Region:Global

Author(s):Geetanshi

Product Code:KRAC2340

Pages:90

Published On:October 2025

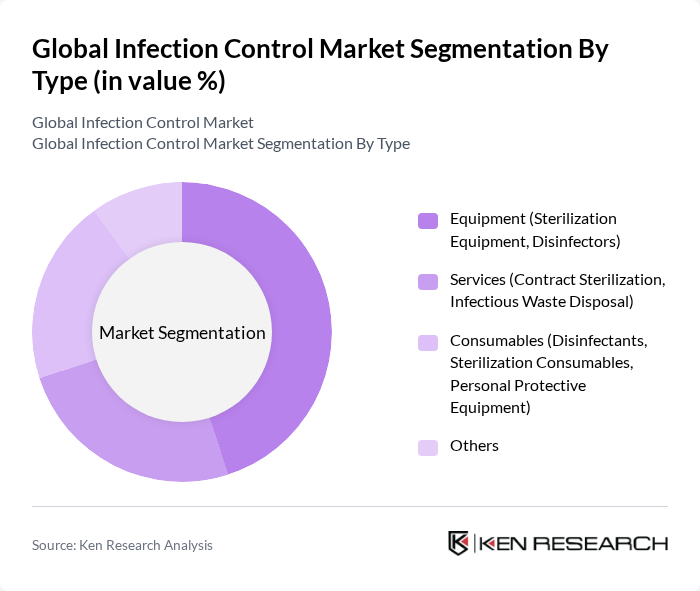

By Type:The market is segmented into Equipment, Services, Consumables, and Others. Among these, Consumables, which include disinfectants, sterilization consumables, and personal protective equipment, are often reported as a leading sub-segment due to their continuous demand across various sectors. The growing focus on maintaining hygiene standards and preventing infections has led to a surge in the adoption of these technologies, making them essential in hospitals and clinics.

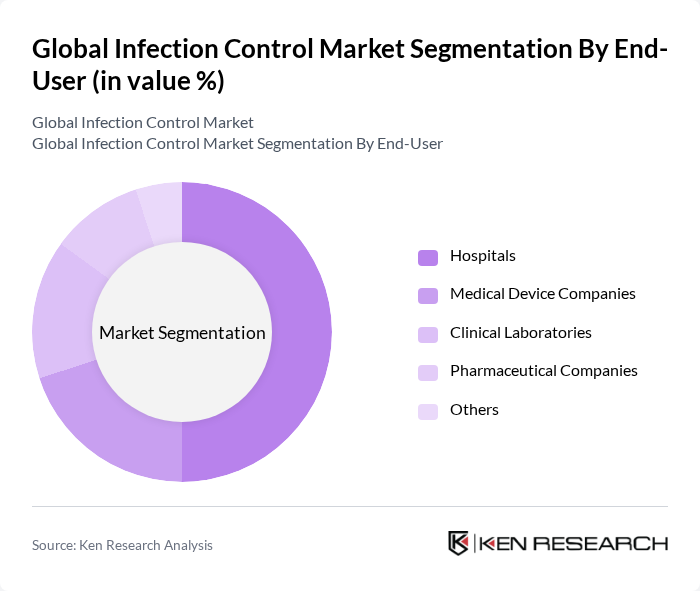

By End-User:The end-user segmentation includes Hospitals, Medical Device Companies, Clinical Laboratories, Pharmaceutical Companies, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of surgical procedures and the rising incidence of HAIs. The need for stringent infection control measures in hospitals has led to a higher demand for infection control products and services.

The Global Infection Control Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Ecolab Inc., Johnson & Johnson, Steris Corporation, Becton, Dickinson and Company, Getinge AB, STERIS plc, Medline Industries, Inc., Reckitt Benckiser Group plc, Cardinal Health, Inc., Halyard Health, Inc., PDI, Inc., Ansell Limited, Kimberly-Clark Corporation, Clorox Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the infection control market in the future is poised for significant transformation, driven by technological advancements and a growing emphasis on preventive healthcare. As healthcare facilities increasingly adopt integrated solutions that leverage data analytics and IoT, the efficiency of infection control measures will improve. Additionally, the rising focus on sustainability will encourage the development of eco-friendly products, aligning with global health initiatives and regulatory standards, ultimately enhancing patient safety and operational effectiveness in healthcare settings.

| Segment | Sub-Segments |

|---|---|

| By Type | Equipment (Sterilization Equipment, Disinfectors) Services (Contract Sterilization, Infectious Waste Disposal) Consumables (Disinfectants, Sterilization Consumables, Personal Protective Equipment) Others |

| By End-User | Hospitals Medical Device Companies Clinical Laboratories Pharmaceutical Companies Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Application | Surgical Instruments Infection Prevention in Healthcare Settings Environmental Disinfection Food Safety Others |

| By Product Form | Liquid Gel Foam Spray Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Infection Control Practices | 120 | Infection Control Officers, Hospital Administrators |

| Manufacturers of Infection Control Products | 80 | Product Managers, Sales Directors |

| Healthcare Facility Infection Control Compliance | 60 | Compliance Officers, Quality Assurance Managers |

| Public Health Initiatives on Infection Control | 50 | Public Health Officials, Policy Makers |

| Research on Emerging Infection Control Technologies | 60 | R&D Managers, Technology Analysts |

The Global Infection Control Market is valued at approximately USD 52 billion, driven by the increasing prevalence of healthcare-associated infections (HAIs) and the rising demand for sterilization and disinfection products across various sectors, including healthcare and food safety.