Region:Middle East

Author(s):Dev

Product Code:KRAB1702

Pages:100

Published On:January 2026

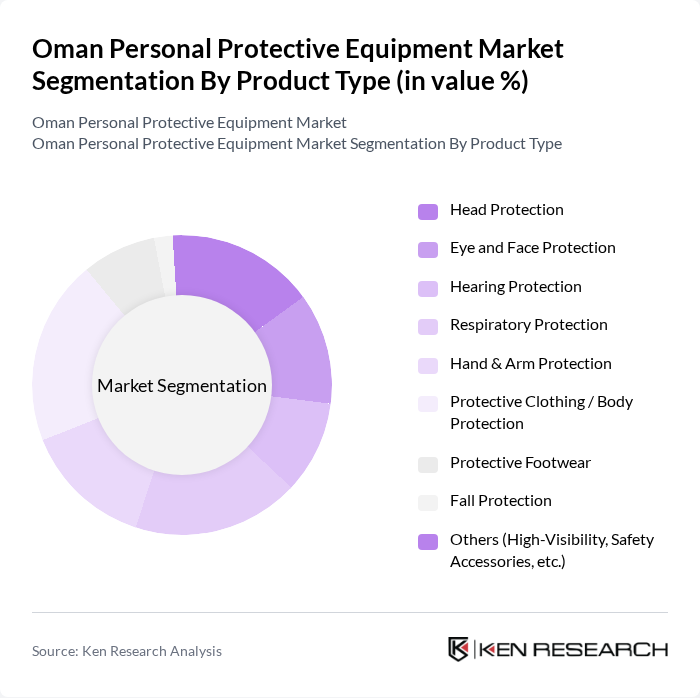

By Product Type:The product type segmentation includes various categories of personal protective equipment that cater to different safety needs in the workplace. The subsegments are Head Protection, Eye and Face Protection, Hearing Protection, Respiratory Protection, Hand & Arm Protection, Protective Clothing / Body Protection, Protective Footwear, Fall Protection, and Others (High-Visibility, Safety Accessories, etc.).

The Protective Clothing / Body Protection subsegment is currently dominating the market due to the increasing demand for safety apparel in various industries, particularly in construction, petrochemicals, and manufacturing, where workers are exposed to heat, chemicals, and mechanical risks. This trend is driven by stringent safety regulations, stronger enforcement of employer responsibility for providing suitable garments, and a heightened focus on worker safety and hygiene. Additionally, the rise in awareness regarding the importance of protective clothing in preventing workplace injuries and contamination has led to a surge in its adoption across both industrial and healthcare environments. The growing trend of customization, multi?risk flame?resistant and chemical?resistant fabrics, and advancements in lightweight, breathable, and smart textiles further enhances the appeal of protective clothing, making it a preferred choice among employers seeking both compliance and comfort.

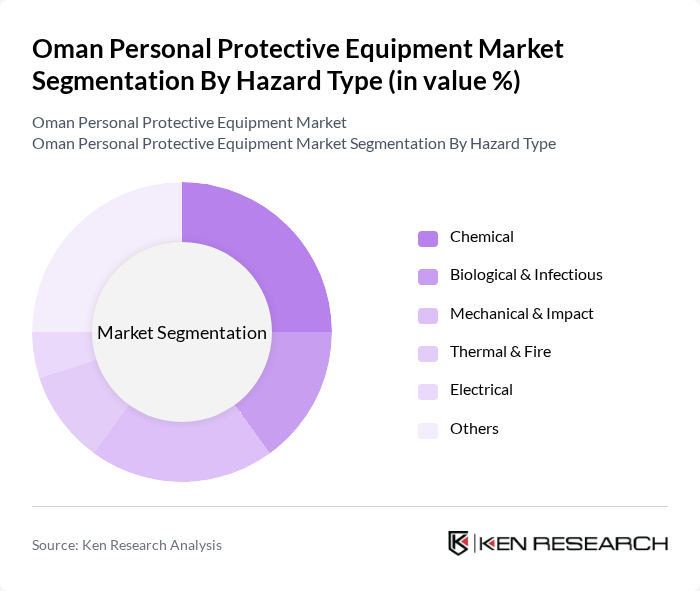

By Hazard Type:The hazard type segmentation categorizes personal protective equipment based on the specific risks they mitigate. The subsegments include Chemical, Biological & Infectious, Mechanical & Impact, Thermal & Fire, Electrical, and Others.

The Chemical hazard type subsegment leads the market, driven by the extensive use of chemicals in industries such as oil and gas, petrochemicals, manufacturing, and agriculture in Oman, which require gloves, suits, respirators, and eye protection for safe handling. The increasing regulatory requirements for chemical safety, including obligations for employers to assess chemical risks, provide appropriate protective equipment, and train workers, have significantly boosted the demand for chemical protective equipment. Additionally, the heightened focus on process safety, incident prevention in refineries and chemical plants, and stricter HSE standards among international operators has increased awareness among employers regarding the importance of equipping workers with appropriate protective gear, further solidifying the dominance of this subsegment.

The Oman Personal Protective Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Safety Products LLC, Al Shanfari Group of Companies, Gulf Safety & Security Services LLC, Muscat Safety Equipment LLC, Al Mufeed Trading LLC, Oman Industrial Safety Products LLC, Al Ahlia Safety & Security Equipment LLC, Safety First Trading LLC, Al Harthy Trading & Services LLC, Oman Protective Gear LLC, Al Jazeera Safety Equipment & Tools, Muscat Industrial Supplies LLC, Oman Safety Solutions LLC, Al Fajr Safety & Industrial Equipment, Safety Zone LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman personal protective equipment market appears promising, driven by ongoing industrial growth and regulatory changes. As the government continues to enforce safety standards, companies will increasingly invest in advanced PPE solutions. Additionally, the integration of smart technology in PPE is expected to enhance user safety and comfort. With a focus on sustainability, manufacturers are likely to innovate eco-friendly products, aligning with global trends and consumer preferences for responsible sourcing and production.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Head Protection Eye and Face Protection Hearing Protection Respiratory Protection Hand & Arm Protection Protective Clothing / Body Protection Protective Footwear Fall Protection Others (High-Visibility, Safety Accessories, etc.) |

| By Hazard Type | Chemical Biological & Infectious Mechanical & Impact Thermal & Fire Electrical Others |

| By End-Use Industry | Oil & Gas and Petrochemicals Construction & Infrastructure Manufacturing & Industrial Healthcare & Laboratories Mining & Metals Utilities, Power & Water Transportation & Logistics Public Safety, Defense & Firefighting Others |

| By Distribution Channel | Direct Tenders & Institutional Procurement Industrial Distributors Retail & Trade Counters E-commerce & Online Platforms Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Other Governorates |

| By Application | Workplace Safety Compliance Project-based & Turnaround Maintenance Emergency Response & Disaster Management Healthcare & Infection Control Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry PPE Usage | 100 | Site Managers, Safety Officers |

| Healthcare Sector PPE Procurement | 80 | Hospital Administrators, Infection Control Specialists |

| Oil & Gas Industry Safety Equipment | 70 | Safety Managers, Operations Supervisors |

| Manufacturing Sector PPE Compliance | 90 | Production Managers, Quality Assurance Officers |

| Retail Sector PPE Sales Insights | 60 | Retail Managers, Product Buyers |

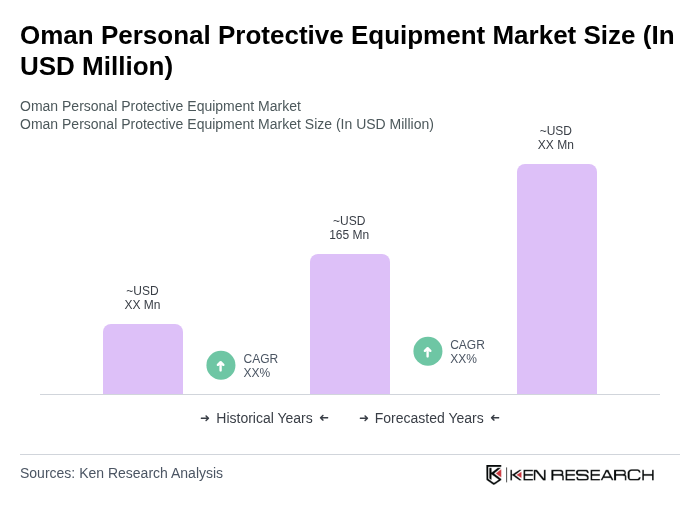

The Oman Personal Protective Equipment market is valued at approximately USD 165 million, driven by strong demand across various sectors such as construction, petrochemicals, and healthcare, reflecting a growing emphasis on workplace safety and health standards.