Region:Global

Author(s):Dev

Product Code:KRAA1691

Pages:95

Published On:August 2025

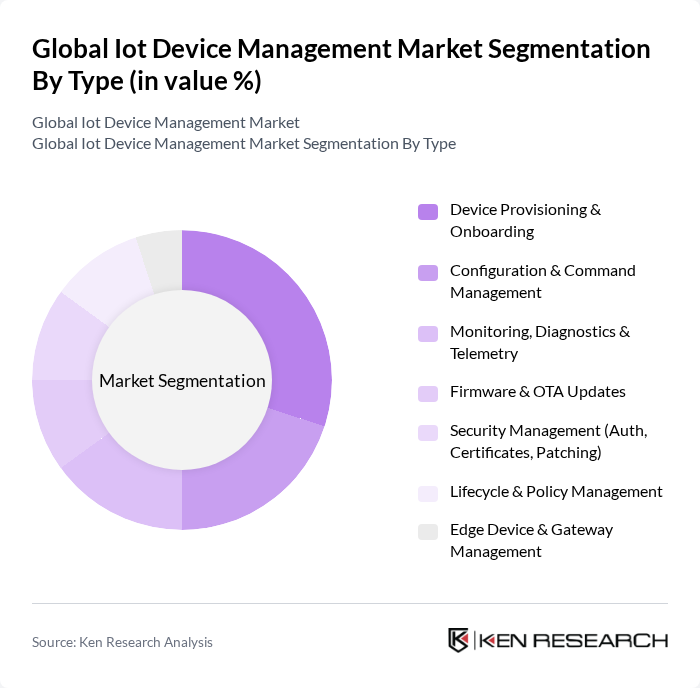

By Type:The IoT device management market can be segmented into various types, including Device Provisioning & Onboarding, Configuration & Command Management, Monitoring, Diagnostics & Telemetry, Firmware & OTA Updates, Security Management (Auth, Certificates, Patching), Lifecycle & Policy Management, and Edge Device & Gateway Management. Among these, Device Provisioning & Onboarding is currently the leading sub-segment due to the increasing need for seamless integration of devices into IoT ecosystems. This segment is crucial for ensuring that devices are correctly configured and operational from the outset, which is essential for user satisfaction and operational efficiency.

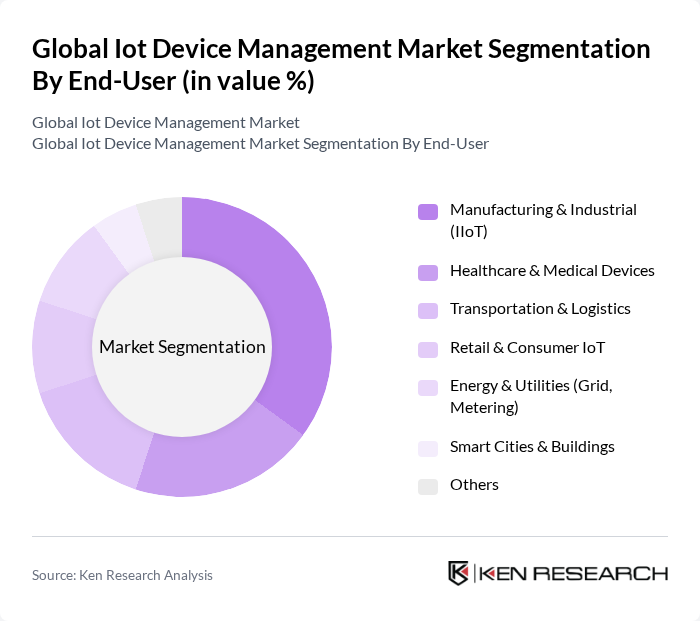

By End-User:The end-user segmentation of the IoT device management market includes Manufacturing & Industrial (IIoT), Healthcare & Medical Devices, Transportation & Logistics, Retail & Consumer IoT, Energy & Utilities (Grid, Metering), Smart Cities & Buildings, and Others. The Manufacturing & Industrial (IIoT) segment is the most dominant, driven by the increasing automation and digital transformation initiatives in industries. The need for real-time monitoring and predictive maintenance in manufacturing processes has led to a surge in demand for IoT device management solutions tailored for industrial applications.

The Global IoT Device Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Cisco Systems, Inc., Microsoft Corporation, Amazon Web Services, Inc., PTC Inc., Siemens AG, Oracle Corporation, SAP SE, GE Digital, Huawei Technologies Co., Ltd., Dell Technologies Inc., Schneider Electric SE, Ericsson AB, Nokia Corporation, Bosch.IO GmbH, Google Cloud, Software AG, Advantech Co., Ltd., Telit Cinterion, Sierra Wireless (a Semtech company), Aeris Communications, Inc., Arm Limited (Pelion Device Management), Samsung Electronics (SmartThings / Knox Manage for IoT), HPE (Aruba IoT & Device Insight), Quectel Wireless Solutions Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IoT device management market is poised for transformative growth, driven by advancements in technology and increasing investments in infrastructure. As organizations prioritize digital transformation, the integration of AI and machine learning will enhance data analytics capabilities, enabling more efficient device management. Additionally, the proliferation of 5G technology will facilitate faster data transmission, further supporting the expansion of IoT applications across various sectors, including smart cities and healthcare.

| Segment | Sub-Segments |

|---|---|

| By Type | Device Provisioning & Onboarding Configuration & Command Management Monitoring, Diagnostics & Telemetry Firmware & OTA Updates Security Management (Auth, Certificates, Patching) Lifecycle & Policy Management Edge Device & Gateway Management |

| By End-User | Manufacturing & Industrial (IIoT) Healthcare & Medical Devices Transportation & Logistics Retail & Consumer IoT Energy & Utilities (Grid, Metering) Smart Cities & Buildings Others |

| By Application | Smart Metering & Utilities Smart Lighting & Building Automation Asset Tracking & Cold Chain Predictive Maintenance Fleet & Telematics Management Remote Patient Monitoring & Wearables Others |

| By Component | Software/Platform Hardware (Gateways, Modules) Services (Professional, Managed) |

| By Deployment Mode | Cloud On-Premises Hybrid |

| By Organization Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| By Connectivity | Cellular (4G/LTE, 5G) LPWAN (LoRaWAN, NB-IoT, LTE-M) Short-Range (Wi?Fi, BLE, Zigbee, Thread) Satellite & Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare IoT Device Management | 100 | Healthcare IT Managers, Medical Device Administrators |

| Manufacturing IoT Solutions | 80 | Operations Managers, Production Supervisors |

| Smart City Infrastructure Management | 70 | City Planners, Urban Development Officers |

| Retail IoT Device Integration | 90 | Retail Technology Directors, Supply Chain Managers |

| Telecommunications IoT Services | 75 | Network Engineers, Telecom Product Managers |

The Global IoT Device Management Market is valued at approximately USD 5.0 billion, reflecting significant growth driven by the increasing adoption of IoT devices across various sectors such as manufacturing, healthcare, and smart cities.