Region:Global

Author(s):Dev

Product Code:KRAC0546

Pages:97

Published On:August 2025

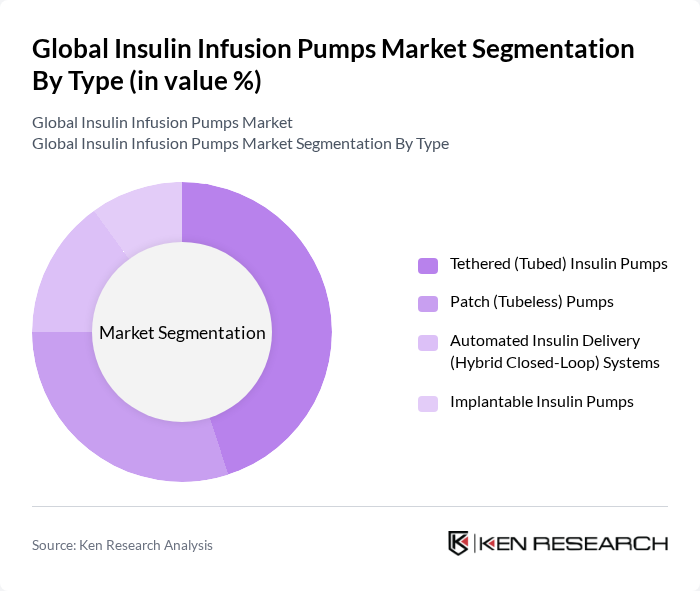

By Type:The market is segmented into four main types of insulin infusion pumps: Tethered (Tubed) Insulin Pumps, Patch (Tubeless) Pumps, Automated Insulin Delivery (Hybrid Closed-Loop) Systems, and Implantable Insulin Pumps. Among these, Tethered (Tubed) Insulin Pumps are the most widely used due to their reliability, broad reimbursement, and established clinical evidence. However, Patch (Tubeless) Pumps are gaining traction due to convenience, reduced on?body footprint, and ease of use, particularly among younger patients and those seeking a more discreet option; adoption is further supported by integration with CGM and app-based control in newer systems.

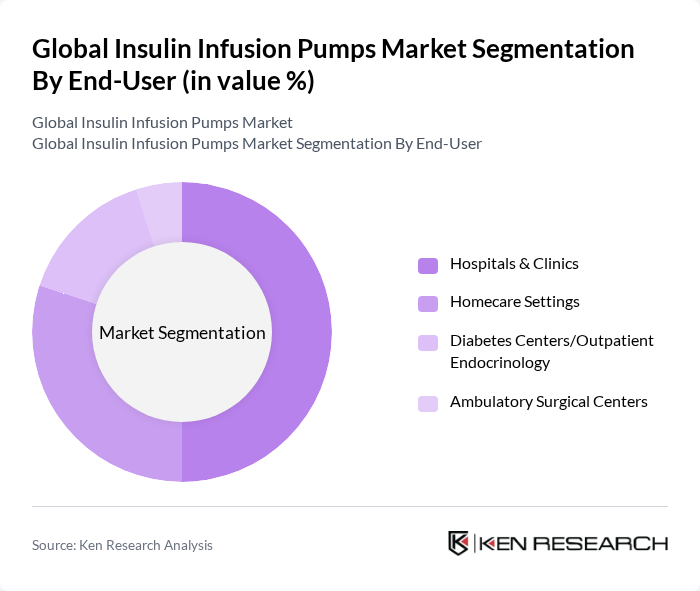

By End-User:The end-user segmentation includes Hospitals & Clinics, Homecare Settings, Diabetes Centers/Outpatient Endocrinology, and Ambulatory Surgical Centers. Hospitals & Clinics dominate due to comprehensive diabetes programs, initiation/training infrastructure, and access to advanced technologies. However, Homecare Settings are rapidly growing as patients increasingly prefer home-based management supported by connected pumps, remote monitoring, and telehealth-enabled training and follow?up.

The Global Insulin Infusion Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc (MiniMed), Insulet Corporation (Omnipod), Tandem Diabetes Care, Inc., Roche Diabetes Care (Accu?Chek/Diabetes Care), Ypsomed AG (mylife YpsoPump), SOOIL Developments Co., Ltd. (DANA Diabecare), Medtrum Technologies Inc., EOFlow Co., Ltd. (EOPatch), Beta Bionics, Inc., Debiotech SA, Abbott Diabetes Care (CGM ecosystem partner), Dexcom, Inc. (CGM ecosystem partner), Diabeloop SA (AID algorithm partner), CeQur SA, VIVI Diabetes (formerly ViCentra) – Kaleido contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insulin infusion pump market appears promising, driven by ongoing technological advancements and increasing patient-centric care initiatives. As healthcare systems evolve, the integration of digital health solutions and automated insulin delivery systems will likely enhance treatment efficacy. Furthermore, the rise of telehealth services is expected to facilitate better diabetes management, allowing patients to access care remotely. These trends indicate a shift towards more personalized and efficient diabetes care solutions, ultimately improving patient outcomes and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Tethered (Tubed) Insulin Pumps Patch (Tubeless) Pumps Automated Insulin Delivery (Hybrid Closed-Loop) Systems Implantable Insulin Pumps |

| By End-User | Hospitals & Clinics Homecare Settings Diabetes Centers/Outpatient Endocrinology Ambulatory Surgical Centers |

| By Distribution Channel | Direct Sales (Manufacturer to Patient/Provider) Specialty Pharmacies & DME Providers Online (Manufacturer Portals and Authorized E-commerce) Medical Device Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Type | Type 1 Diabetes Insulin?requiring Type 2 Diabetes Pediatric (?18 years) Adult (19–64 years) Geriatric (65+ years) |

| By Product Features | CGM Integration & Interoperability Mobile App/Bluetooth Connectivity Customizable Basal/Bolus & Advanced Algorithms Waterproofing, Form Factor & Wear Time |

| By Component | Pump Device Infusion Sets & Cannulas Reservoirs/Cartridges & Pods Batteries/Power & Chargers |

| By Price Range | Entry-Level Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologist Insights | 90 | Endocrinologists, Diabetes Care Specialists |

| Patient User Experience | 120 | Diabetes Patients, Caregivers |

| Healthcare Provider Perspectives | 80 | Nurses, Diabetes Educators |

| Manufacturer Feedback | 60 | Product Managers, R&D Directors |

| Market Trends Analysis | 70 | Healthcare Analysts, Market Researchers |

The Global Insulin Infusion Pumps Market is valued at approximately USD 5.9 billion, driven by the increasing prevalence of diabetes and advancements in insulin delivery technology, including automated systems and continuous glucose monitoring integration.