Region:Middle East

Author(s):Shubham

Product Code:KRAB6185

Pages:83

Published On:October 2025

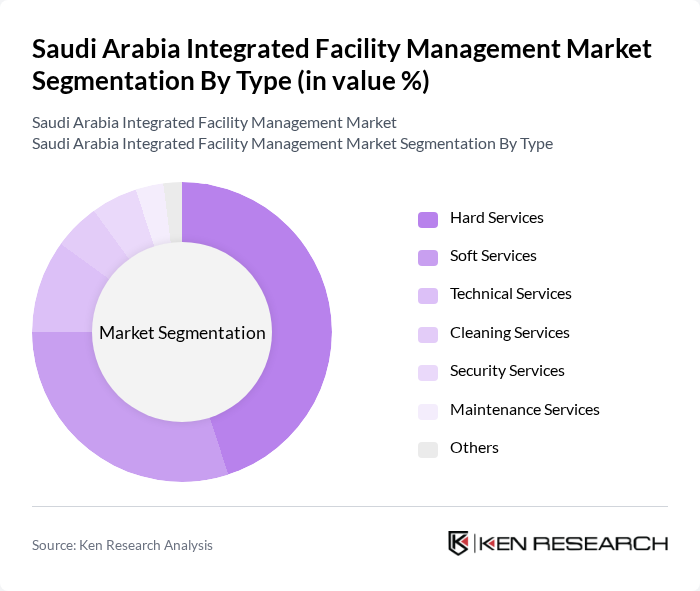

By Type:The market is segmented into various types, including Hard Services, Soft Services, Technical Services, Cleaning Services, Security Services, Maintenance Services, and Others. Among these, Hard Services and Soft Services are the most prominent, with Hard Services encompassing essential maintenance and repair functions, while Soft Services focus on non-core activities such as cleaning and security. The increasing demand for comprehensive management solutions has led to a significant rise in the adoption of both service types.

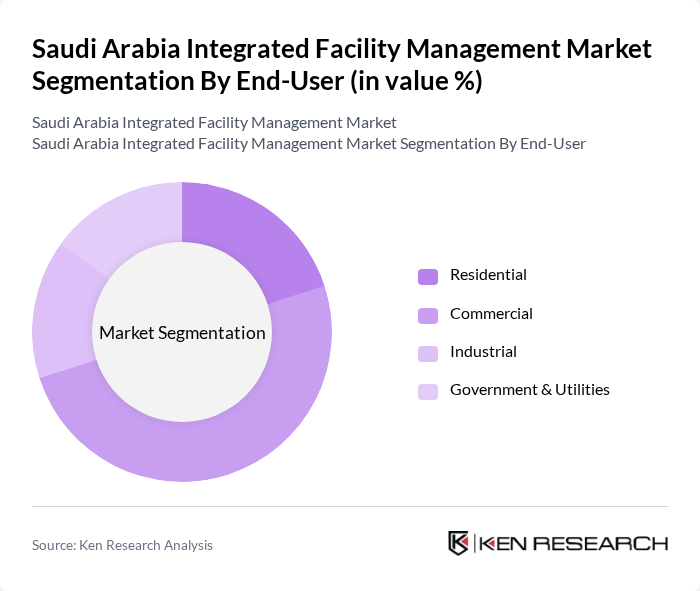

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Commercial sector is the leading segment, driven by the increasing number of office spaces and retail establishments. The demand for integrated facility management services in commercial buildings is fueled by the need for enhanced operational efficiency and cost-effectiveness, making it a critical area for service providers.

The Saudi Arabia Integrated Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, JLL (Jones Lang LaSalle), CBRE Group, Inc., G4S plc, Sodexo, EMCOR Group, Inc., Serco Group plc, Cofely Besix Facility Management, Al-Futtaim Engineering, Al Habtoor Group, Transguard Group, Apleona HSG, Khidmah LLC, Farnek Services LLC, Mace Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the integrated facility management market in Saudi Arabia appears promising, driven by ongoing urbanization and government initiatives. As the country continues to invest in infrastructure and smart technologies, the demand for integrated solutions will likely increase. Additionally, the emphasis on sustainability and energy efficiency will shape service offerings, encouraging innovation. Companies that adapt to these trends and focus on compliance will be well-positioned to capitalize on emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Technical Services Cleaning Services Security Services Maintenance Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Service Model | Integrated Facilities Management Bundled Services Single Service Providers |

| By Sector | Healthcare Education Retail Hospitality |

| By Contract Type | Fixed-Price Contracts Time and Material Contracts Cost-Plus Contracts |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 80 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 70 | Campus Facility Managers, Administrative Heads |

| Government Building Maintenance | 60 | Public Sector Facility Managers, Procurement Officers |

| Commercial Real Estate Management | 90 | Property Managers, Asset Managers |

The Saudi Arabia Integrated Facility Management Market is valued at approximately USD 15 billion, reflecting significant growth driven by urbanization, construction activities, and the demand for operational efficiency in facility management services.