Region:Middle East

Author(s):Shubham

Product Code:KRAA8725

Pages:97

Published On:November 2025

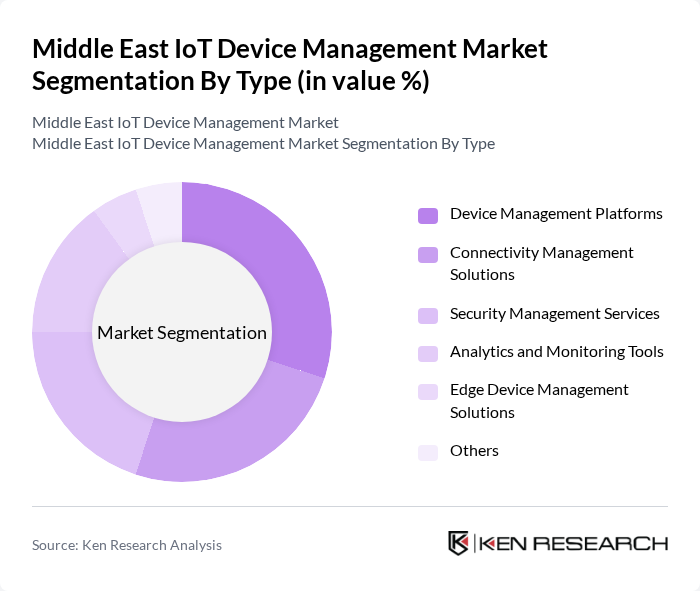

By Type:The market is segmented into Device Management Platforms, Connectivity Management Solutions, Security Management Services, Analytics and Monitoring Tools, Edge Device Management Solutions, and Others. Device Management Platforms are central to lifecycle management, provisioning, firmware updates, and remote monitoring of IoT devices. Connectivity Management Solutions facilitate seamless integration and network optimization for large-scale IoT deployments. Security Management Services address authentication, encryption, and threat detection, while Analytics and Monitoring Tools enable real-time data analysis and predictive maintenance. Edge Device Management Solutions focus on decentralized control and local data processing, supporting latency-sensitive applications. The Others category includes niche and customized solutions tailored for specific industry requirements.

Device Management Platforms remain the leading sub-segment, underpinning the region’s IoT infrastructure by enabling centralized control, lifecycle management, and security enforcement for diverse device fleets. The complexity of modern IoT ecosystems and the imperative for scalable, automated management solutions are driving sustained demand for these platforms. Organizations are increasingly prioritizing platforms that offer integrated analytics, remote diagnostics, and compliance monitoring to streamline operations and mitigate security risks.

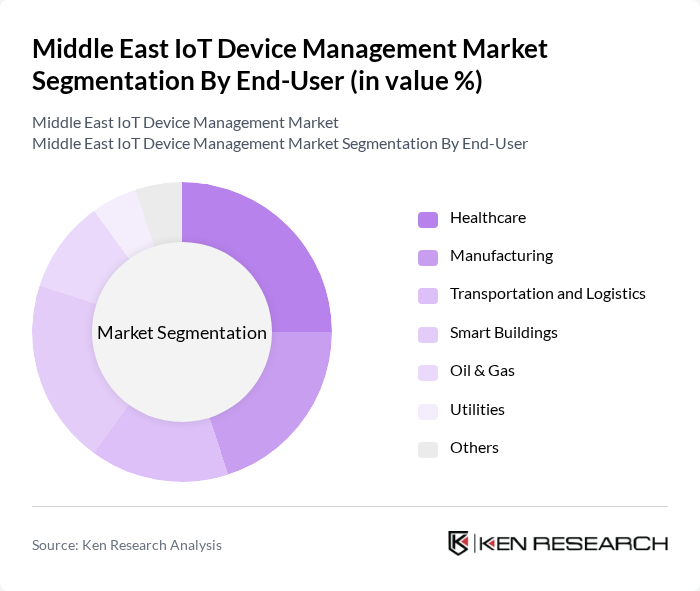

By End-User:The market is segmented by end-users, including Healthcare, Manufacturing, Transportation and Logistics, Smart Buildings, Oil & Gas, Utilities, and Others. Healthcare organizations leverage IoT device management for remote patient monitoring, telemedicine, and medical asset tracking. Manufacturing enterprises utilize IoT to optimize production, enable predictive maintenance, and ensure supply chain visibility. Transportation and Logistics providers deploy IoT for fleet management and real-time tracking, while Smart Buildings integrate device management for energy optimization and security. The Oil & Gas sector adopts IoT for asset monitoring and operational safety, and Utilities implement device management for grid automation and resource efficiency. The Others segment covers specialized applications in sectors such as retail and agriculture.

Healthcare is the most prominent end-user segment, propelled by the surge in remote patient monitoring, telemedicine, and the integration of IoT-enabled medical devices. The pandemic accelerated digital health transformation, with providers deploying IoT solutions to improve patient outcomes, automate workflows, and enhance operational efficiency. This momentum is sustained by regulatory mandates for data security, interoperability, and real-time analytics, positioning healthcare as a primary driver of IoT device management adoption in the region.

The Middle East IoT Device Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Siemens AG, PTC Inc., Honeywell International Inc., Schneider Electric SE, Ericsson AB, GE Digital, Nokia Corporation, Dell Technologies, Qualcomm Technologies, Inc., ZTE Corporation, Etisalat Group (e&), STC (Saudi Telecom Company), Ooredoo Group, Innovent.io, Injazat (G42) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East IoT device management market appears promising, driven by technological advancements and increasing investments in infrastructure. The integration of AI and machine learning into IoT solutions is expected to enhance operational efficiencies and data analytics capabilities. Furthermore, the ongoing development of 5G technology will facilitate faster and more reliable connectivity, enabling a broader range of applications and services, thus fostering market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Device Management Platforms Connectivity Management Solutions Security Management Services Analytics and Monitoring Tools Edge Device Management Solutions Others |

| By End-User | Healthcare Manufacturing Transportation and Logistics Smart Buildings Oil & Gas Utilities Others |

| By Industry Vertical | Retail Agriculture Energy and Utilities Telecommunications Government & Smart Cities Others |

| By Deployment Model | Cloud-based Solutions On-premises Solutions Hybrid Solutions Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Application | Remote Monitoring Predictive Maintenance Asset Tracking Smart Metering Connected Infrastructure Management Others |

| By Service Type | Professional Services Managed Services Consulting Services Integration & Deployment Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare IoT Device Management | 60 | Healthcare IT Managers, Medical Device Administrators |

| Smart City Infrastructure Management | 50 | Urban Planners, Smart City Project Managers |

| Manufacturing IoT Solutions | 55 | Factory Operations Managers, Automation Engineers |

| Retail IoT Applications | 45 | Retail Technology Directors, Supply Chain Analysts |

| Telecommunications IoT Services | 50 | Network Operations Managers, Telecom Product Managers |

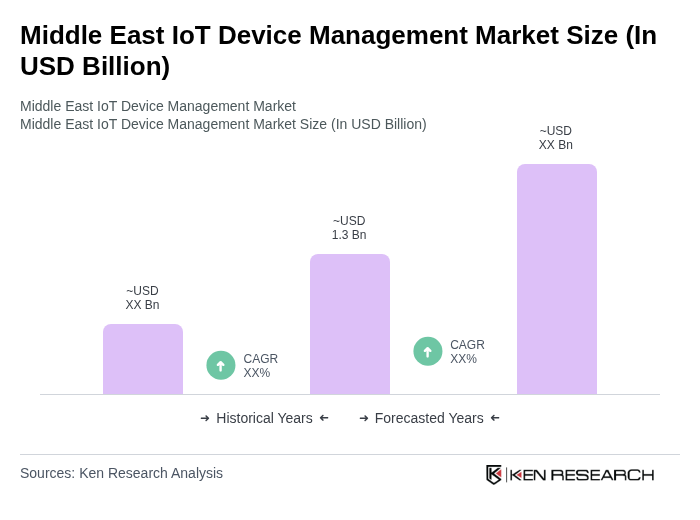

The Middle East IoT Device Management Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the increasing adoption of IoT technologies across various sectors, including healthcare, manufacturing, and smart cities.