Region:Middle East

Author(s):Dev

Product Code:KRAD0594

Pages:93

Published On:August 2025

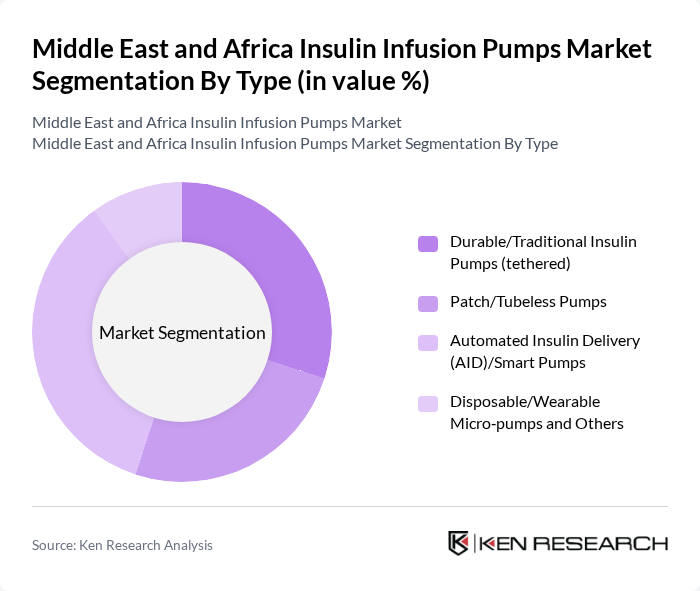

By Type:The insulin infusion pumps market can be segmented into various types, including Durable/Traditional Insulin Pumps (tethered), Patch/Tubeless Pumps, Automated Insulin Delivery (AID)/Smart Pumps, and Disposable/Wearable Micro-pumps and Others. Among these, the Automated Insulin Delivery (AID)/Smart Pumps segment is gaining significant traction due to their advanced features, such as real-time glucose monitoring integration and algorithm-driven automated insulin delivery that improve time-in-range and reduce hypoglycemia. Increasing adoption of sensor-augmented and closed-loop systems is a key driver of this segment across MEA centers of excellence and private pay markets .

By End-User:The market can also be segmented based on end-users, which include Hospitals & Specialty Diabetes Centers, Homecare/Personal Use, Ambulatory Clinics, and Others. The Hospitals & Specialty Diabetes Centers segment is currently leading the market due to the high volume of diabetes patients seeking treatment in these facilities. These centers provide comprehensive diabetes management services—including structured education, CGM integration, and access to advanced pump therapy—which are crucial for effective diabetes care in MEA settings .

The Middle East and Africa Insulin Infusion Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Insulet Corporation, Roche Diabetes Care (F. Hoffmann?La Roche AG), Tandem Diabetes Care, Inc., Ypsomed AG, SOOIL Development Co., Ltd., Becton, Dickinson and Company (BD), Dana Diabecare (I?SENS/IDS – regional), Terumo Corporation, Nipro Corporation, Eversense (Senseonics Holdings, Inc.), Diabeloop SA, Deka Research & Development (Omnipod partnerships), Awamedica / Gulf Medical Co. (regional distributors), GulfDrug LLC (UAE) / Pharmed Healthcare (Egypt) – distributors contribute to innovation, geographic expansion, and service delivery in this space .

The future of the insulin infusion pumps market in the Middle East and Africa appears promising, driven by technological advancements and increasing healthcare investments. As governments prioritize diabetes management, the integration of digital health technologies and telemedicine is expected to enhance patient care. Furthermore, the growing trend towards personalized medicine will likely lead to the development of more tailored insulin delivery solutions, improving patient outcomes and adherence to treatment protocols.

| Segment | Sub-Segments |

|---|---|

| By Type | Durable/Traditional Insulin Pumps (tethered) Patch/Tubeless Pumps Automated Insulin Delivery (AID)/Smart Pumps Disposable/Wearable Micro?pumps and Others |

| By End-User | Hospitals & Specialty Diabetes Centers Homecare/Personal Use Ambulatory Clinics Others |

| By Distribution Channel | Direct Tenders to Providers Distributors/Importers Retail & Hospital Pharmacies Online Channels |

| By Region | GCC (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) North Africa (Egypt, Algeria, Morocco, Tunisia) Sub?Saharan Africa (South Africa, Nigeria, Kenya, Rest) Rest of Middle East (Iran, Iraq, Jordan, Israel, Others) |

| By Age Group | Pediatric Adult Geriatric |

| By Insurance Coverage | Private Insurance/Reimbursement Public Insurance/National Health Schemes Out?of?Pocket |

| By Price Range | Entry/Value Mid?Tier Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Endocrinologists, Diabetes Educators |

| Hospital Procurement Departments | 90 | Procurement Managers, Supply Chain Directors |

| Patients Using Insulin Pumps | 110 | Diabetes Patients, Caregivers |

| Medical Device Distributors | 70 | Sales Managers, Product Specialists |

| Health Insurance Providers | 60 | Policy Analysts, Claims Managers |

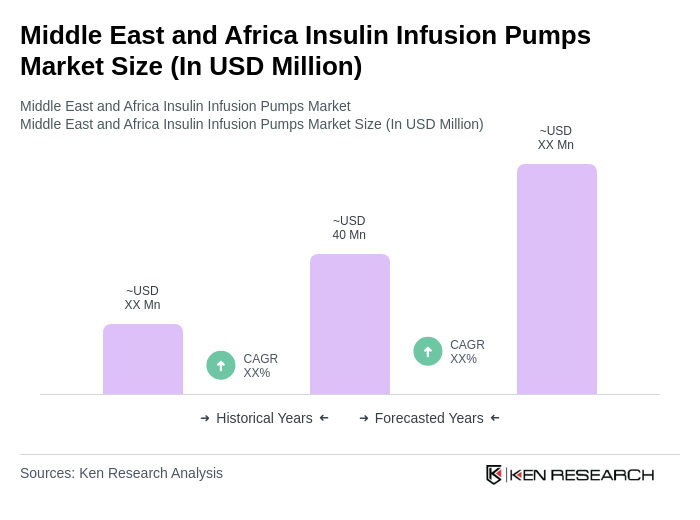

The Middle East and Africa Insulin Infusion Pumps Market is valued at approximately USD 40 million, reflecting a significant demand driven by the increasing prevalence of diabetes and advancements in insulin delivery technologies.