Region:North America

Author(s):Dev

Product Code:KRAA1483

Pages:88

Published On:August 2025

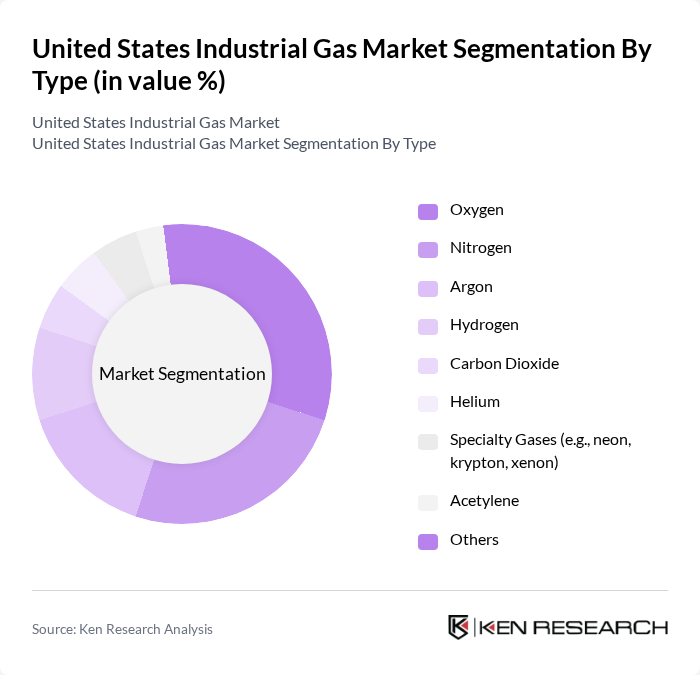

By Type:The industrial gas market is segmented into oxygen, nitrogen, argon, hydrogen, carbon dioxide, helium, specialty gases (such as neon, krypton, xenon), acetylene, and others. Each type serves distinct applications: oxygen is critical for healthcare and metal fabrication, nitrogen for electronics and food preservation, argon for welding, hydrogen for clean energy and chemical synthesis, carbon dioxide for beverages and water treatment, helium for medical imaging and electronics, specialty gases for lighting and semiconductor manufacturing, and acetylene for cutting and welding .

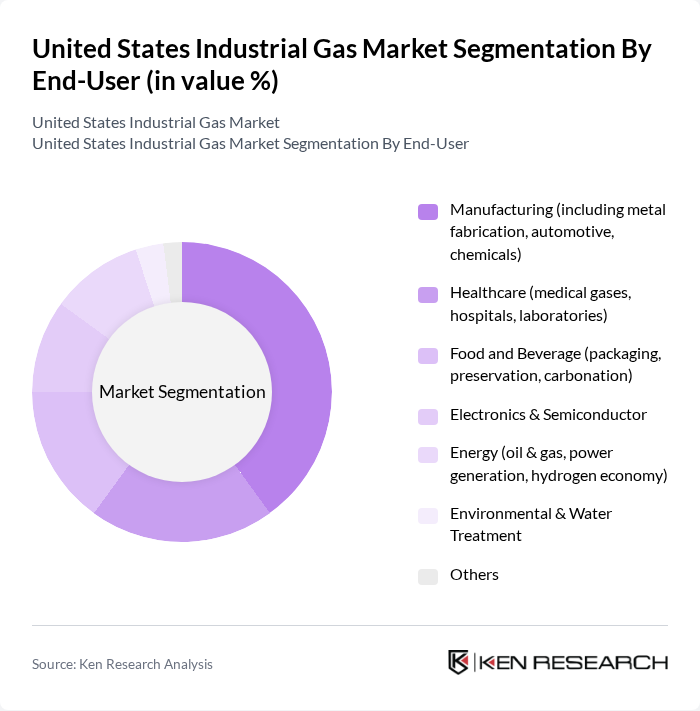

By End-User:The end-user segmentation includes manufacturing (metal fabrication, automotive, chemicals), healthcare (medical gases, hospitals, laboratories), food and beverage (packaging, preservation, carbonation), electronics and semiconductor (chip fabrication, display manufacturing), energy (oil & gas, power generation, hydrogen economy), environmental and water treatment (pollution control, water purification), and others. Each sector utilizes industrial gases for specific applications, driving demand and shaping market trends .

The United States Industrial Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Messer North America, Inc., Matheson Tri-Gas, Inc., Praxair, Inc. (now part of Linde plc), Airgas, Inc. (an Air Liquide company), Taiyo Nippon Sanso Corporation, Iwatani Corporation, Universal Industrial Gases, Inc., Gulf Coast Environmental Systems, American Welding & Gas, Inc., Norco, Inc., Cryogenic Industries, Inc., Weldstar, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States industrial gas market appears promising, driven by technological advancements and a strong focus on sustainability. As industries increasingly adopt cleaner energy solutions, the demand for hydrogen and other eco-friendly gases is expected to rise. Additionally, digital transformation in supply chain management will enhance operational efficiency, allowing companies to respond swiftly to market changes. Overall, the market is poised for growth, supported by evolving consumer preferences and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Oxygen Nitrogen Argon Hydrogen Carbon Dioxide Helium Specialty Gases (e.g., neon, krypton, xenon) Acetylene Others |

| By End-User | Manufacturing (including metal fabrication, automotive, chemicals) Healthcare (medical gases, hospitals, laboratories) Food and Beverage (packaging, preservation, carbonation) Electronics & Semiconductor Energy (oil & gas, power generation, hydrogen economy) Environmental & Water Treatment Others |

| By Application | Welding and Cutting Chemical Processing Metal Fabrication Medical Applications Food Preservation & Packaging Electronics Manufacturing Water Treatment Others |

| By Distribution Mode | Cylinder Delivery (Packaged Gases) Bulk Supply (Liquid Gases) On-Site Generation (Tonnage Supply) Pipeline Supply Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Cost-Plus Pricing Dynamic Pricing Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Customer Type | Large Enterprises SMEs Government Agencies Research Institutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Gas Usage | 150 | Plant Managers, Production Supervisors |

| Healthcare Gas Applications | 100 | Medical Equipment Managers, Hospital Administrators |

| Food Processing Gas Utilization | 80 | Quality Control Managers, Operations Directors |

| Energy Sector Gas Consumption | 70 | Energy Analysts, Procurement Managers |

| Research and Development in Gas Technologies | 40 | R&D Managers, Innovation Officers |

The United States Industrial Gas Market is valued at approximately USD 27 billion, reflecting a significant growth driven by increasing demand across various sectors such as manufacturing, healthcare, and energy.