Region:Global

Author(s):Rebecca

Product Code:KRAB0307

Pages:86

Published On:August 2025

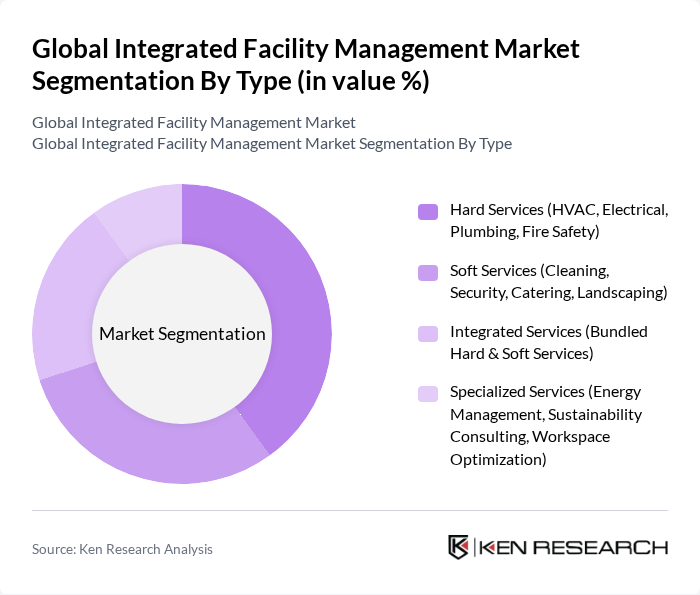

By Type:The market is segmented into various types, including Hard Services, Soft Services, Integrated Services, and Specialized Services. Each of these segments plays a crucial role in the overall facility management landscape, catering to different operational needs and client requirements.

The Hard Services segment, which includes HVAC, electrical, plumbing, and fire safety, dominates the market due to the essential nature of these services in maintaining operational efficiency and safety in facilities. As organizations increasingly prioritize compliance with safety regulations and energy efficiency, the demand for these services has surged. Additionally, the integration of smart technologies in hard services—such as IoT sensors for predictive maintenance and energy optimization—has enhanced their effectiveness, making them indispensable in modern facility management .

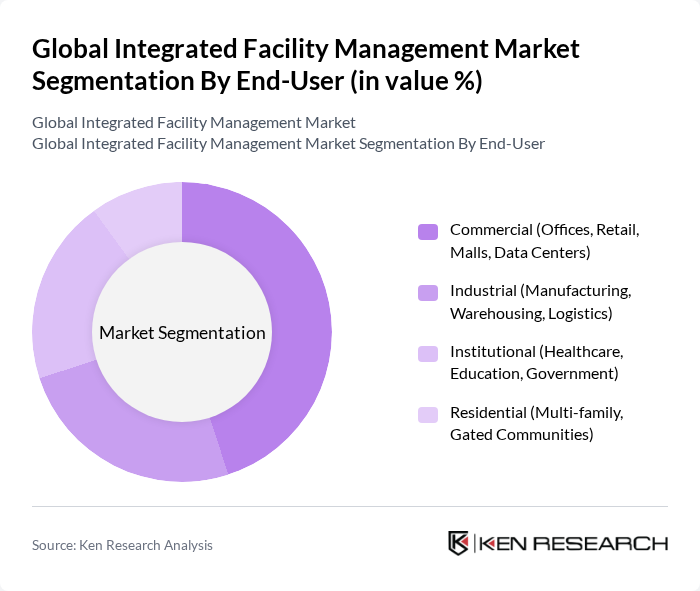

By End-User:The market is segmented based on end-users, including Commercial, Industrial, Institutional, and Residential sectors. Each end-user category has unique requirements and challenges that integrated facility management services aim to address.

The Commercial segment leads the market, driven by the increasing need for efficient space management and operational cost reduction in offices, retail spaces, and data centers. As businesses focus on enhancing employee productivity and customer experience, the demand for integrated facility management services that streamline operations and improve service delivery has grown significantly. This trend is further supported by the rise of flexible workspaces, adoption of digital platforms for facility management, and the need for enhanced security and maintenance in commercial properties .

The Global Integrated Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS A/S, CBRE Group, Inc., JLL (Jones Lang LaSalle Incorporated), Sodexo S.A., Aramark Corporation, G4S Limited, Compass Group PLC, Cushman & Wakefield plc, ABM Industries Incorporated, Serco Group plc, Mitie Group plc, EMCOR Group, Inc., Brookfield Global Integrated Solutions (BGIS), OCS Group Limited, Atalian Global Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the integrated facility management market appears promising, driven by the increasing adoption of smart technologies and a growing emphasis on sustainability. As organizations prioritize employee well-being and operational efficiency, the demand for integrated solutions is expected to rise. Additionally, the shift towards data-driven decision-making will enhance service delivery and operational transparency, positioning facility management as a critical component of organizational strategy in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (HVAC, Electrical, Plumbing, Fire Safety) Soft Services (Cleaning, Security, Catering, Landscaping) Integrated Services (Bundled Hard & Soft Services) Specialized Services (Energy Management, Sustainability Consulting, Workspace Optimization) |

| By End-User | Commercial (Offices, Retail, Malls, Data Centers) Industrial (Manufacturing, Warehousing, Logistics) Institutional (Healthcare, Education, Government) Residential (Multi-family, Gated Communities) |

| By Service Model | Outsourced In-House Hybrid |

| By Industry Vertical | Manufacturing Healthcare Retail IT & Telecom BFSI (Banking, Financial Services, Insurance) Hospitality Education |

| By Geographic Coverage | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Technology Integration | IoT Solutions AI and Machine Learning Cloud-Based Solutions Predictive Maintenance Platforms |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Outcome-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Management | 60 | Healthcare Facility Managers, Facility Coordinators |

| Educational Institution Facility Management | 50 | Campus Facility Managers, Administrative Heads |

| Retail Space Management | 40 | Store Facility Managers, Regional Facility Directors |

| Industrial Facility Management | 50 | Plant Facility Managers, Safety Officers |

The Global Integrated Facility Management Market is valued at approximately USD 163 billion, reflecting a significant growth trend driven by the demand for efficient facility management solutions and the rise of smart buildings.