engineers |

The Global Industrial Gas Market is valued at approximately USD 119 billion, driven by increasing demand across various sectors such as healthcare, manufacturing, and energy, particularly for applications like metal fabrication and welding.