Region:Global

Author(s):Dev

Product Code:KRAA2618

Pages:82

Published On:August 2025

By Type:The market is segmented into various types of devices, including embolization devices, radiofrequency ablation devices, microwave ablation devices, cryoablation devices, biopsy devices, support devices (e.g., guidewires, catheters), stents, and others. Among these, embolization devices are leading the market due to their effectiveness in treating tumors by blocking blood flow, which is crucial for tumor growth. The increasing adoption of these devices in hospitals and surgical centers is driven by their minimally invasive nature, improved patient outcomes, and expanding clinical indications for tumor management .

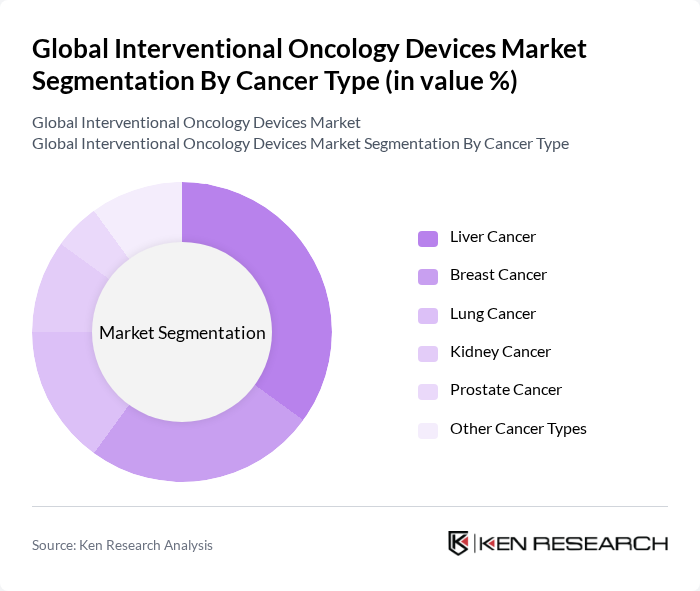

By Cancer Type:The market is categorized based on the types of cancer treated, including liver cancer, breast cancer, lung cancer, kidney cancer, prostate cancer, and other cancer types. Liver cancer is the leading segment due to its high incidence rates and the effectiveness of interventional oncology devices in managing this type of cancer. The increasing awareness, screening programs, and preference for minimally invasive therapies are also contributing to the growth of this segment .

The Global Interventional Oncology Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Johnson & Johnson (Ethicon), Siemens Healthineers AG, Varian Medical Systems, Inc., Cook Medical LLC, AngioDynamics, Inc., Merit Medical Systems, Inc., Hologic, Inc., Stryker Corporation, Philips Healthcare (Koninklijke Philips N.V.), GE Healthcare, Terumo Corporation, FUJIFILM Holdings Corporation, NeuWave Medical, Inc. (a Johnson & Johnson company), Baxter International Inc., BD (Becton, Dickinson and Company, including C.R. Bard), B. Braun Melsungen AG, Argon Medical Devices, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the interventional oncology devices market appears promising, driven by ongoing technological advancements and a growing emphasis on personalized medicine. As healthcare systems increasingly adopt outpatient procedures, the demand for innovative, minimally invasive devices is expected to rise. Furthermore, the integration of artificial intelligence in device development is likely to enhance diagnostic accuracy and treatment efficacy, paving the way for improved patient outcomes and operational efficiencies in oncology care.

| Segment | Sub-Segments |

|---|---|

| By Type | Embolization Devices Radiofrequency Ablation Devices Microwave Ablation Devices Cryoablation Devices Biopsy Devices Support Devices (e.g., guidewires, catheters) Stents Others |

| By Cancer Type | Liver Cancer Breast Cancer Lung Cancer Kidney Cancer Prostate Cancer Other Cancer Types |

| By Application | Tumor Ablation Tumor Biopsy Tumor Embolization Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Image-Guided Therapy Robotic-Assisted Surgery Navigation Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Interventional Radiology Practices | 100 | Interventional Radiologists, Oncology Specialists |

| Hospital Procurement Departments | 80 | Procurement Managers, Supply Chain Directors |

| Medical Device Manufacturers | 60 | Product Managers, R&D Directors |

| Clinical Research Organizations | 50 | Clinical Research Coordinators, Data Analysts |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Specialists |

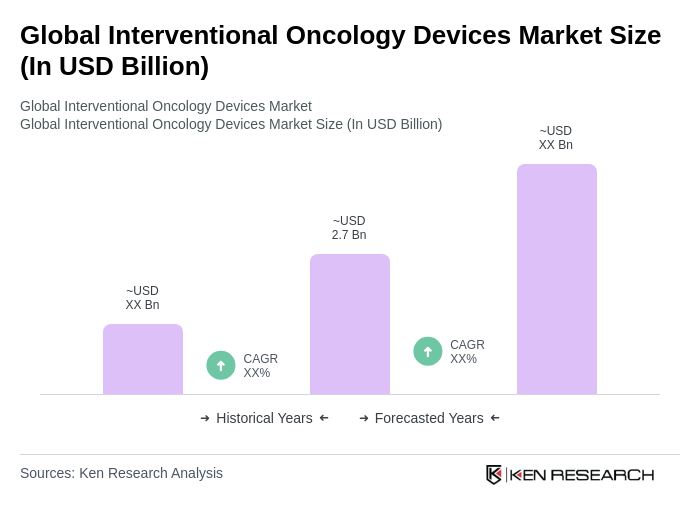

The Global Interventional Oncology Devices Market is valued at approximately USD 2.7 billion, driven by the increasing prevalence of cancer, advancements in minimally invasive technology, and the demand for image-guided tumor therapies.